Rigetti Computing (NasdaqCM:RGTI) Sees 60% Price Surge Over Last Quarter

In June 2025, Rigetti Computing (NasdaqCM:RGTI) underwent significant index constituent changes and completed a $350 million follow-on equity offering, paralleling a 60% share price climb over the last quarter. The company shifted towards growth-focused indices, aligning its prospects with broader tech stock rallies as indices like the S&P 500 and Nasdaq reached new highs. Rigetti's Q1 earnings report showcased improved net income, contrasting with declining sales, while the S&P 500's broader market rally of 13% over the year and 2.2% weekly gain suggests these strategic maneuvers supported or complemented the general market trends.

We've identified 4 possible red flags with Rigetti Computing (at least 1 which is a bit unpleasant) and understanding the impact should be part of your investment process.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Over the past year, Rigetti Computing achieved an astounding total return exceeding 1262%, setting a remarkable performance backdrop. This impressive appreciation places it ahead of the overall US Market, which returned 13.2%, and the US Semiconductor industry, which posted a 14.4% gain. Such a significant surge underscores the stock's volatility and the market's expectations regarding its future prospects.

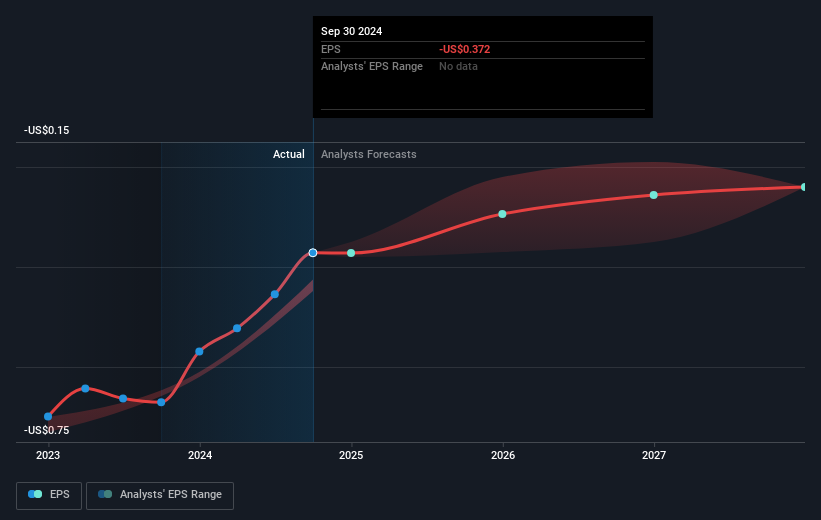

Looking forward, the strategic shifts discussed earlier, including the index constituent changes and successful capital raising, could reinforce the revenue and earnings forecasts. Despite the company being unprofitable, a forecasted revenue growth of 40.4% per year highlights its potential. Meanwhile, the share price increase narrows the gap to the consensus price target of US$14.83, suggesting the market is leaning toward a positive outlook about the company's valuation. However, the current elevated Price-To-Book Ratio indicates a higher valuation than industry peers, which investors may need to consider carefully.

Jump into the full analysis health report here for a deeper understanding of Rigetti Computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10