HP Inc (NYSE:HPQ) reported weaker-than-expected earnings for the second quarter on Wednesday.

HP reported second-quarter revenue of $13.22 billion, beating analyst estimates of $13.15 billion. The company reported second-quarter adjusted earnings of 71 cents per share, missing estimates of 80 cents per share, according to Benzinga Pro.

"In Q2, we delivered solid revenue growth, led by strong Commercial performance in Personal Systems and continued momentum behind our future of work strategy," said Enrique Lores, president and CEO of HP.

HP said it expects third-quarter adjusted earnings of 68 cents to 80 cents per share versus estimates of 90 cents per share. The company also lowered its full-year adjusted earnings outlook from a range of $3.45 to $3.75 per share to a new range of $3 to $3.30 per share. Analysts had been anticipating full-year adjusted earnings of $3.49 per share.

HP shares fell 6.4% to trade at $25.42 on Thursday.

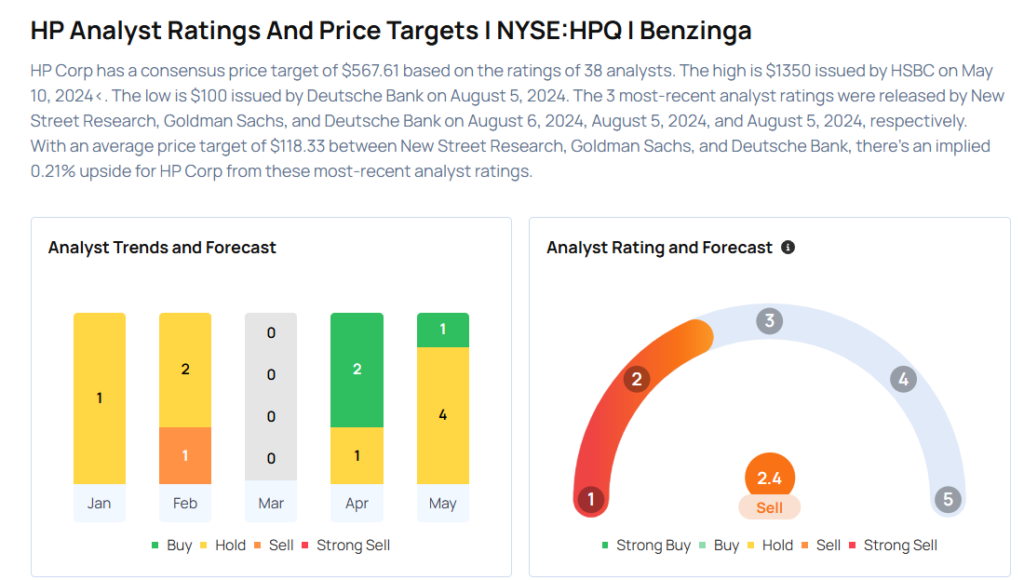

These analysts made changes to their price targets on HP following earnings announcement.

- JP Morgan analyst Samik Chatterjee maintained HP with an Overweight rating and lowered the price target from $30 to $27.

- Barclays analyst Tim Long maintained HP with an Equal-Weight rating and cut the price target from $36 to $28.

Considering buying HPQ stock? Here’s what analysts think:

Read This Next:

- Jim Cramer Says This Quantum Computing Stock Is ‘So High’ And ‘Too Speculative’

Photo via Shutterstock