Academy Sports and Outdoors, Inc. (NASDAQ:ASO) reported downbeat first-quarter results on Tuesday.

The company reported quarterly adjusted earnings per share of 76 cents, missing the analyst consensus estimate of 90 cents. Net sales of $1.35 billion missed the Street view of $1.37 billion.

“During the first quarter we saw continued progress across our strategic initiatives, including the opening of five new stores, and the biggest brand launch in the Company’s history with the addition of the Jordan Brand,” said Steve Lawrence, Chief Executive Officer.

The company adjusted its full-year guidance, widening the range to account for potential economic uncertainties and tariff impacts.

Academy Sports has revised its fiscal year 2025 adjusted earnings per share guidance to a range of $5.45-$6.25, previously $5.75-$6.20, while the analyst consensus is $5.96. Concurrently, the company also revised its FY2025 sales outlook to $5.97 billion-$6.26 billion, from $6.09 billion-$6.26 billion, against an estimated $6.14 billion.

This revised outlook considers multiple tariff scenarios and what the company termed an "uncertain demand environment."

Academy Sports and Outdoors shares gained 4.6% to trade at $46.67 on Wednesday.

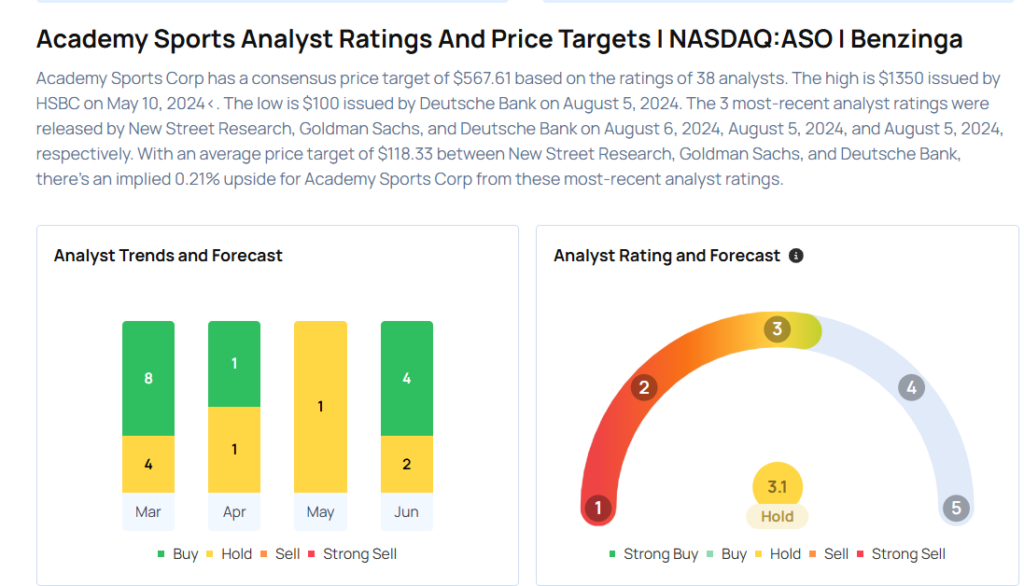

These analysts made changes to their price targets on Academy Sports and Outdoors following earnings announcement.

- Telsey Advisory Group analyst Cristina Fernandez maintained Academy Sports with an Outperform rating and lowered the price target from $60 to $58.

- B of A Securities analyst Robert Ohmes maintained the stock with a Neutral and lowered the price target from $60 to $55.

Considering buying ASO stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech And Telecom Stocks You May Want To Dump In Q2

Photo via Shutterstock