BlackRock (NYSE:BLK) Considers Selling Aramco Pipeline Stake Back To Energy Giant

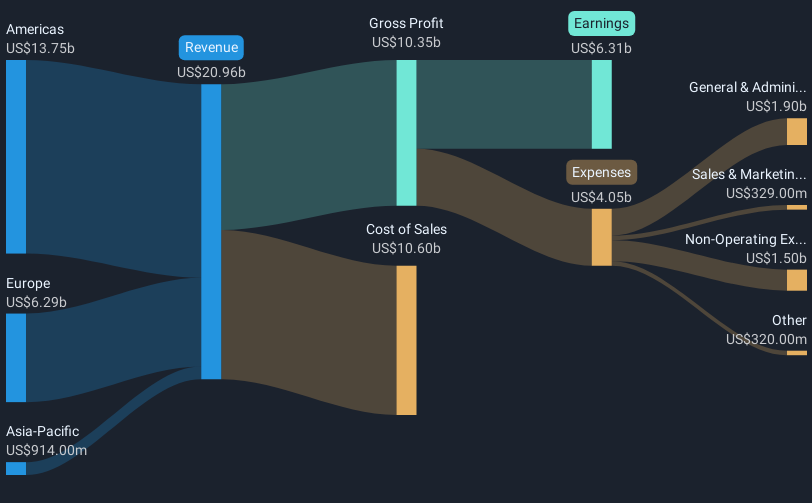

BlackRock (NYSE:BLK) is reportedly in talks to sell its stake in Aramco’s natural-gas pipeline network, marking a significant shift in its asset strategy. This move coincides with a remarkable 32% rise in the company's stock over the last quarter. While the broader market rose by 2% this week, the firm benefited from M&A discussions and product innovations. Recent initiatives, like launching new ETFs and collaborating with Great Gray Trust, have reinforced its market position. Additionally, activity in mergers and acquisitions, and the declared dividend, provided further momentum, aligning with rising market performance and contributing to a positive investor sentiment.

We've identified 1 possible red flag for BlackRock that you should be aware of.

The end of cancer? These 24 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BlackRock's potential sale of its stake in Aramco’s natural-gas pipeline network could reshape its asset base, enhancing liquidity and enabling investment in higher-margin opportunities like private markets and technology. This aligns with the firm's ongoing efforts to expand in alternative investments and improve margins. Such moves could bolster revenue growth amid economic uncertainties, contributing to anticipated margins reaching 32.7% by 2028, up from today’s 30.1%.

The company's long-term performance has been strong, with total shareholder returns, including dividends, reaching 122.38% over the past five years. Over the last year alone, BlackRock's stock outperformed the US Capital Markets industry, which returned 36.1%. This robust performance relative to the market showcases the firm's ability to capitalize on market opportunities and foster investor confidence.

The stock’s recent price increase complements the positive sentiment, but it's important to note the current share price of US$914.97 remains slightly below the analysts' price target of US$1,023.32. This suggests potential for further appreciation, contingent on achieving forecasted revenue growth of 9.9% annually and earnings projections. The market will be watching closely to see how BlackRock navigates these transitions and executes its expansion plans, particularly in private credit and infrastructure investments, which are critical for sustaining long-term growth.

Click here to discover the nuances of BlackRock with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackRock might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10