Canopy Growth Corporation (NASDAQ:CGC) will release its fourth-quarter earnings results before the opening bell on Friday, May 30.

Analysts expect the Smiths Falls, Canada-based company to report a quarterly loss at 20 cents per share. According to data from Benzinga Pro, Canopy Growth projects to report quarterly revenue at $71.83 million.

On April 1, the company announced that it strengthened its balance sheet with early prepayment of its senior secured term loan. Canopy said it made an optional early prepayment of $100 million under its senior secured term loan. The prepayment results in interest expense savings of approximately $13 million on an annualized basis.

Canopy Growth shares fell 3.4% to close at $1.71 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

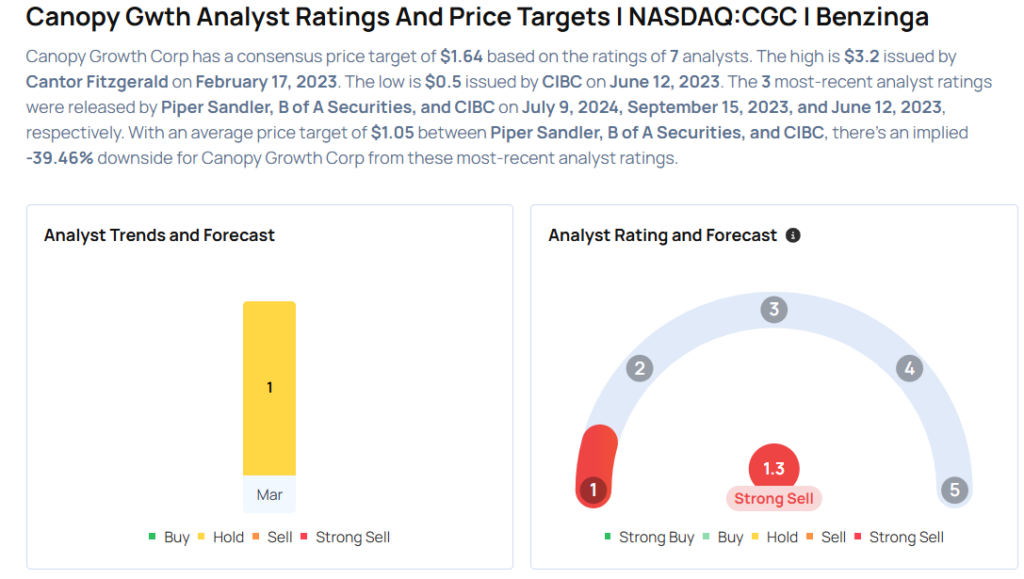

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Zuanic & Associates analyst Pablo Zuanic initiated coverage on the stock with a Neutral rating on March 27, 2025. This analyst has an accuracy rate of 50%.

- Piper Sandler analyst Michael Lavery maintained an Underweight rating and cut the price target from $3 to $2 on July 9, 2024. This analyst has an accuracy rate of 66%.

Considering buying CGC stock? Here’s what analysts think:

Read This Next:

- Top 2 Materials Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock