RH (NYSE:RH) will release earnings results for the first quarter, after the closing bell on Thursday, June 12.

Analysts expect the Corte Madera, California-based company to report quarterly loss at 7 cents per share, versus a year-ago loss of 40 cents per share. RH projects to report quarterly revenue at $818.57 million, compared to $726.96 million a year earlier, according to data from Benzinga Pro.

On May 20, RH named Lisa Chi as President and Co-Chief Merchandising & Creative Officer.

RH shares fell 5.5% to close at $178.98 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

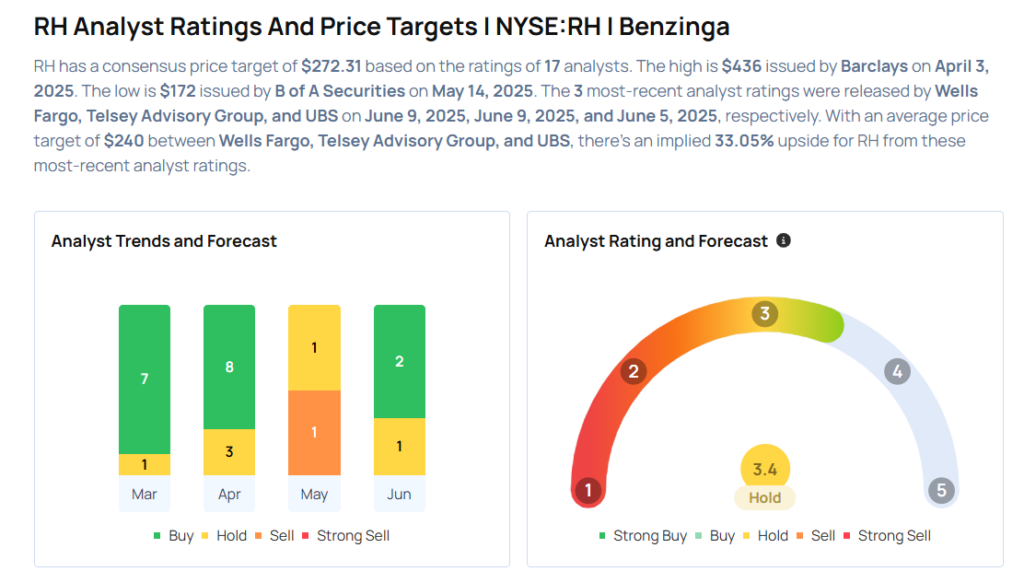

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wells Fargo analyst Zachary Fadem maintained an Overweight rating and cut the price target from $300 to $250 on June 9, 2025. This analyst has an accuracy rate of 84%.

- UBS analyst Michael Lasser maintained a Neutral rating and cut the price target from $235 to $215 on June 5, 2025. This analyst has an accuracy rate of 79%.

- Goldman Sachs analyst Kate McShane maintained a Neutral rating and cut the price target from $276 to $194 on May 5, 2025. This analyst has an accuracy rate of 67%.

- JP Morgan analyst Christopher Horvers maintained an Overweight rating and slashed the price target from $510 to $250 on April 14, 2025. This analyst has an accuracy rate of 71%.

- Morgan Stanley analyst Simeon Gutman maintained an Overweight rating and cut the price target from $530 to $300 on April 3, 2025. This analyst has an accuracy rate of 66%.

Considering buying RH stock? Here’s what analysts think:

Read This Next:

- Top 2 Consumer Stocks That May Plunge In June

Photo via Shutterstock