热点栏目

客户端

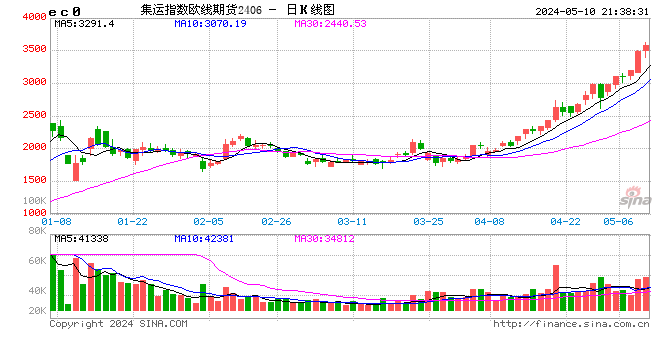

2025年5月23日,早盘收盘,国内期货主力合约跌多涨少。集运欧线涨超3%,鸡蛋、多晶硅、豆粕涨近1%;跌幅方面,焦煤、丁二烯橡胶、液化石油气(LPG)、烧碱跌超2%,氧化铝、锰硅、纯碱、SC原油、玻璃跌超1%。

国投期货表示,现货端马士基昨日正式开舱价攀升至2300+美元/FEU,HMM开舱$2500/FEU,有望推动市场对6月初揽货预期改善。由于6-8月为传统季节性旺季,因而6月初成为验证旺季需求预期的短期观测指标,预计短期盘面或继续受即期价格走势及欧线运力调配节奏主导,由于各航司月末超售囤货量规模不同,6月上旬宣涨落地兑现程度或有所差异,若有现货报价下调情况发生,易对盘面形成利空情绪扰动。

新浪合作大平台期货开户 安全快捷有保障

![]()

责任编辑:赵思远

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.