Accenture Plc (NYSE:ACN) posted better-than-expected third-quarter earnings on Friday.

The company reported quarterly earnings of $3.49 per share, topping the analyst consensus estimate of $3.31.

The company reported sales of $17.7 billion, slightly exceeding the analyst consensus estimate of $17.30 billion. Sales increased 8% in U.S. dollars and 7% in local currency.

“I am very pleased with our third quarter fiscal 2025 results, including our 30 clients with quarterly bookings greater than $100 million, broad-based growth and continued expansion of our leadership in Gen AI. Companies need resilience and results, and we are laser-focused on delivering measurable value for our clients, which is fueling our growth and making a difference for us in the market. I want to thank our more than 790,000 people for all they do every day to deliver on the promise of technology and human ingenuity as only Accenture can.”

Accenture narrowed its fiscal year 2025 revenue growth outlook to 6%-7% (prior 5%-7%) in local currency. The company forecasts 2025 diluted earnings of $12.77-$12.89 (prior $12.55-$12.79) per share compared to the consensus of $12.75.

Accenture shares rose 1.4% to trade at $289.35 on Monday.

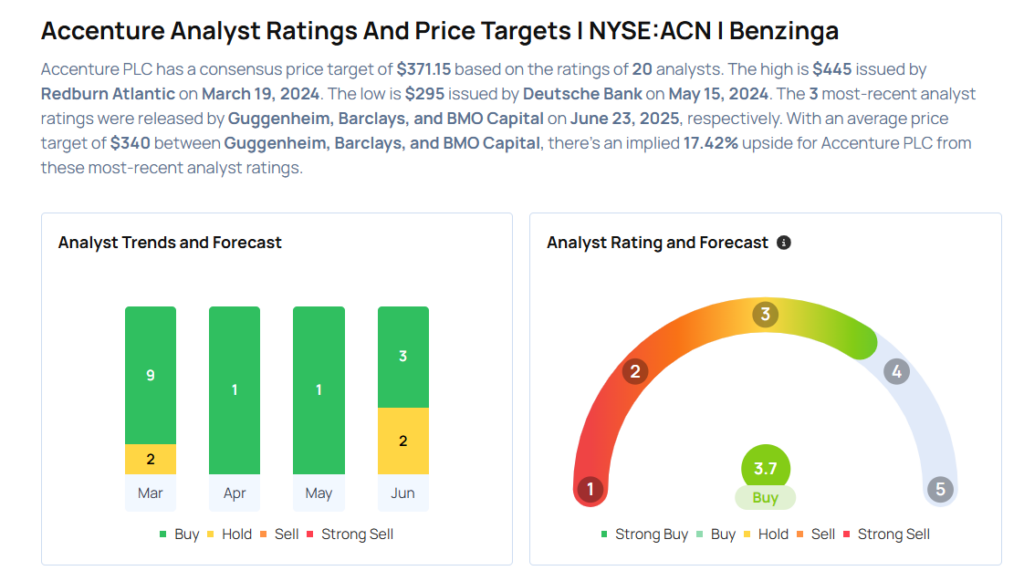

These analysts made changes to their price targets on Accenture following earnings announcement.

- BMO Capital analyst Keith Bachman maintained Accenture with a Market Perform and lowered the price target from $355 to $325.

- Barclays analyst Ramsey El-Assal maintained the stock with an Overweight rating and lowered the price target from $390 to $360.

- Guggenheim analyst Jonathan Lee maintained Accenture with a Buy and cut the price target from $360 to $335.

Considering buying ACN stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech Stocks That Could Sink Your Portfolio In June

Photo via Shutterstock