Austco Healthcare And 2 Other ASX Penny Stocks To Consider

The Australian market has shown some resilience despite remaining below the 8,600-point mark, with materials stocks gaining traction due to rising iron ore prices. In this context, investors might consider exploring penny stocks—an investment area that continues to intrigue due to its potential for growth and value. While the term 'penny stocks' may seem dated, these smaller or newer companies can offer compelling opportunities when backed by strong financials and clear growth strategies.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.365 | A$104.6M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.34 | A$110.39M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.34M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.88 | A$444.04M | ✅ 4 ⚠️ 2 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.725 | A$456.11M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.59 | A$870.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.69 | A$828.23M | ✅ 5 ⚠️ 3 View Analysis > |

| Accent Group (ASX:AX1) | A$1.51 | A$907.79M | ✅ 3 ⚠️ 2 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.80 | A$144.98M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 462 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Austco Healthcare (ASX:AHC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Austco Healthcare Limited, with a market cap of A$121.96 million, provides healthcare communication solutions across Australia, New Zealand, Asia, Europe, and North America.

Operations: The company generates revenue from healthcare communication solutions, with A$11.31 million from Asia, A$4.16 million from Europe, and A$41.65 million from North America.

Market Cap: A$121.96M

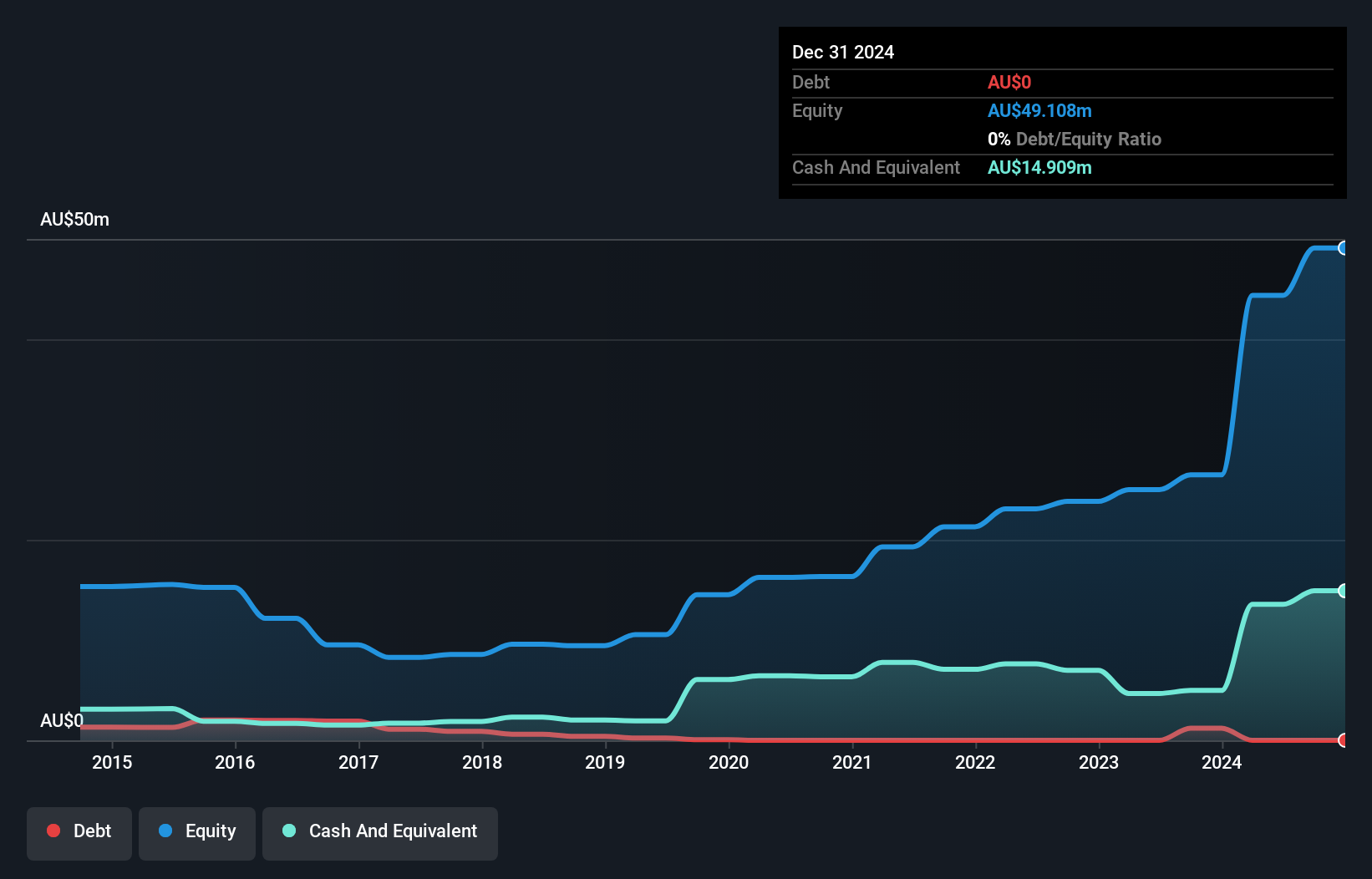

Austco Healthcare Limited, with a market cap of A$121.96 million, stands out with strong financial health and growth potential. The company is debt-free and boasts high-quality earnings, having seen a significant 330.8% increase in earnings over the past year, surpassing both its historical average and industry growth rates. Its net profit margins have improved to 12.2%, up from last year's 4.6%. Austco's short-term assets of A$45.4 million comfortably cover both short-term (A$23.3 million) and long-term liabilities (A$1.8 million). Despite trading at a substantial discount to its estimated fair value, it maintains stable weekly volatility at 7%.

- Take a closer look at Austco Healthcare's potential here in our financial health report.

- Evaluate Austco Healthcare's prospects by accessing our earnings growth report.

Change Financial (ASX:CCA)

