Palo Alto Networks Inc. (NASDAQ:PANW) posted better-than-expected earnings for its third quarter on Tuesday.

Palo Alto reported third-quarter revenue of $2.29 billion, beating the consensus estimate of $2.28 billion. The company reported third-quarter adjusted earnings of 80 cents per share, beating analyst estimates of 77 cents per share, according to Benzinga Pro.

"In Q3, we continued to make progress on our platformization strategy and achieved an important milestone in crossing $5 billion in Next-Gen Security ARR," said Nikesh Arora, chairman and CEO of Palo Alto Networks. "Our scale and platform breadth makes us a leading consolidator of choice in cybersecurity."

The company also raised its full-year 2025 guidance. The company now expects full-year revenue of $9.17 billion to $9.19 billion, up from prior guidance of $9.14 billion to $9.19 billion. The company now anticipates full-year adjusted earnings of $3.26 to $3.28 per share, up from prior guidance of $3.18 to $3.24 per share, per Benzinga Pro.

Palo Alto shares fell 6.5% to trade at $181.75 on Wednesday.

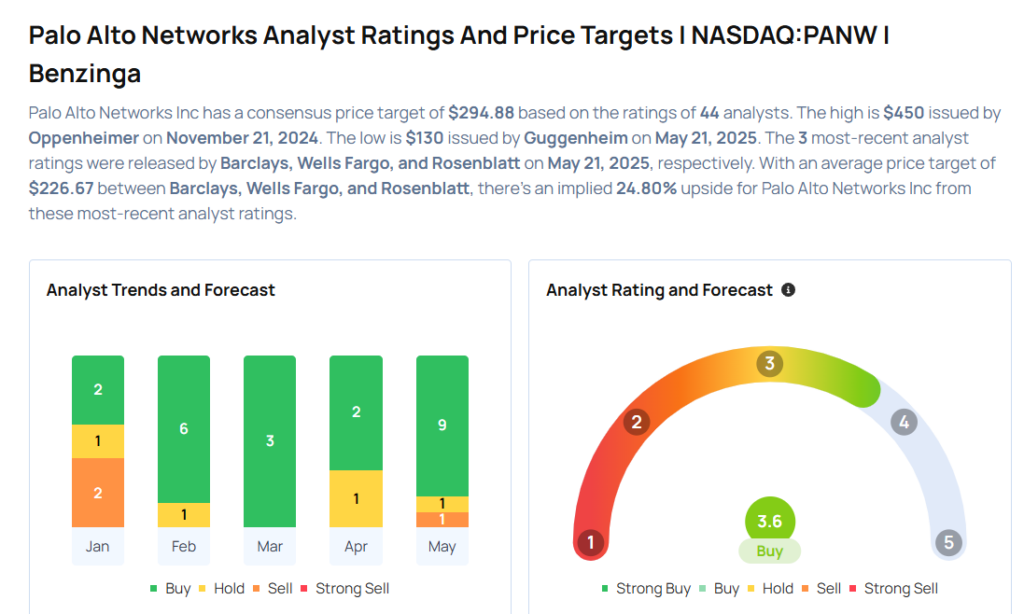

These analysts made changes to their price targets on Palo Alto following earnings announcement.

- Barclays analyst Saket Kalia maintained Palo Alto Networks with an Overweight rating and lowered the price target from $213 to $210.

- Wells Fargo analyst Andrew Nowinski maintained the stock with an Overweight rating and raised the price target from $225 to $235.

- Bernstein analyst Peter Weed maintained Palo Alto with an Outperform rating and lowered the price target from $229 to $225.

- TD Securities analyst Shaul Eyal reiterated Palo Alto Networks with a Buy and maintained a $230 price target.

- Guggenheim analyst John Difucci reiterated the stock with a Sell and maintained $130 price target.

- Keybanc analyst Eric Heath reiterated Palo Alto Networks with an Overweight rating and maintained $220 price target.

Considering buying PANW stock? Here’s what analysts think:

Read This Next:

- Target, Lowe’s And 3 Stocks To Watch Heading Into Wednesday