Conagra Brands, Inc. (NYSE:CAG) will release earnings results for the fourth quarter, before the opening bell on Thursday, July 10.

Analysts expect the Chicago, Illinois-based company to report quarterly earnings at 61 cents per share, versus 61 cents per share in the year-ago period. Conagra Brands projects to report quarterly revenue at $2.88 billion, compared to $2.91 billion a year earlier, according to data from Benzinga Pro.

On June 25, Conagra Brands announced it will complete the removal of certified food, drug, and cosmetic colors from its U.S. frozen product portfolio by the end of 2025.

Conagra Brands shares rose 2.8% to close at $21.05 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

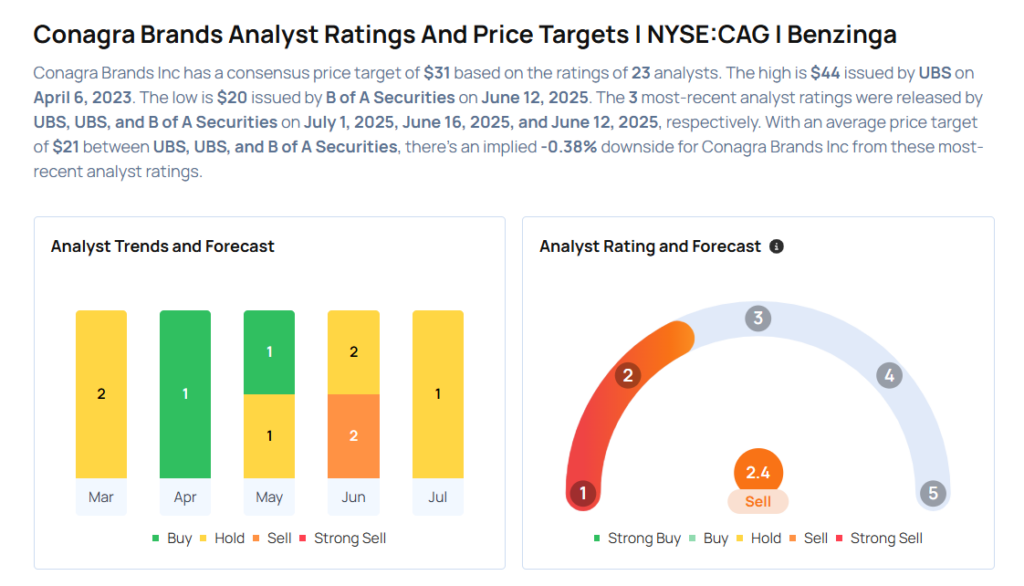

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- B of A Securities analyst Bryan Spillane downgraded the stock from Neutral to Underperform and cut the price target from $27 to $20 on June 12, 2025. This analyst has an accuracy rate of 61%.

- Goldman Sachs analyst Leah Jordan downgraded the stock from Neutral to Sell and slashed the price target from $26 to $21 on June 9, 2025. This analyst has an accuracy rate of 66%.

- Wells Fargo analyst Chris Carey maintained an Equal-Weight rating and decreased the price target from $27 to $23 on June 2, 2025. This analyst has an accuracy rate of 61%.

- JP Morgan analyst Ken Goldman maintained a Neutral rating and cut the price target from $26 to $25 on May 6, 2025. This analyst has an accuracy rate of 76%.

- Morgan Stanley analyst Megan Alexander initiated coverage on the stock with an Equal-Weight rating and a price target of $27 on March 24, 2025. This analyst has an accuracy rate of 70%.

Considering buying CAG stock? Here’s what analysts think:

Read This Next:

- Cramer Backs This Mining Giant After $1.6B Bet

Photo via Shutterstock