Ciena Corporation (NYSE:CIEN) will release its second-quarter financial results before the opening bell on Thursday, June 5.

Analysts expect the Hanover, Maryland-based company to report quarterly earnings at 52 cents per share, up from 27 cents per share in the year-ago period. Ciena projects quarterly revenue of $1.09 billion, compared to $910.83 million a year earlier, according to data from Benzinga Pro.

On March 11, Ciena Corpreported a fiscal first-quarter 2025 revenue growth of 3.3% year-on-year to $1.07 billion, beating the analyst consensus estimate of $1.05 billion.

Ciena shares gained 0.8% to close at $83.89 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

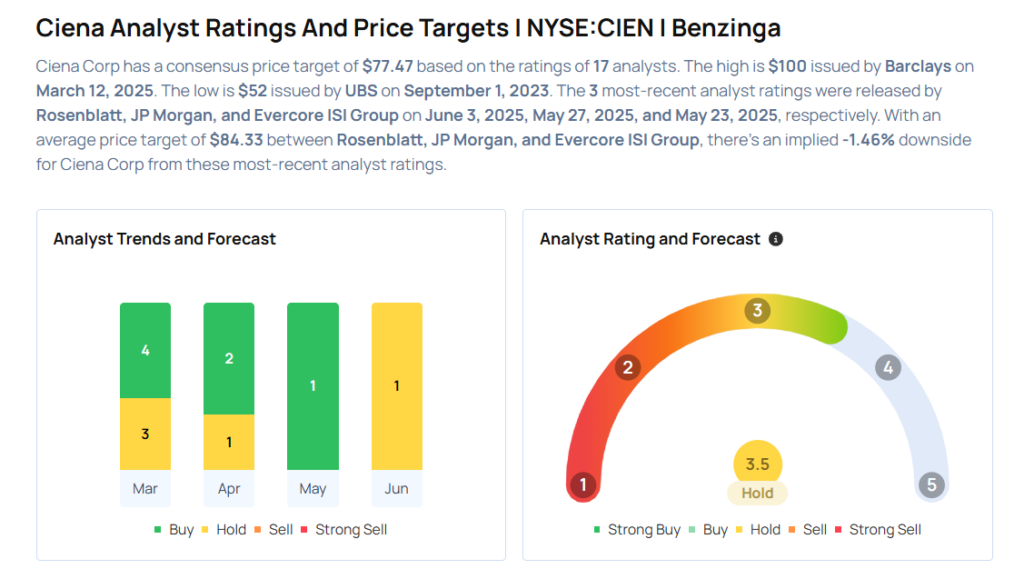

- Rosenblatt analyst Mike Genovese maintained a Neutral rating and raised the price target from $65 to $85 on June 3, 2025. This analyst has an accuracy rate of 68%.

- JP Morgan analyst Samik Chatterjee maintained an Overweight rating and boosted the price target from $76 to $86 on May 27, 2025. This analyst has an accuracy rate of 70%.

- Evercore ISI Group analyst Amit Daryanani maintained an In-Line rating and raised the price target from $68 to $82 on May 23, 2025. This analyst has an accuracy rate of 74%.

- Citigroup analyst Jim Suava maintained a Buy rating and cut the price target from $98 to $75 on April 14, 2025. This analyst has an accuracy rate of 69%.

- B. Riley Securities analyst Dave Kang maintained a Buy rating and cut the price target from $97 to $89 on March 12, 2025. This analyst has an accuracy rate of 75%

Considering buying CIEN stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: Arrowhead Pharmaceuticals Doesn’t ‘Have The Horses’

Photo via Shutterstock