Analog Devices, Inc. (NASDAQ:ADI) will release its second-quarter earnings results before the opening bell on Thursday, May 22.

Analysts expect the Wilmington, Massachusetts-based company to report quarterly earnings at $1.70 per share, up from $1.40 per share in the year-ago period. According to data from Benzinga Pro, Analog Devices projects to report quarterly revenue at $2.51 billion, compared to $2.16 billion a year earlier.

On Feb. 19, Analog Devices reported better-than-expected first-quarter EPS and revenues.

Analog Devices shares fell 1% to close at $222.22 on Wednesday.

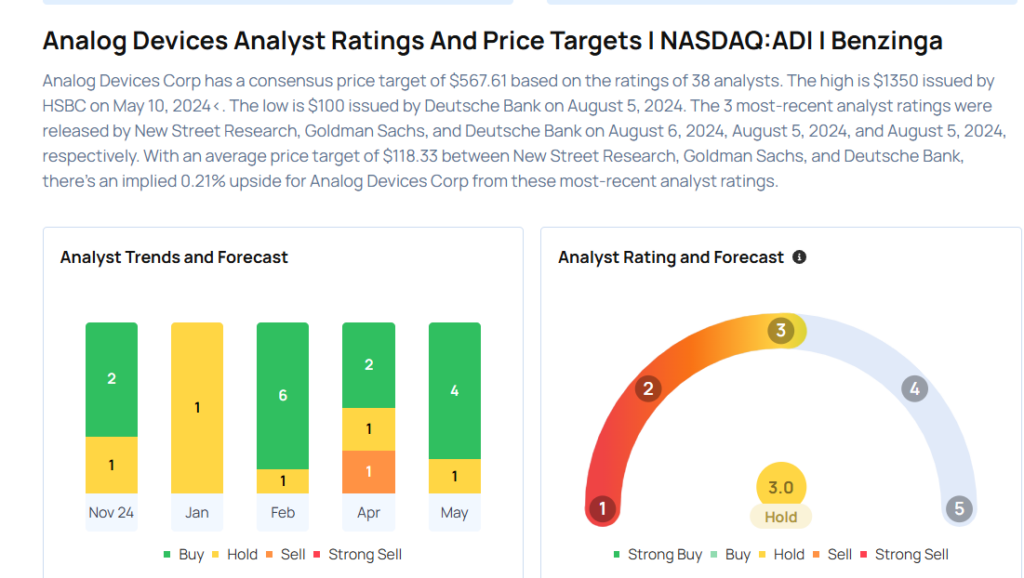

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Stifel analyst Tore Svanberg maintained a Buy rating and raised the price target from $225 to $248 on May 20, 2025. This analyst has an accuracy rate of 76%.

- Citigroup analyst Christopher Danely maintained a Buy rating and boosted the price target from $235 to $260 on May 19, 2025. This analyst has an accuracy rate of 79%.

- Cantor Fitzgerald analyst C J Muse maintained a Neutral rating and increased the price target from $230 to $250 on May 19, 2025. This analyst has an accuracy rate of 65%.

- Oppenheimer analyst Rick Schafer maintained an Outperform rating and boosted the price target from $225 to $265 on May 16, 2025. This analyst has an accuracy rate of 79%.

- UBS analyst Timothy Arcuri maintained a Buy rating and slashed the price target from $300 to $295 on May 12, 2025. This analyst has an accuracy rate of 78%

Considering buying ADI stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Recommends Not Buying Mosaic, Doesn’t Like This Industrial Stock