Donaldson Company, Inc. (NYSE:DCI) will release its third-quarter financial results before the opening bell on Tuesday, June 3.

Analysts expect the Bloomington, Minnesota-based company to report quarterly earnings at 95 cents per share, up from 92 cents per share in the year-ago period. Donaldson projects quarterly revenue of $933.45 million, compared to $927.9 million a year earlier, according to data from Benzinga Pro.

On June 2, Donaldson named Richard Lewis as Chief Operating Officer, effective Aug. 1.

Donaldson shares fell 0.6% to close at $69.17 on Monday.

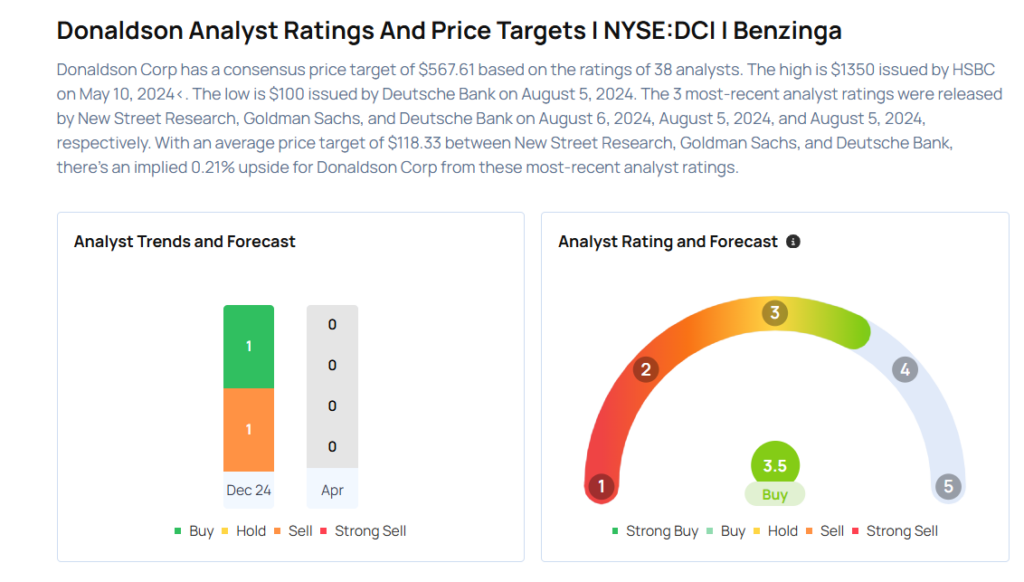

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Stifel analyst Nathan Jones maintained a Hold rating and cut the price target from $70 to $63 on April 14, 2025. This analyst has an accuracy rate of 78%.

- Baird analyst Richard Eastman maintained an Outperform rating and boosted the price target from $81 to $83 on Dec. 4, 2024. This analyst has an accuracy rate of 74%.

- Raymond James analyst Tim Thein initiated coverage on the stock with a Market Perform rating on June 28, 2024. This analyst has an accuracy rate of 68%.

Considering buying DCI stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Tech And Telecom Stocks Delivering High-Dividend Yields

Photo via Shutterstock