Discovering Asian Penny Stocks: OCI International Holdings And Two More Hidden Gems

Global markets have shown a muted response to recent U.S. tariff announcements, with Asian indices reflecting mixed sentiments amidst ongoing trade tensions and economic data releases. In such a landscape, penny stocks—often smaller or newer companies—can still offer intriguing opportunities for investors seeking value and growth potential. Despite the term's vintage feel, these stocks can be hidden gems when backed by strong financials, offering prospects for both stability and long-term success.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.40 | HK$883.33M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.27 | HK$1.89B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.18 | HK$1.97B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.58 | THB2.75B | ✅ 3 ⚠️ 3 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.605 | SGD576.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.36 | SGD9.29B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.92 | THB1.35B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.23 | SGD46.51M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.47 | SGD951.99M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 984 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

OCI International Holdings (SEHK:329)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: OCI International Holdings Limited is an investment holding company offering asset management services in Hong Kong and the People's Republic of China, with a market cap of approximately HK$764.87 million.

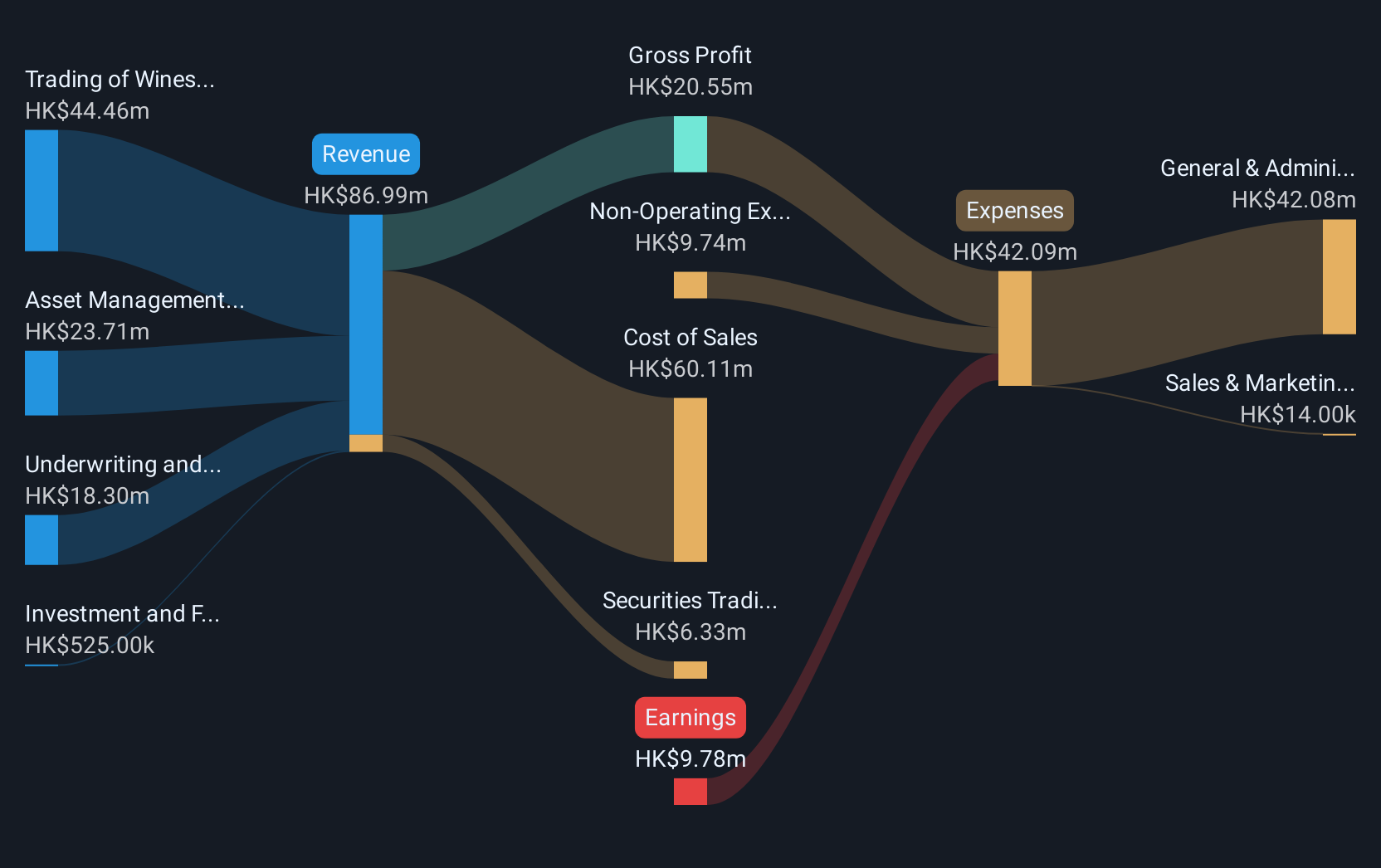

Operations: The company generates revenue from several segments, including Asset Management (HK$23.71 million), Trading of Wines and Beverage (HK$44.46 million), Securities Trading and Investments (-HK$6.33 million), Underwriting and Placing of Securities (HK$18.30 million), and Investment and Financial Advisory Services (HK$0.53 million).

Market Cap: HK$764.87M

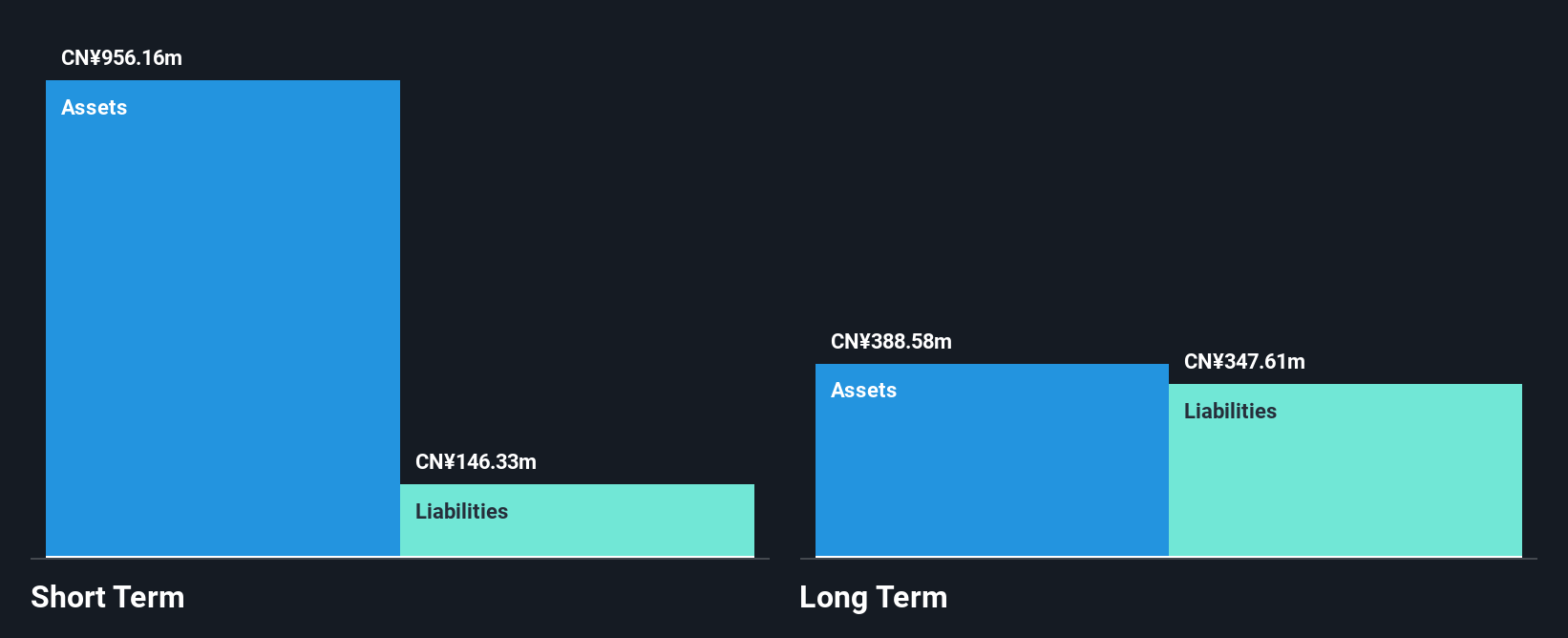

OCI International Holdings Limited, with a market cap of approximately HK$764.87 million, is an investment holding company in Hong Kong and China. Despite being unprofitable, it has reduced losses by 14.1% annually over the past five years and maintains a strong cash runway exceeding three years due to positive free cash flow growth. Its short-term assets significantly surpass both short-term and long-term liabilities, indicating solid financial stability despite volatility in its share price. Recently, OCI filed for a follow-on equity offering worth HK$83.99 million at HK$0.28 per share, suggesting potential capital raising efforts amidst ongoing operational challenges.

- Navigate through the intricacies of OCI International Holdings with our comprehensive balance sheet health report here.

- Evaluate OCI International Holdings' historical performance by accessing our past performance report.

Antengene (SEHK:6996)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Antengene Corporation Limited is a clinical-stage APAC biopharmaceutical company focused on developing novel oncology therapies in Greater China and internationally, with a market cap of HK$2.13 billion.

Operations: The company's revenue is primarily derived from the research, development, and commercialization of pharmaceutical products, amounting to CN¥91.95 million.

Market Cap: HK$2.13B

Antengene Corporation Limited, with a market cap of HK$2.13 billion, is focused on oncology therapies and has shown potential despite being unprofitable. The company has reduced its losses by 25% annually over five years and maintains a cash runway for 1.8 years under current conditions. Its short-term assets exceed both short-term and long-term liabilities, indicating financial resilience. Recent clinical data from trials such as ATG-037 highlight promising efficacy in CPI-resistant cancers, while strategic collaborations with Merck & Co., Inc., enhance its pipeline's potential impact across various tumor types in the global market landscape.

- Jump into the full analysis health report here for a deeper understanding of Antengene.

