Kroger Co. (NYSE:KR) reported better-than-expected first-quarter adjusted EPS results on Friday.

The company reported first-quarter adjusted earnings per share of $1.49, beating the analyst consensus estimate of $1.46. Quarterly sales of $45.12 billion missed the Street view of $45.19 billion, with identical sales ex-fuel increasing 3.2%.

Gross margin in the quarter under review increased to 23% from 22% a year ago. The improvement in gross margin was primarily attributable to the sale of Kroger Specialty Pharmacy, lower shrink, and lower supply chain costs, partially offset by the mix effect from growth in pharmacy sales which have lower margins.

"Our strong sales results and positive momentum give us confidence to raise our identical sales ex-fuel guidance, to a new range of 2.25% to 3.25%. While first-quarter sales and profitability exceeded our expectations, the macroeconomic environment remains uncertain, and as a result, other elements of our guidance remain unchanged," CFO David Kennerley said.

Kroger shares gained 2.4% to trade at $73.72 on Monday.

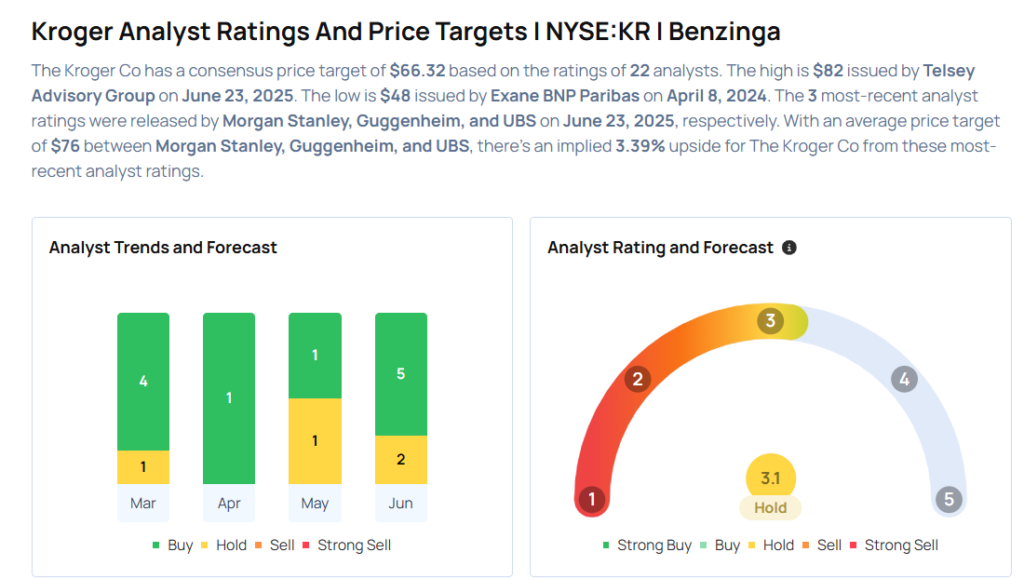

These analysts made changes to their price targets on Kroger following earnings announcement.

- Deutsche Bank analyst Paul Trussell maintained Kroger with a Hold and raised the price target from $57 to $67.

- Telsey Advisory Group analyst Joseph Feldman maintained the stock with an Outperform rating and raised the price target from $73 to $82.

- UBS analyst Michael Lasser maintained the stock with a Neutral and raised the price target from $66 to $74.

- Guggenheim analyst John Heinbockel maintained Kroger with a Buy and boosted the price target from $73 to $78.

- Morgan Stanley analyst Simeon Gutman maintained the stock with an Equal-Weight rating and raised the price target from $71 to $76.

Considering buying KR stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech Stocks That Could Sink Your Portfolio In June

Photo via Shutterstock