Simply Wall St Financial Health Rating: ★★★★★★

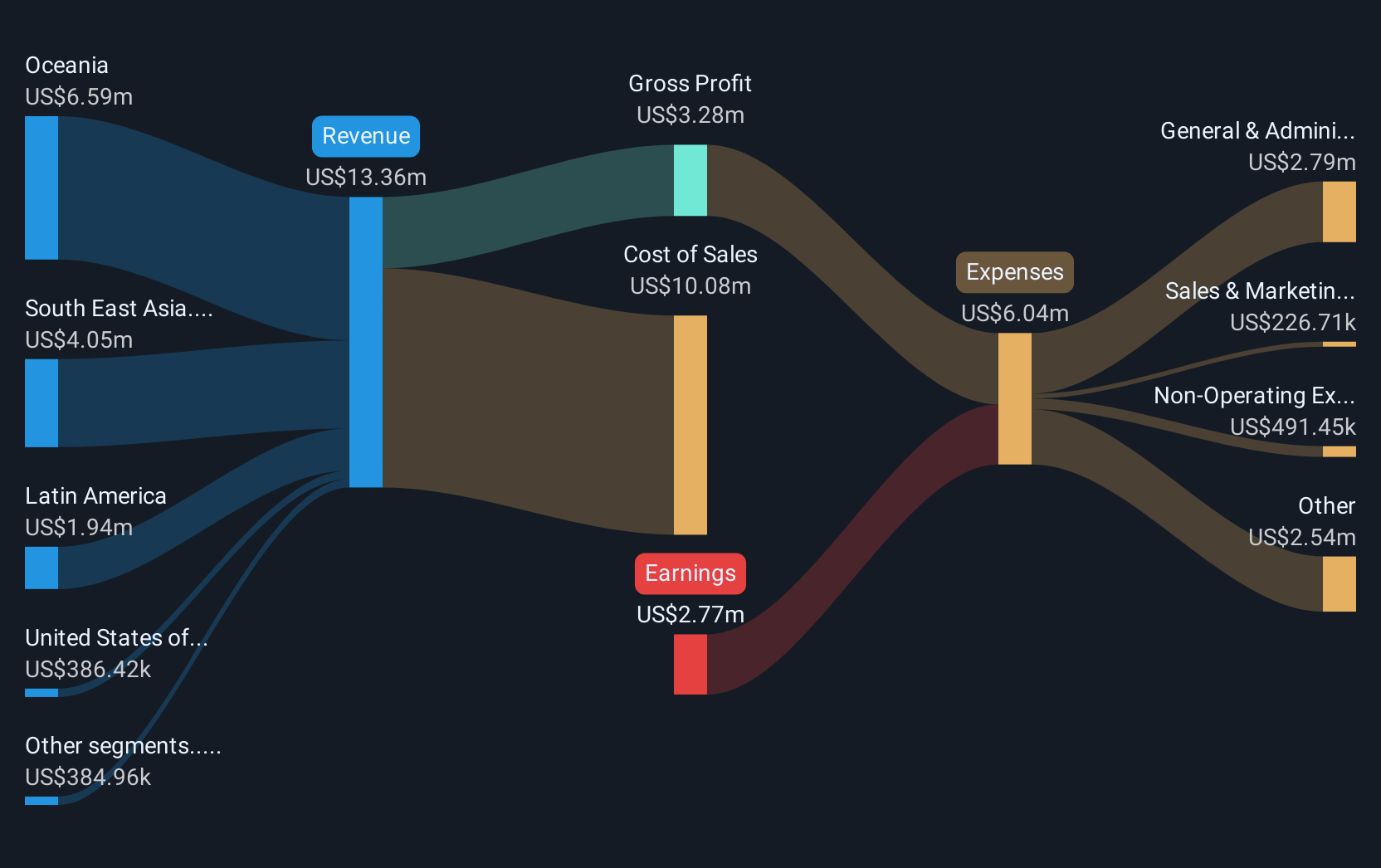

Overview: Change Financial Limited offers a payments management platform and payment testing solutions across South East Asia, Oceania, Latin America, the United States, and other international markets with a market cap of A$59.76 million.

Operations: The company generates revenue of $13.36 million from its development and provision of card payments software and services.

Market Cap: A$59.76M

Change Financial Limited, with a market cap of A$59.76 million, is focused on payments management across diverse international markets. While the company remains unprofitable, its short-term assets of $8.0 million exceed both short and long-term liabilities, indicating solid liquidity management. The firm is debt-free and has not diluted shareholders recently, which may appeal to investors wary of equity dilution risks common in penny stocks. Despite high volatility and negative return on equity at -39.65%, Change Financial maintains a cash runway exceeding one year based on current free cash flow trends, suggesting financial resilience amidst ongoing challenges in achieving profitability.

- Dive into the specifics of Change Financial here with our thorough balance sheet health report.

- Learn about Change Financial's future growth trajectory here.

GWA Group (ASX:GWA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GWA Group Limited is involved in the research, design, manufacture, importation, and marketing of building fixtures and fittings for residential and commercial properties across Australia, New Zealand, and international markets with a market cap of A$636.49 million.

Operations: The company generates revenue of A$417.40 million from its Water Solutions segment.

Market Cap: A$636.49M

GWA Group Limited, with a market cap of A$636.49 million, has stable weekly volatility and high-quality earnings but faces challenges with negative earnings growth over the past year. Its short-term assets exceed short-term liabilities, yet they fall short of covering long-term liabilities. The company's net debt to equity ratio is satisfactory at 29.8%, and its interest payments are well covered by EBIT at 8.1 times coverage, indicating manageable debt levels despite a low return on equity of 12.1%. Recent board changes include Stephen Roche's retirement as Non-Executive Director effective August 2025, highlighting ongoing governance adjustments.

- Click here and access our complete financial health analysis report to understand the dynamics of GWA Group.

- Gain insights into GWA Group's outlook and expected performance with our report on the company's earnings estimates.

Turning Ideas Into Actions

- Click this link to deep-dive into the 462 companies within our ASX Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10