Johnson & Johnson (NYSE:JNJ) will release earnings results for the second quarter, before the opening bell on Wednesday, July 16.

Analysts expect the New Brunswick, New Jersey-based company to report quarterly earnings at $2.68 per share, down from $2.82 per share in the year-ago period. Johnson & Johnson projects to report quarterly revenue of $22.86 billion, compared to $22.45 billion a year earlier, according to data from Benzinga Pro.

On July 8, Johnson & Johnson announced the submission of a supplemental new drug application to the US FDA based upon long-term data evaluating the safety and efficacy of CAPLYTA for the prevention of relapse in schizophrenia.

Johnson & Johnson shares gained 0.9% to close at $157.69 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

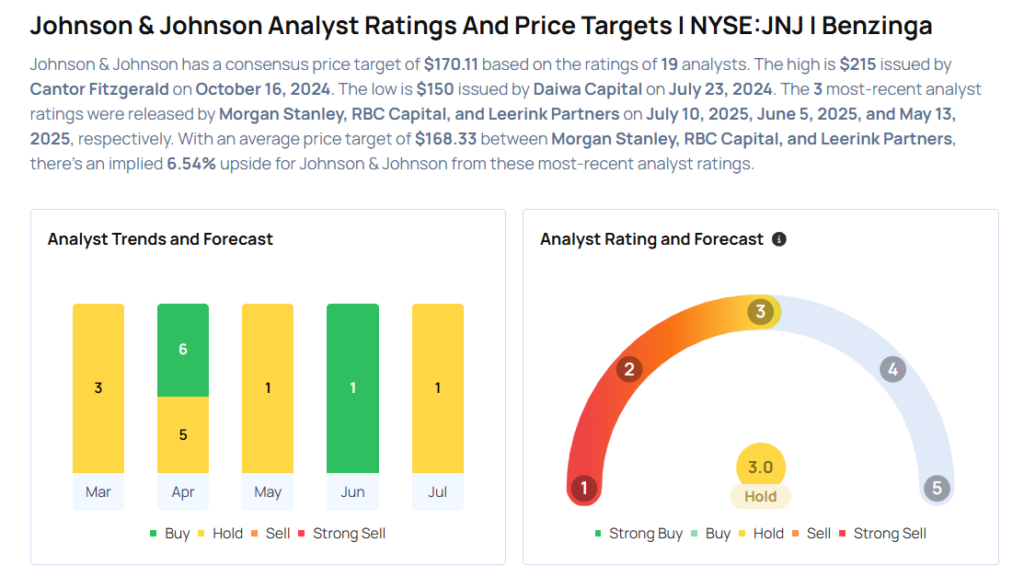

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Morgan Stanley analyst Terence Flynn maintained an Equal-Weight rating and raised the price target from $169 to $171 on July 10, 2025. This analyst has an accuracy rate of 64%.

- Leerink Partners analyst David Risinger downgraded the stock from Outperform to Market Perform and slashed the price target from $169 to $153 on May 13, 2025. This analyst has an accuracy rate of 71%.

- Barclays analyst Matt Miksic maintained an Equal-Weight rating and cut the price target from $166 to $165 on April 17, 2025. This analyst has an accuracy rate of 66%.

- Raymond James analyst Jayson Bedford maintained an Outperform rating and increased the price target from $162 to $164 on April 16, 2025. This analyst has an accuracy rate of 67%.

- B of A Securities analyst Tim Anderson maintained a Neutral rating and cut the price target from $171 to $159 on April 10, 2025. This analyst has an accuracy rate of 62%

Considering buying JNJ stock? Here’s what analysts think:

Read This Next:

- How To Earn $500 A Month From JPMorgan Stock Ahead Of Q2 Earnings

Photo via Shutterstock