Zoom Communications Inc. (NASDAQ:ZM) will release its first-quarter earnings results after the closing bell on Wednesday, May 21.

Analysts expect the San Jose, California-based company to report quarterly earnings at $1.31 per share, down from $1.35 per share in the year-ago period. Zoom projects to report quarterly revenue at $1.17 billion, compared to $1.14 billion a year earlier, according to data from Benzinga Pro.

On May 7, Zoom announced plans to integrate Zoom CX with ServiceNow CRM and IT Service Management.

Zoom shares fell 0.3% to close at $83.10 on Tuesday.

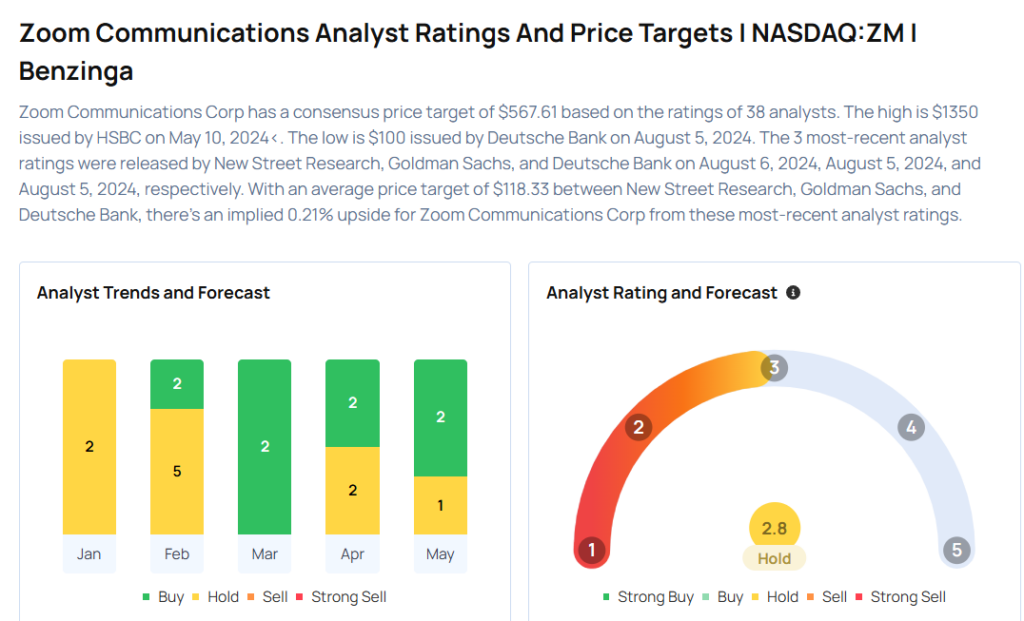

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Citigroup analyst Tyler Radke maintained a Neutral rating and cut the price target from $85 to $84 on May 15, 2025. This analyst has an accuracy rate of 70%.

- Rosenblatt analyst Catharine Trebnick maintained a Buy rating with a price target of $90 on May 8, 2025. This analyst has an accuracy rate of 72%.

- Wells Fargo analyst Michael Turrin maintained an Equal-Weight rating and cut the price target from $85 to $75 on April 22, 2025. This analyst has an accuracy rate of 63%.

- Morgan Stanley analyst Meta Marshall maintained an Equal-Weight rating and slashed the price target from $96 to $73 on April 16, 2025. This analyst has an accuracy rate of 77%.

- Mizuho analyst Siti Panigrahi maintained an Outperform rating and cut the price target from $105 to $71 on April 15, 2025. This analyst has an accuracy rate of 60%.

Considering buying ZM stock? Here’s what analysts think:

Read This Next:

- Top 2 Risk Off Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock