What Bank of New York Mellon (BK)'s RLUSD Custodian Role Means For Shareholders

- Earlier this month, Ripple selected The Bank of New York Mellon Corporation as the primary custodian for Ripple USD (RLUSD) reserves, partnering to bridge institutional digital asset adoption with established banking infrastructure.

- This collaboration highlights BNY Mellon's further integration into regulated digital asset services and reinforces its role in supporting enterprise-level stablecoin operations.

- We'll explore how BNY Mellon's role as RLUSD's primary reserve custodian may impact its investment narrative and digital asset credentials.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Bank of New York Mellon Investment Narrative Recap

To be confident in Bank of New York Mellon as an investment, you need to believe in its evolution from a traditional custodian and transaction bank into a technology-driven platform supporting both conventional and digital assets. The recent partnership with Ripple to custody RLUSD reserves reflects BNY Mellon's continued push into regulated digital assets, but this news is not expected to materially change the company's primary short term catalyst: driving top-line growth through better cross-selling and digital initiatives. Meanwhile, a key risk, execution challenges as BNY Mellon integrates new digital platforms and services, remains top of mind for shareholders.

Beyond digital asset initiatives, BNY Mellon's recent dividend increase, raising its quarterly cash payout by 13% to US$0.53, stands out. This move points to underlying financial strength, which is important context as the company invests in technology and digital infrastructure to boost efficiency and expand future earnings, an area that could see further scrutiny as new ventures like RLUSD adoption unfold.

Yet, in contrast to the opportunities from new partnerships, investors should be aware of the operational risks that come with transitioning to a more platforms-oriented model, particularly when ...

Read the full narrative on Bank of New York Mellon (it's free!)

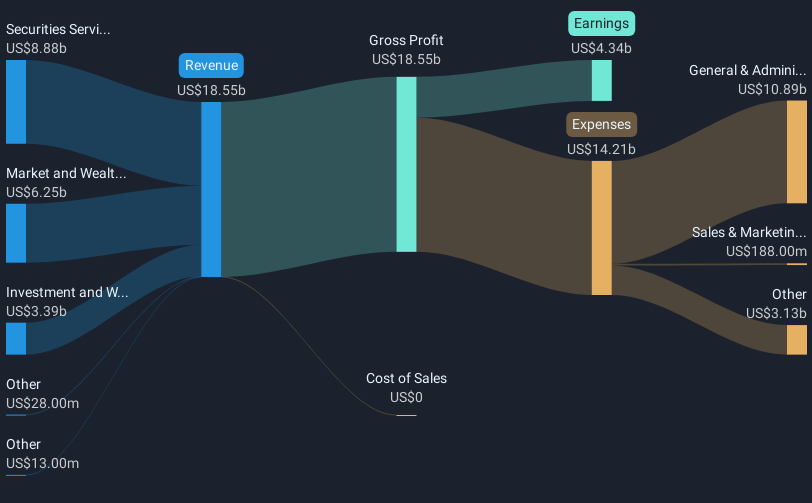

Bank of New York Mellon's outlook anticipates $20.7 billion in revenue and $5.4 billion in earnings by 2028. This projection is based on an annual revenue growth rate of 3.1% and an earnings increase of $0.9 billion from the current earnings of $4.5 billion.

Uncover how Bank of New York Mellon's forecasts yield a $90.93 fair value, a 5% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community provides five fair value estimates for BNY Mellon, spread from US$70.50 to US$102.51 per share. While these varied outlooks reflect different expectations, many participants are also weighing risks around new platform transitions and operational complexity, factors that could affect future returns in ways not captured by traditional valuation measures.

Explore 5 other fair value estimates on Bank of New York Mellon - why the stock might be worth 26% less than the current price!

Build Your Own Bank of New York Mellon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of New York Mellon research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bank of New York Mellon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of New York Mellon's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of New York Mellon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10