Reversal Of Fortune For Liberty Latin America Insiders Who Made A US$3.34m Purchase

Insiders who bought US$3.34m worth of Liberty Latin America Ltd. (NASDAQ:LILA) stock in the last year have seen some of their losses recouped as the stock gained 10% last week. However, the purchase is proving to be a costly gamble, since losses made by insiders have totalled US$566k since the time of purchase.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

The Last 12 Months Of Insider Transactions At Liberty Latin America

The Independent Director Brendan Paddick made the biggest insider purchase in the last 12 months. That single transaction was for US$1.9m worth of shares at a price of US$9.28 each. That means that an insider was happy to buy shares at above the current price of US$6.49. It's very possible they regret the purchase, but it's more likely they are bullish about the company. To us, it's very important to consider the price insiders pay for shares. Generally speaking, it catches our eye when insiders have purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price.

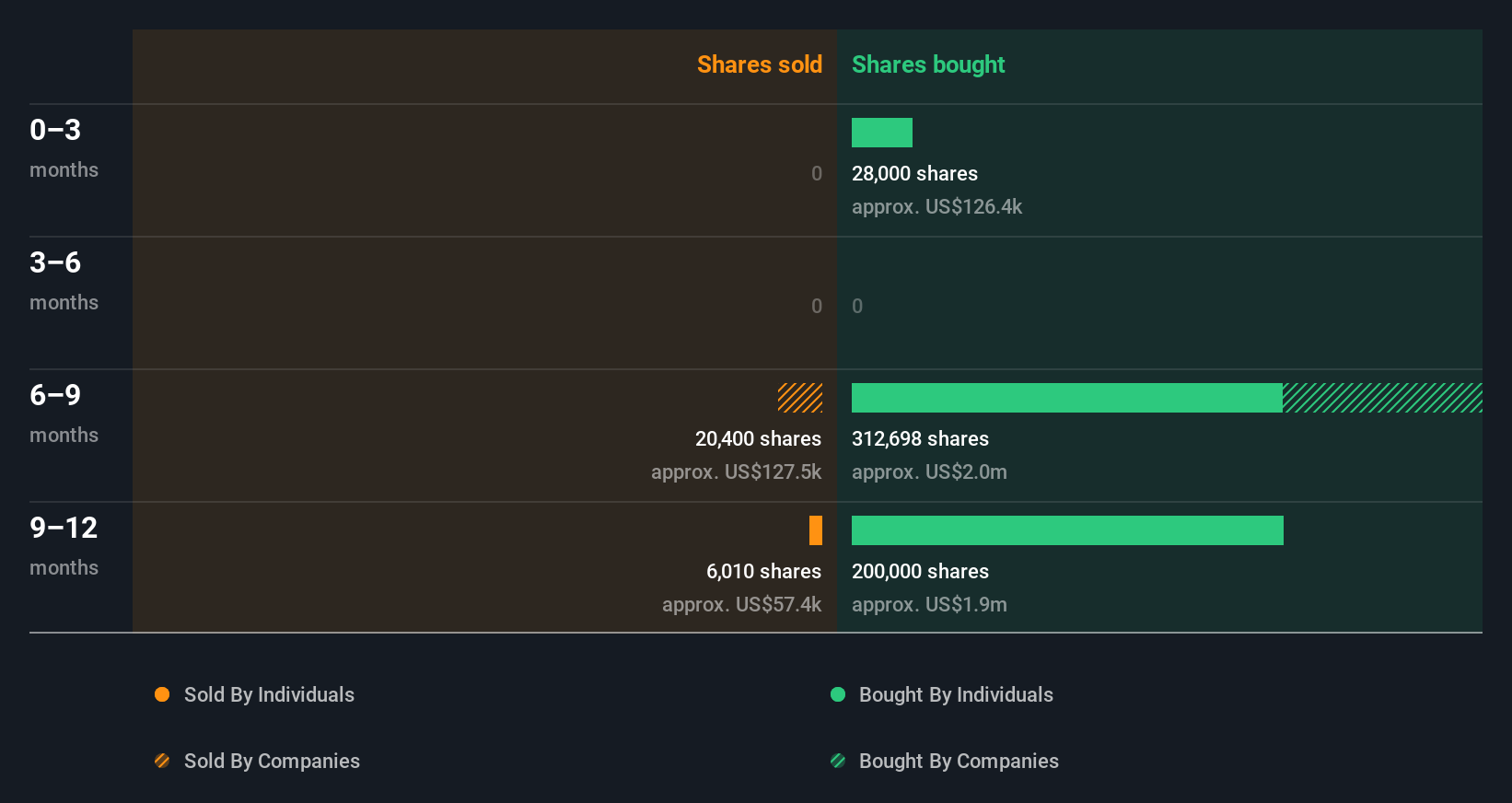

Happily, we note that in the last year insiders paid US$3.3m for 427.55k shares. But they sold 6.01k shares for US$57k. In total, Liberty Latin America insiders bought more than they sold over the last year. The average buy price was around US$7.81. I'd consider this a positive as it suggests insiders see value at around the current price. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

View our latest analysis for Liberty Latin America

Liberty Latin America is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Liberty Latin America Insiders Bought Stock Recently

Over the last quarter, Liberty Latin America insiders have spent a meaningful amount on shares. Senior VP & CFO Christopher Noyes spent US$127k on stock, and there wasn't any selling. This makes one think the business has some good points.

Insider Ownership Of Liberty Latin America

For a common shareholder, it is worth checking how many shares are held by company insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. It's great to see that Liberty Latin America insiders own 11% of the company, worth about US$146m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Liberty Latin America Tell Us?

It is good to see the recent insider purchase. We also take confidence from the longer term picture of insider transactions. But on the other hand, the company made a loss during the last year, which makes us a little cautious. When combined with notable insider ownership, these factors suggest Liberty Latin America insiders are well aligned, and quite possibly think the share price is too low. That's what I like to see! Of course, the future is what matters most. So if you are interested in Liberty Latin America, you should check out this free report on analyst forecasts for the company.

Of course Liberty Latin America may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10