Mediterranean fast-casual chain CAVA Group Inc. (NYSE:CAVA) is confidently progressing towards its ambitious goal of operating 1,000 restaurants by 2032, the company announced during its first-quarter 2025 earnings call.

What Happened: Despite broader economic uncertainties and potential headwinds, CEO Brett Schulman emphasized the brand’s strong momentum and reaffirmed its long-term strategic vision.

“We are well on our way to our goal of at least 1,000 restaurants by 2032, creating more spaces where connection, community, and Mediterranean hospitality can thrive,” Schulman stated during the call.

This expansion is being fueled by a robust first quarter, which saw a healthy 10.8% growth in same-restaurant sales, driven by a significant 7.5% rise in traffic.

The company also opened 15 new restaurants in the quarter, bringing its total count to 382.

Adding to investor confidence, Schulman addressed concerns regarding the potential impact of Donald Trump‘s tariffs on the company’s supply chain. “That said, our exposure remains limited based on the current policies, which are fluid, given that the majority of our ingredients are domestically sourced or covered under existing contracts,” he added.

CAVA also celebrated surpassing $1 billion in revenue on a trailing 12-month basis, a significant milestone highlighting its leadership in the category. “A milestone that is a testament to Mediterranean becoming the next large-scale cultural cuisine category, a category we have firmly established our leadership in,” Schulman noted.

The company also highlighted the success of its reimagined loyalty program, which has seen sales through the program increase by 340 basis points as a percentage of total revenue, with membership approaching 8 million.

See Also: Warren Buffett Shows How Patience Pays: 98% Of His $160 Billion Wealth Came After Turning 65, Thanks The Power Of ‘Compound Interest’

Why It Matters: The Mediterranean fast-casual restaurant chain company’s first-quarter revenue increased 28.2% year-over-year to $331.83 million, beating the consensus estimate of $326.88 million, according to Benzinga Pro.

It also reported first-quarter adjusted earnings of 22 cents per share, beating analyst estimates of 14 cents per share.

CAVA maintains its previous forecast for full-year same-restaurant sales growth at 6% to 8%, while increasing its new restaurant opening projections for the year to between 64 and 68, up from the prior range of 62 to 66.

Shares of CAVA fell 0.48% on Thursday. The stock was down 14% on a year-to-date basis, but 28.12% higher over a year.

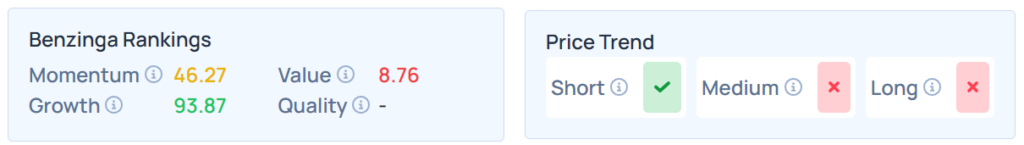

Benzinga Edge Stock Rankings shows that CAVA had a stronger price trend over the short term but a weaker trend over the medium and long term. Its momentum ranking was moderate at the 46.27th percentile, whereas its value ranking was poor at the 8.76th percentile; the details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher on Thursday. The SPY was up 0.49% to $590.46, while the QQQ advanced 0.11% to $519.25, according to Benzinga Pro data.

Read Next:

- Gordon Johnson Warns Of Potential ‘Liberation Day 2.0’ As 30-Year Treasury Yields Approach 5% Amid Dollar Weakness

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: courtesy of CAVA