TradingKey – On Wednesday, July 9, both NVIDIA (NVDA) and Bitcoin (BTC) reached new all-time highs, sparking debate over which asset offers better long-term potential.

NVIDIA: The AI Titan Breaks $4 Trillion

NVIDIA’s stock surged nearly 3% intraday, hitting $164.42 per share, making it the first publicly traded company to surpass a $4 trillion market cap. It closed at $162, up 1.8% on the day.

NVIDIA Stock Chart – Source: TradingKey.

Bitcoin: The Leading Crypto Breaks $112K

Bitcoin rallied 2% in the past 24 hours, briefly touching $112,052, surpassing its previous record from May. It later pulled back to $110,994, with a market cap of $2.225 trillion, ranking #6 globally.

Bitcoin Price Chart – Source: TradingKey

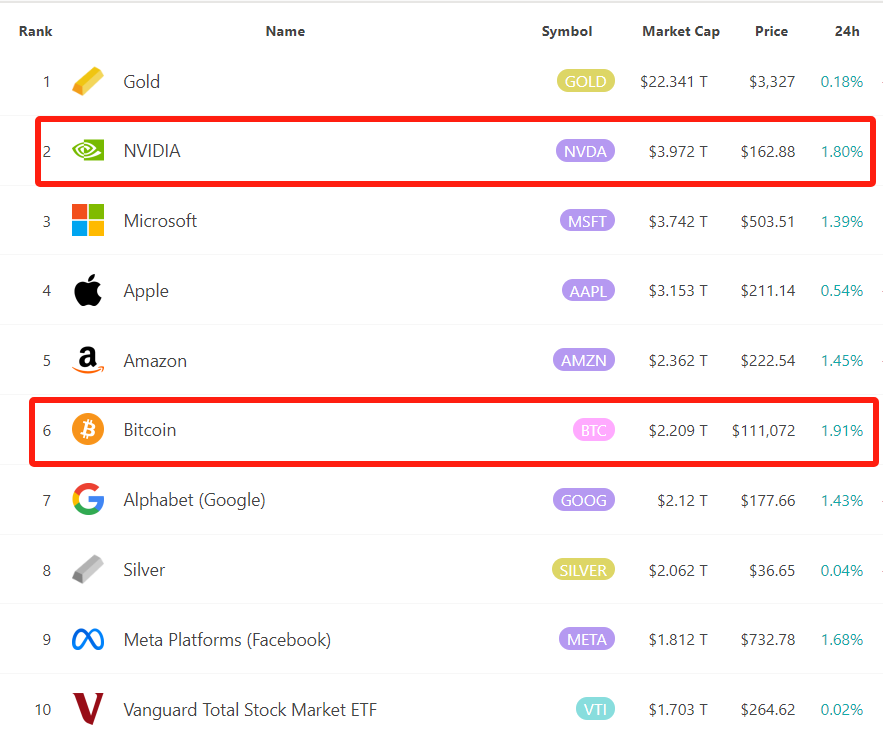

Currently, Nvidia ranks second in the global asset ranking, second only to gold (XAUUSD), far ahead of Apple (AAPL), Microsoft (MSFT) and Amazon (AMZN), etc.; Bitcoin ranks sixth, surpassing Google (GOOG), Meta (META) and silver (XAGUSD), etc.

The top ten assets in the world by market value, source: 8marketcap.

Institutional Outlook

As a leading company in artificial intelligence (AI), Nvidia's soaring stock price shows that investors, especially Wall Street, have great confidence in the AI industry. As the market demand for AI technology continues to soar, many institutions have raised Nvidia's target price.

Firm | New Target | Upside from $162 |

$185 | +14% | |

Citigroup | $190 | +17% |

Loop Capital | $250 | +54% |

As the world's largest cryptocurrency, the rise in Bitcoin prices also reflects the market's recognition of the emerging blockchain technology and cryptocurrency industry, and some institutions remain bullish on its future.

Firm | Target Price |

Standard Chartered | $200K (2025), $300K (2026), $400K (2027), $500K (2028) |

ARK Invest | $1 million by 2030 |

AMBCrypto | $200K–$300K by 2030 |

How Should Investors Choose?

NVIDIA and Bitcoin represent two transformative technologies:

- NVIDIA: AI infrastructure, chip innovation, enterprise adoption.

- Bitcoin: Blockchain decentralization, digital scarcity, financial sovereignty.

They’re not mutually exclusive:

- Bitcoin mining relies on AI chips.

- Blockchain firms provide compute and data for AI models.

Investors can:

- Favor NVIDIA if bullish on AI and enterprise tech.

- Favor Bitcoin if confident in crypto’s role in future finance.

- Hold both to diversify across innovation sectors.

Find out more