Undiscovered Gems in the US Market for July 2025

The United States market has shown robust performance, rising 2.1% in the last week and 14% over the past year, with all sectors experiencing gains and earnings projected to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks that are not only poised for growth but also remain underappreciated by the broader market can offer investors unique opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| Senstar Technologies | NA | -20.82% | 14.32% | ★★★★★★ |

| China SXT Pharmaceuticals | 64.25% | -29.05% | 10.33% | ★★★★★☆ |

| Gulf Island Fabrication | 19.65% | -2.17% | 42.26% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

| Vantage | 6.72% | -16.62% | -15.47% | ★★★★☆☆ |

Click here to see the full list of 281 stocks from our US Undiscovered Gems With Strong Fundamentals screener.

Let's dive into some prime choices out of from the screener.

West Bancorporation (WTBA)

Simply Wall St Value Rating: ★★★★★★

Overview: West Bancorporation, Inc. is a financial holding company that offers community banking and trust services to individuals and small- to medium-sized businesses in the United States, with a market capitalization of approximately $356.91 million.

Operations: The primary revenue stream for West Bancorporation comes from its community banking segment, generating $82.85 million.

West Bancorporation, with total assets of US$4 billion and equity of US$237.9 million, is making waves in the financial sector. The company has a robust pipeline for loan growth, holding total deposits at US$3.3 billion and loans at US$3 billion. Its net interest margin stands at 1.9%, while maintaining an impressive allowance for bad loans at just 0.01% of total loans, showcasing high credit quality. Recently added to several Russell Growth indices, West Bancorporation's earnings grew by 18% last year—outpacing industry averages—and it trades at a discount to its estimated fair value by about 30%.

- West Bancorporation's operational improvements and strategic asset replacements drive earnings growth. Click here to explore the full narrative on West Bancorporation's investment thesis.

