Hancock Whitney Corporation (NASDAQ:HWC) will release earnings results for the second quarter, after the closing bell on Tuesday, July 15.

Analysts expect the Gulfport, Mississippi-based company to report quarterly earnings at $1.36 per share, up from $1.31 per share in the year-ago period. Hancock Whitney projects to report quarterly revenue of $376.07 million, compared to $362.43 million a year earlier, according to data from Benzinga Pro.

Hancock Whitney shareholders voted to elect Chevron Corporation executive Albert J. Williams to the board of directors of Hancock Whitney Corporation at the company’s annual shareholder meeting on April 23.

Hancock Whitney shares gained 1.4% to close at $60.77 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

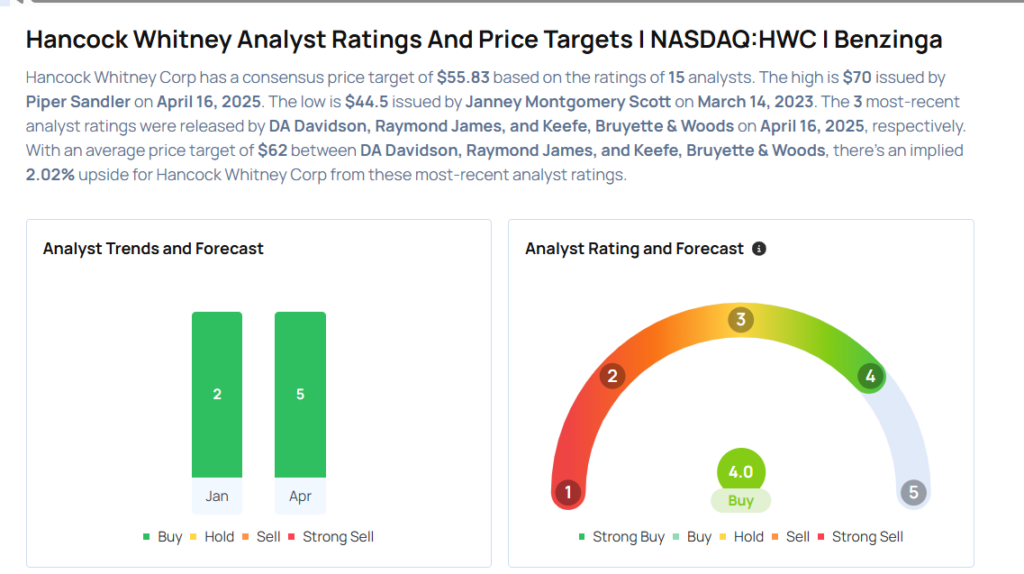

- DA Davidson analyst Gary Tenner maintained a Buy rating and cut the price target from $69 to $62 on April 16, 2025. This analyst has an accuracy rate of 77%.

- Raymond James analyst Michael Rose reiterated a Strong Buy rating and slashed the price target from $72 to $62 on April 16, 2025. This analyst has an accuracy rate of 69%.

- Keefe, Bruyette & Woods analyst Catherine Mealor maintained an Outperform rating and cut the price target from $68 to $62 on April 16, 2025. This analyst has an accuracy rate of 69%.

- Piper Sandler analyst Stephen Scouten reiterated an Overweight rating and raised the price target from $68 to $70 on April 16, 2025. This analyst has an accuracy rate of 72%.

- Stephens & Co. analyst Matt Olney maintained an Overweight rating and cut the price target from $73 to $69 on April 16, 2025. This analyst has an accuracy rate of 75%

Considering buying HWC stock? Here’s what analysts think:

Read This Next:

- Top 2 Industrials Stocks You May Want To Dump This Quarter

Photo via Shutterstock