Overall option-market activity eased in May, but popular '0DTE' contracts saw their strongest monthly volume on record

The share of trading volume in S&P 500-linked options contracts on the verge of expiration surged to a fresh record high in May, marking the latest milestone in the growth of one of Wall Street's most popular options strategies, according to data from Cboe Global Markets.

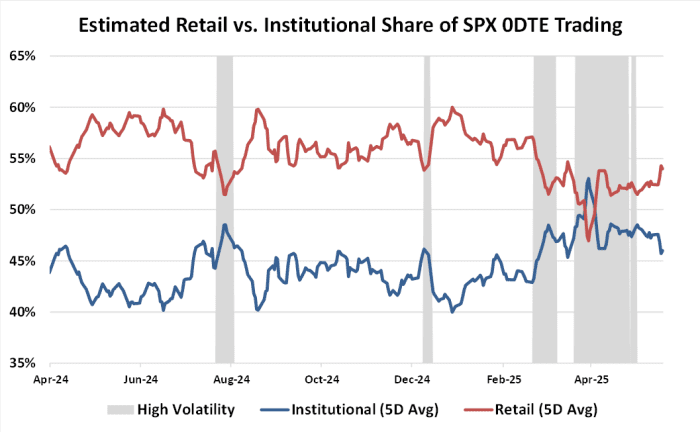

While overall options-market activity eased last month, so-called "zero days to expiry," or "0DTE," contracts comprised more than 60% of volume in the S&P 500 SPX complex, the highest share for any single month on record. What is more, much of the bump in activity last month was driven by retail investors, according to Cboe's Mandy Xu.

"While overall May SPX option volumes moderated from their April highs, 0DTE options surged higher, making up over 61% of overall SPX volumes in May - a new record share and an increase of 9ppts from April," Xu said in emailed commentary. "0DTE" is a popular acronym used to refer to "zero-day" options.

"The jump was powered by retail traders, as retail 0DTE trading rebounded following a decline in April, with retail trading now making up 54% of total SPX 0DTE volume (vs. a low of 47% in April)."

Technically, every option contract becomes a "0DTE" during the last day of its lifespan, unless the holder chooses to exercise it beforehand.

Trading activity in "0DTE" options started to take off in 2022, as Cboe Global Markets (Cboe) finished expanding offerings of weekly S&P 500 contracts that expired every day of the trading week.

So far, only "0DTE" contracts tied to major indexes like the S&P 500 and a handful of index-tracking ETFs can be traded daily. 0DTE contracts on S&P 500 futures are also available.

But recently, Nasdaq Inc. $(NDAQ)$ announced plans to start offering more weekly contracts for popular stocks like Tesla Inc. $(TSLA)$ and Nvidia Corp. $(NVDA)$, widely seen as a critical first step toward enabling traders to trade "0DTE" strategies tied to individual stocks.