Snowflake Inc. (NYSE:SNOW) posted better-than-expected earnings and sales results for the first quarter on Wednesday.

Snowflake reported first-quarter revenue of $1.04 billion, beating analyst estimates of $1.01 billion. The AI data cloud company reported adjusted earnings of 24 cents per share, beating analyst estimates of 21 cents per share, according to Benzinga Pro.

"Snowflake's mission is to empower every enterprise to achieve its full potential through data and AI," said Sridhar Ramaswamy, CEO of Snowflake. "Our focus on making the Snowflake platform easy to use, to enable fluid access to data wherever it sits, and trusted for enterprise-grade performance, is what makes us differentiated and beloved by more than 11,000 customers. We see an enormous opportunity ahead as we extend this value throughout the full data lifecycle."

The company also said it expects second-quarter product revenue in the range of $1.035 billion to $1.04 billion, up approximately 25% year-over-year. The company anticipates full-year product revenue of $4.33 billion, representing 25% year-over-year growth.

Snowflake shares fell 2.1% to close at $179.12 on Wednesday.

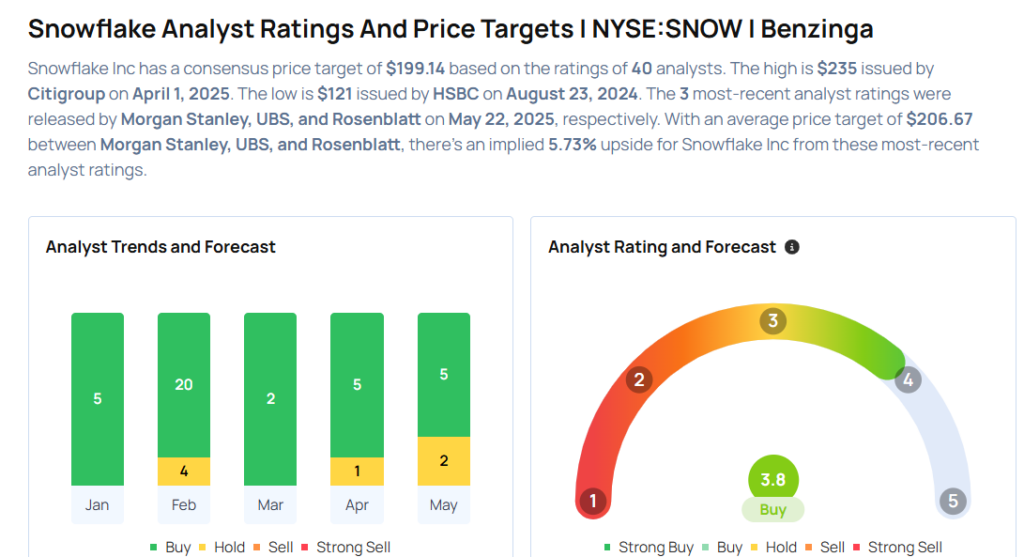

These analysts made changes to their price targets on Snowflake following earnings announcement.

- Needham analyst Mike Cikos maintained Snowflake with a Buy and raised the price target from $215 to $230.

- Rosenblatt analyst Blair Abernethy maintained the stock with a Buy and raised the price target from $205 to $210.

- UBS analyst Karl Keirstead maintained Snowflake with a Neutral and raised the price target from $200 to $210.

- Morgan Stanley maintained Snowflake with an Equal-Weight rating and boosted the price target from $185 to $200.

Considering buying SNOW stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Recommends Not Buying Mosaic, Doesn’t Like This Industrial Stock