Circle IPO Debut Outperforms Meta, Airbnb, and Robinhood

Circle, the company behind the USDC stablecoin, made a stunning entrance on Wall Street this week. On Thursday, June 5, 2025, the company debuted on the New York Stock Exchange under the ticker CRCL. The stock was priced at $31 per share for the launch, and as expected, it had a very great debut.

The demand once the market initially opened was overwhelming and unexpected. But what happened next was beyond expectations. When markets opened Thursday morning, Circle’s stock more than tripled within minutes. Trading was so intense that the NYSE had to halt it multiple times due to extreme volatility.

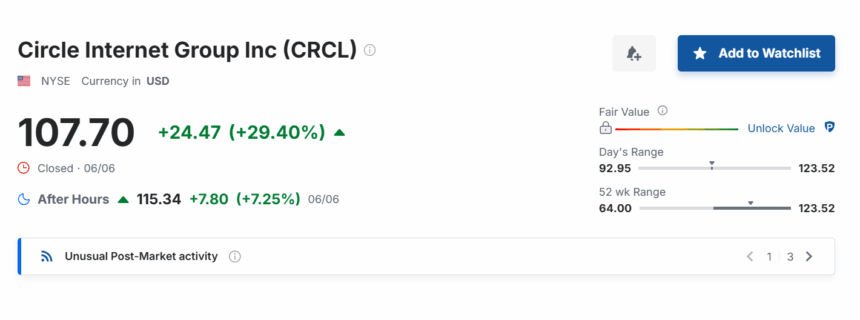

By the end of the day, Circle’s stock had closed at $82.84, marking a 167% gain from its IPO price. The momentum didn’t stop there. On Friday, CRCL hit a high of $123.51—just 49 cents away from quadrupling its original offering price. Currently, the price has settled at $107.70, representing a 29% surge over the last 24 hours.

That kind of surge is rare. Compared to other well-known tech IPOs, Circle’s performance stands out. Meta, formerly Facebook, went public in 2012 at $38 per share. It ended its first trading day flat, closing at $38.23. Even with a massive $104 billion valuation, Meta’s stock didn’t move much.

Robinhood had a rougher start. In 2021, it priced its IPO at $38, but the stock closed down over 8% on the first day at $34.82. Uber also had a disappointing debut in 2019, closing its first trading day below its $45 IPO price.

Even Airbnb, whose 2020 IPO was seen as a breakout, posted a 112% jump from $68 to $144.71 on its first day, but still, they all didn’t match Circle’s spike.

Circle’s valuation after the IPO was about $19 billion. That’s smaller than Meta or Airbnb at their debut, but the stock’s price action caught major attention.

CRCL is now seen as one of the few ways for investors to get exposure to the crypto sector on the stock market. Just a day after Circle’s debut, crypto exchange Gemini confirmed it had filed to go public too.

Also Read: Analyst Calls for Bearish Bets on Circle Stock, Short Squeeze Incoming?

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10