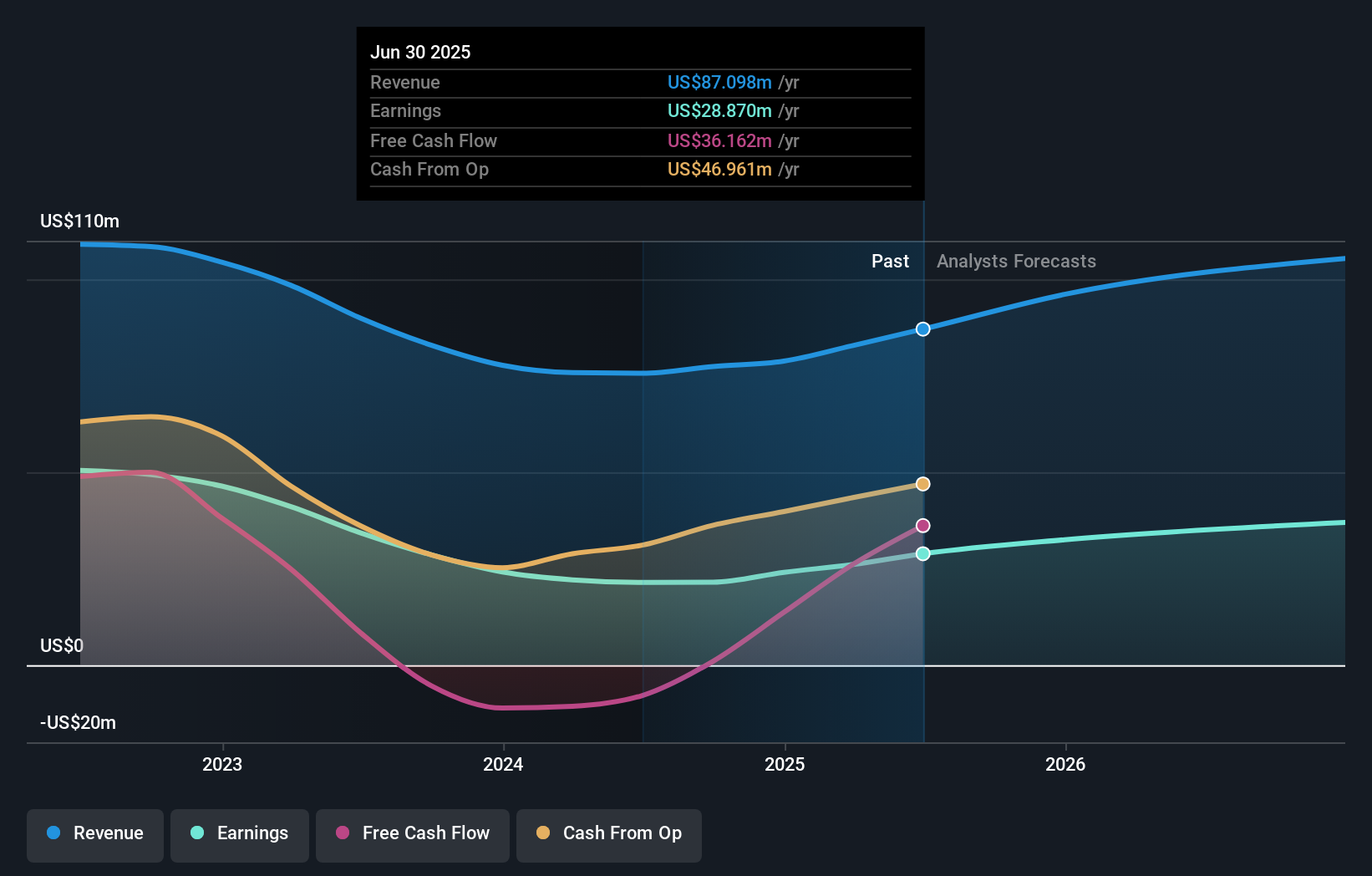

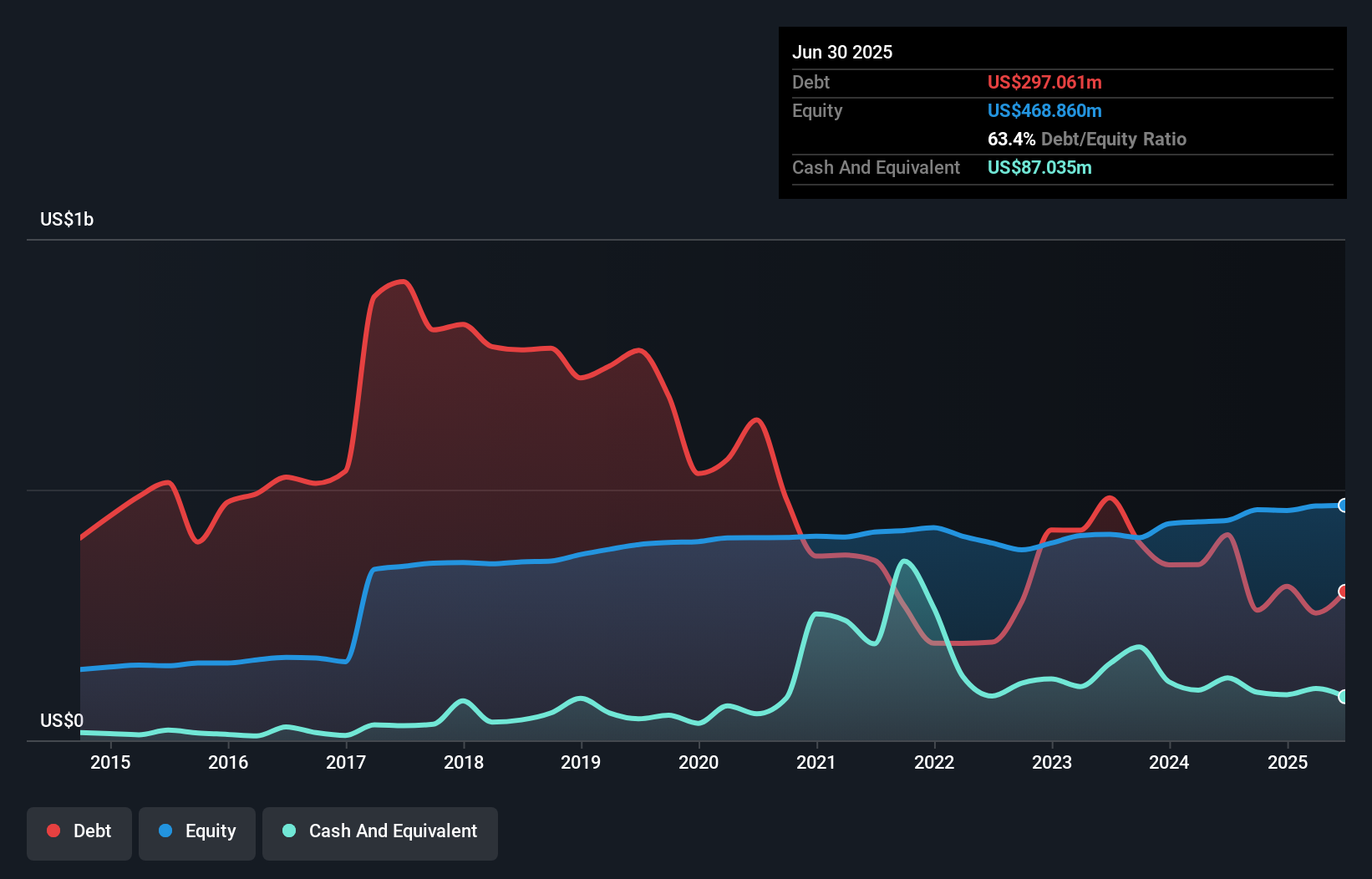

Bar Harbor Bankshares (BHB)

Simply Wall St Value Rating: ★★★★★★

Overview: Bar Harbor Bankshares, with a market cap of $493.82 million, operates as the holding company for Bar Harbor Bank & Trust, offering a range of banking and nonbanking products and services to consumers and businesses.

Operations: BHB generates revenue primarily from its community banking industry segment, amounting to $149.88 million.

Bar Harbor Bankshares, with assets totaling US$4.1 billion and equity of US$467.3 million, is an intriguing player in the financial sector. Its total deposits stand at US$3.3 billion against loans of US$3.1 billion, indicating a solid balance sheet structure supported by primarily low-risk funding sources like customer deposits. The bank's bad loans are minimal at 0.3%, backed by a robust allowance of 354%. Trading at 44% below its estimated fair value, it presents a potential bargain for investors seeking undervalued opportunities with high-quality earnings and consistent growth over the past five years at 9%.

- Dive into the specifics of Bar Harbor Bankshares here with our thorough health report.

Review our historical performance report to gain insights into Bar Harbor Bankshares''s past performance.

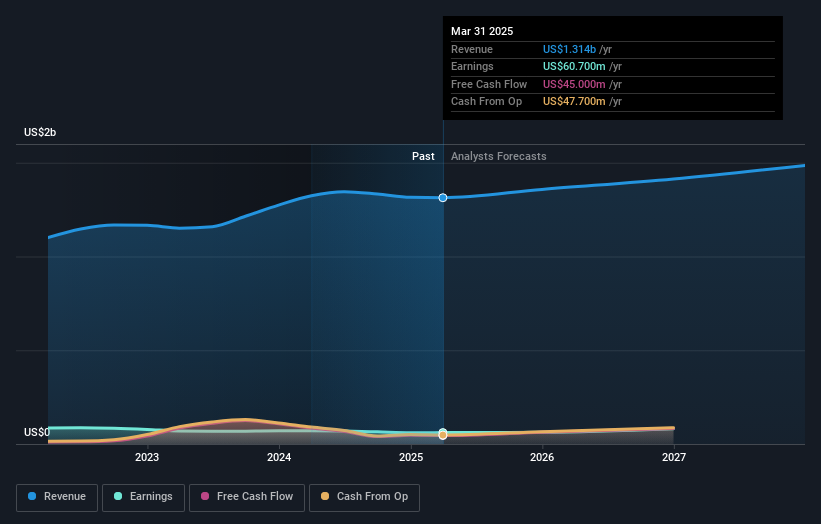

Global Industrial (GIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Global Industrial Company operates as an industrial distributor of a wide range of MRO products in the United States and Canada, with a market cap of approximately $1.08 billion.

Operations: Global Industrial generates revenue primarily through its Industrial Products Group, which reported $1.31 billion in sales. The company's market cap stands at approximately $1.08 billion.

Global Industrial, a nimble player in the industrial distribution sector, is making waves with its strategic focus on customer relationship management and supply chain diversification. With no debt on its books, this company stands out for its financial discipline. Its recent earnings report showed sales of US$321 million and net income of US$13.6 million, slightly up from last year. Despite a negative earnings growth rate of 13% over the past year compared to industry averages, it trades at 35% below estimated fair value, suggesting potential upside as it aims for profit margins to rise from 4.6% to 6.5%.

- Global Industrial's strategic diversification and CRM implementation aim to enhance growth and stabilize margins. Click here to explore the narrative on Global Industrial's strategic initiatives and market potential.

Taking Advantage

- Get an in-depth perspective on all 281 US Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Bancorporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10