- Gain insights into Antengene's future direction by reviewing our growth report.

Digital China Holdings (SEHK:861)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers in Mainland China, with a market capitalization of approximately HK$5.27 billion.

Operations: The company's revenue is primarily derived from three segments: Big Data Products and Solutions (CN¥3.24 billion), Software and Operating Services (CN¥5.52 billion), and Traditional and Localization Services (CN¥7.96 billion).

Market Cap: HK$5.27B

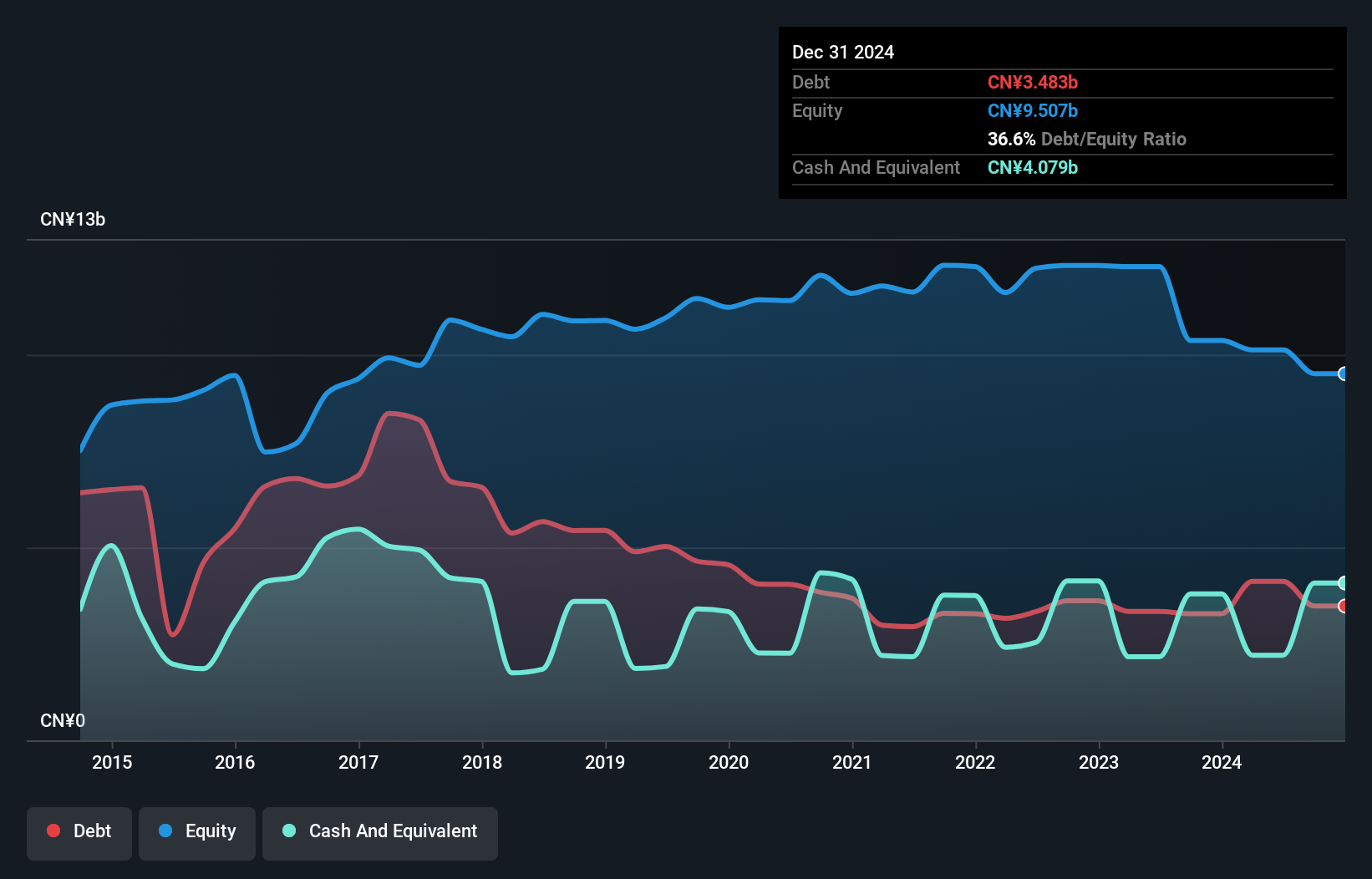

Digital China Holdings Limited, with a market cap of approximately HK$5.27 billion, offers big data solutions and remains unprofitable despite its diverse revenue streams from Big Data Products (CN¥3.24 billion), Software Services (CN¥5.52 billion), and Traditional Services (CN¥7.96 billion). The company has more cash than debt and a stable weekly volatility of 7%. Its short-term assets significantly cover both short-term and long-term liabilities, indicating solid financial footing. A recent dividend affirmation reflects shareholder confidence despite earnings declining by 58.8% annually over the past five years, highlighting ongoing challenges in achieving profitability.

- Click here to discover the nuances of Digital China Holdings with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Digital China Holdings' track record.

Make It Happen

- Explore the 984 names from our Asian Penny Stocks screener here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10