Verint Systems Inc. (NASDAQ:VRNT) will release its first-quarter earnings results after the closing bell on Wednesday, June 4.

Analysts expect the Melville, New York-based company to report quarterly earnings at 23 cents per share, down from 59 cents per share in the year-ago period. Verint Systems projects to report quarterly revenue at $194.22 million, compared to $221.28 million a year earlier, according to data from Benzinga Pro.

On May 28, Verint announced it signed a $13 million multi-year deal agreement with one of the top U.S. insurance companies.

Verint Systems shares rose 3.4% to close at $17.81 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

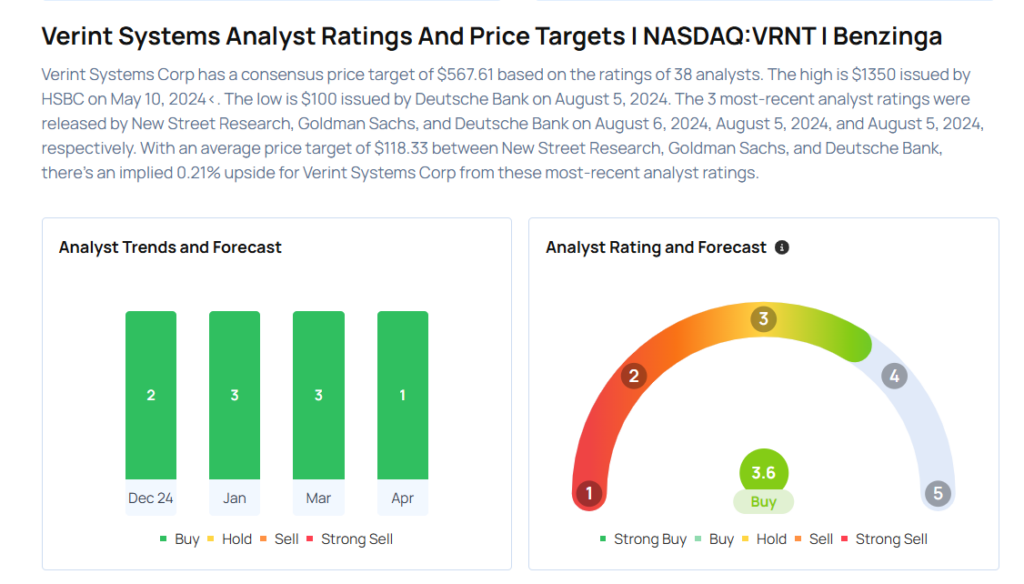

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wedbush analyst Daniel Ives maintained an Outperform rating and cut the price target from $38 to $30 on March 28, 2025. This analyst has an accuracy rate of 81%.

- Evercore ISI Group analyst Peter Levine maintained an In-Line rating and slashed the price target from $34 to $23 on March 27, 2025. This analyst has an accuracy rate of 73%.

- TD Cowen analyst Shaul Eyal maintained a Buy rating and cut the price target from $40 to $36 on Sept. 5, 2024. This analyst has an accuracy rate of 78%.

Considering buying VRNT stock? Here’s what analysts think:

Read This Next:

- Cramer: Should’ve Told Investors To ‘Pull The Trigger’ On Trade Desk, Can’t Believe ‘How Low’ Gentex Has Fallen

Photo via Shutterstock