29Metals Limited (ASX:29M) Held Back By Insufficient Growth Even After Shares Climb 28%

Despite an already strong run, 29Metals Limited (ASX:29M) shares have been powering on, with a gain of 28% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 31% over that time.

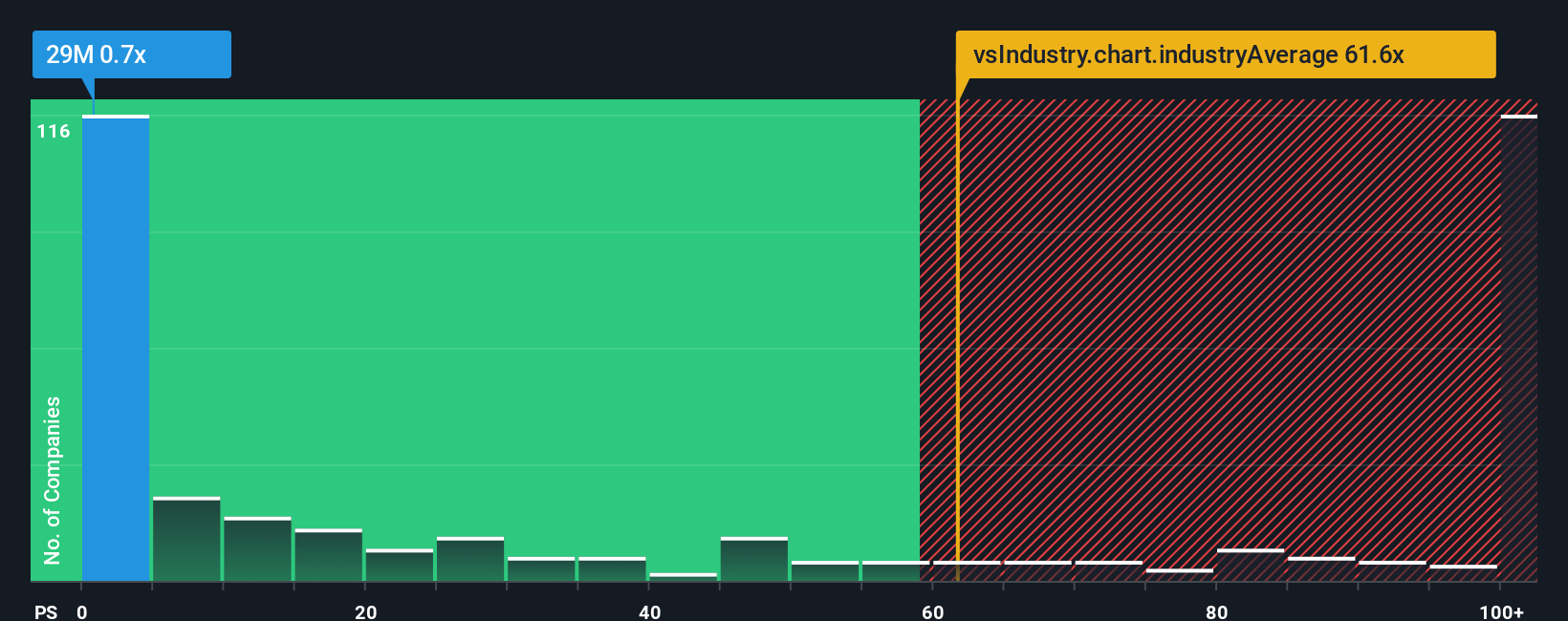

Although its price has surged higher, 29Metals may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Metals and Mining industry in Australia have P/S ratios greater than 61.6x and even P/S higher than 421x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Check out our latest analysis for 29Metals

What Does 29Metals' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, 29Metals has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think 29Metals' future stacks up against the industry? In that case, our free report is a great place to start.How Is 29Metals' Revenue Growth Trending?

In order to justify its P/S ratio, 29Metals would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. Still, revenue has fallen 8.3% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 8.6% each year during the coming three years according to the nine analysts following the company. With the industry predicted to deliver 114% growth per year, the company is positioned for a weaker revenue result.

With this information, we can see why 29Metals is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does 29Metals' P/S Mean For Investors?

29Metals' recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of 29Metals' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for 29Metals (1 can't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10