Crypto Expert Chris Burniske Highlights Favorable Market Conditions

- Chris Burniske's remarks stabilize crypto market sentiment post-pullback.

- Favorable conditions could benefit long-term investors.

- Solana seen potentially outperforming Bitcoin and Ethereum.

Chris Burniske emphasizes the crypto market's favorable dynamics amid recent pullbacks impacting Bitcoin and other assets.

Chris Burniske, a partner at Placeholder, addressed market sentiments on May 30 concerning a crypto market pullback. Sharing his insights on social media, Burniske suggested the market's current state should not be confused with a downturn. His confidence remained robust, supported by his previous bullish statements highlighting favorable conditions for investing in crypto, particularly in Solana. Placeholder is actively involved with major blockchain projects, although no new funding was announced alongside his comments.

Crypto Expert Chris Burniske Highlights Favorable Market Conditions

Chris Burniske, a partner at Placeholder, addressed market sentiments on May 30 concerning a crypto market pullback. Sharing his insights on social media, Burniske suggested the market's current state should not be confused with a downturn. His confidence remained robust, supported by his previous bullish statements highlighting favorable conditions for investing in crypto, particularly in Solana. Placeholder is actively involved with major blockchain projects, although no new funding was announced alongside his comments.

The market conditions he described suggest a potential for continued growth. His comments reinforce the notion that Bitcoin, Ethereum, and Solana stand to benefit. Placeholder's strategic focus remains on developing core networks, mirroring Burniske's optimism.

"Loving where the market is right now. BTC is making PTSD people fear a precipice when it’s already filled the liquidation wick and fell as far as ~15% from its recent highs. ... The setup is sweet for our entry into 2025. … if you’re a long-term investor with conviction, you should be salivating." — Chris Burniske, Partner, Placeholder

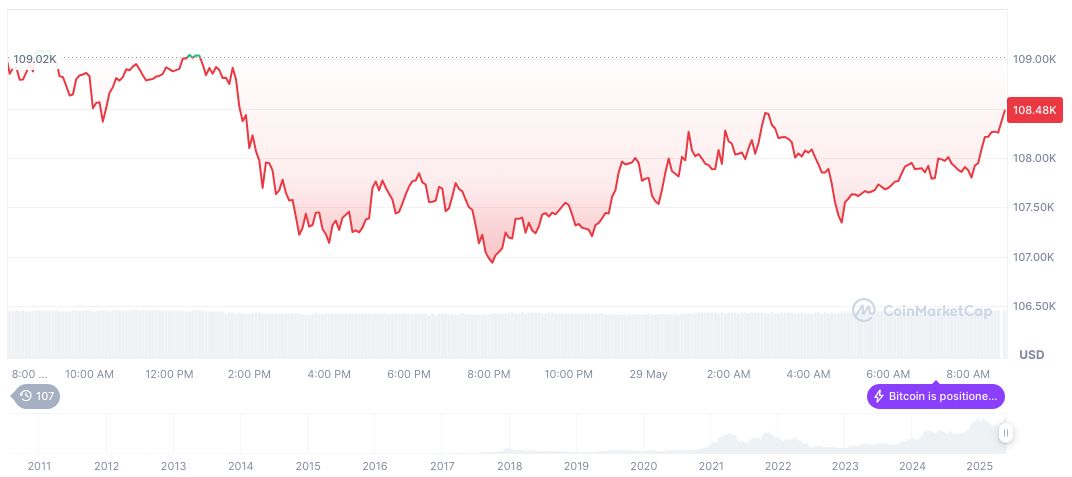

Bitcoin Dips Yet Shows Long-Term Recovery Potential

Did you know? The cryptocurrency market has experienced multiple cycles of boom and bust, often influenced by regulatory news and technological advancements.

Bitcoin (BTC) traded at $105,981.87, with a market cap reaching 2,106,052,808,253, according to CoinMarketCap. Despite a 1.89% decline in 24-hours, Bitcoin maintained a market dominance of 62.95%. It experienced a 7-day price drop of 4.94% but noted increases over the past 30 and 60 days. The circulating supply stood at 19,871,821 as of May 30, 2025.

Coincu research highlights the potential for new technological innovations and infrastructure improvements in key blockchain ecosystems. Experts anticipate regulatory shifts could arise, enhancing framework stability, thereby affecting long-term adoption strategies. The favorable market view suggested by Burniske affirms the resilience of quality assets in ongoing cycles.

Read original article on coincu.comDisclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10