The J. M. Smucker Company (NYSE:SJM) reported mixed fourth-quarter financial results and issued FY26 adjusted EPS guidance below estimates on Tuesday.

JM Smucker reported quarterly earnings of $2.31 per share which beat the analyst consensus estimate of $2.24 per share. The company reported quarterly sales of $2.14 billion which missed the analyst consensus estimate of $2.18 billion.

“Our fourth quarter and full-year results underscore the demand for our leading brands, the resilience of our business, and our ability to act with speed and agility in a dynamic operating environment,” said Mark Smucker, Chief Executive Officer and Chair of the Board. “This year we strengthened our financial position and grew both adjusted earnings per share and free cash flow, while investing in our business, paying down debt, and returning cash to our shareholders through dividends.”

J.M. Smucker forecasts fiscal year 2026 adjusted earnings per share between $8.50 and $9.50, falling below the analyst consensus of $10.26. The company also anticipates net sales to increase by 2% to 4% for the upcoming fiscal year.

J.M. Smucker shares gained 1.8% to trade at $96.11 on Wednesday.

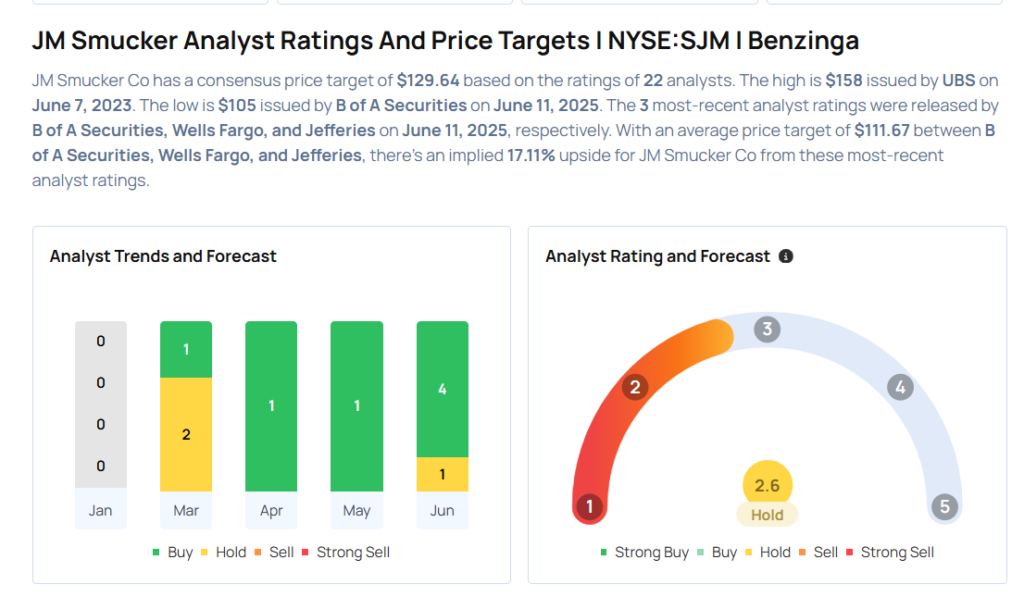

These analysts made changes to their price targets on J.M. Smucker following earnings announcement.

- Jefferies analyst Rob Dickerson upgraded JM Smucker from Hold to Buy and lowered the price target from $118 to $115.

- Wells Fargo analyst Chris Carey maintained the stock with an Overweight rating and lowered the price target from $135 to $115.

- B of A Securities analyst Peter Galbo maintained JM Smucker with a Neutral and lowered the price target from $118 to $105.

Considering buying SJM stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech And Telecom Stocks You May Want To Dump In Q2

Photo via Shutterstock