Dekon Food and Agriculture Group (HKG:2419) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Dekon Food and Agriculture Group (HKG:2419) shares have continued their recent momentum with a 27% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 62% in the last year.

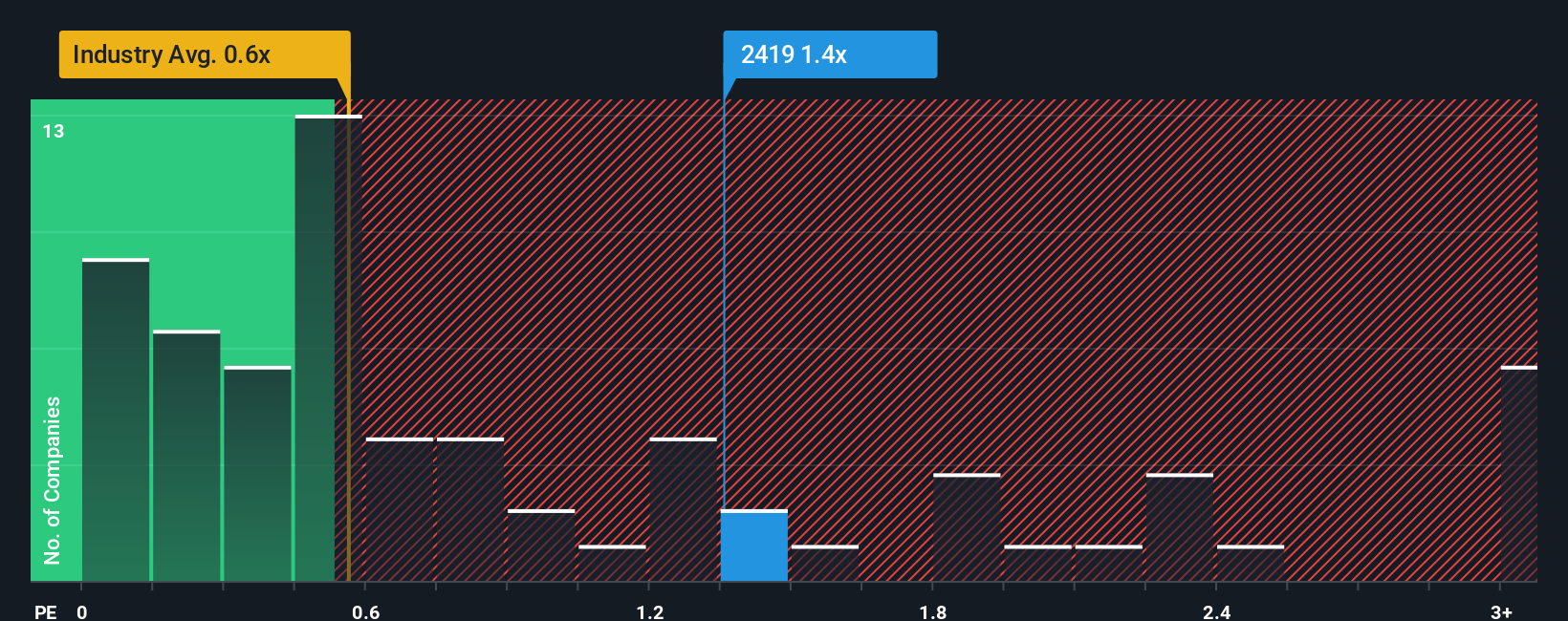

Since its price has surged higher, you could be forgiven for thinking Dekon Food and Agriculture Group is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.4x, considering almost half the companies in Hong Kong's Food industry have P/S ratios below 0.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

See our latest analysis for Dekon Food and Agriculture Group

What Does Dekon Food and Agriculture Group's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Dekon Food and Agriculture Group has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Dekon Food and Agriculture Group.Is There Enough Revenue Growth Forecasted For Dekon Food and Agriculture Group?

Dekon Food and Agriculture Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. Pleasingly, revenue has also lifted 127% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 16% each year as estimated by the three analysts watching the company. With the industry only predicted to deliver 5.5% per annum, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Dekon Food and Agriculture Group's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Dekon Food and Agriculture Group's P/S

The large bounce in Dekon Food and Agriculture Group's shares has lifted the company's P/S handsomely. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Dekon Food and Agriculture Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Dekon Food and Agriculture Group (at least 1 which is a bit concerning), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10