Acuity Inc. (NYSE:AYI) will release earnings results for the third quarter, before the opening bell on Thursday, June 26.

Analysts expect the Atlanta, Georgia-based company to report quarterly earnings at $4.43 per share, up from 62 cents per share in the year-ago period. Acuity projects to report quarterly revenue at $1.15 billion, compared to $6.81 billion a year earlier, according to data from Benzinga Pro.

On April 3, Acuity Brands reported fiscal second-quarter 2025 net sales growth of 11.1% year over year to $1.01 billion, missing the analyst consensus estimate of $1.03 billion.

Acuity shares rose 1.3% to close at $284.44 on Wednesday.

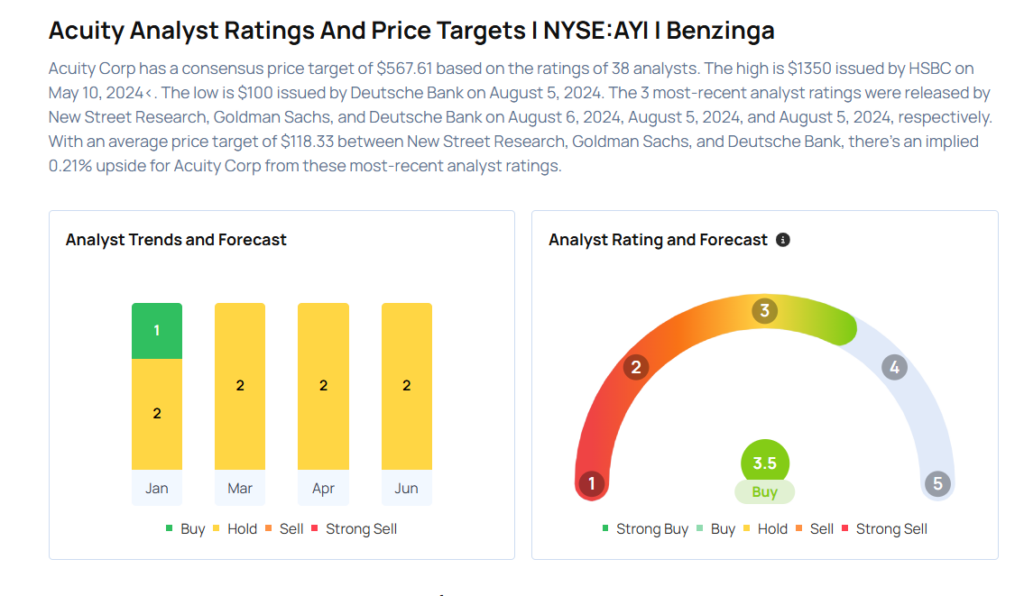

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Baird analyst Timothy Wojs maintained a Neutral rating and raised the price target from $295 to $315 on June 18, 2025. This analyst has an accuracy rate of 61%.

- Wells Fargo analyst Joseph O'Dea maintained an Equal-Weight rating and raised the price target from $275 to $285 on June 17, 2025. This analyst has an accuracy rate of 63%.

- Oppenheimer analyst Christopher Glynn maintained an Outperform rating and increased the price target from $370 to $380 on Jan. 9, 2025. This analyst has an accuracy rate of 79%.

Considering buying AYI stock? Here’s what analysts think:

Read This Next:

- Top 3 Real Estate Stocks You May Want To Dump In June

Photo via Shutterstock