Discovering ASX Penny Stocks: Aurelia Metals Among 3 Noteworthy Picks

As the Australian market shows signs of resilience, with the XJO tracking above 8,600 points despite sectoral fluctuations, investors are keenly observing opportunities beyond the mainstream. Penny stocks, a term that may seem outdated but remains pertinent for those seeking growth potential in smaller or newer companies, often present unique investment prospects. In this article, we explore three penny stocks that demonstrate strong financial health and offer potential for significant returns amidst current market dynamics.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.38 | A$108.9M | ✅ 3 ⚠️ 3 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.17 | A$102.37M | ✅ 4 ⚠️ 3 View Analysis > |

| GTN (ASX:GTN) | A$0.61 | A$116.31M | ✅ 3 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$464.09M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.39 | A$2.72B | ✅ 5 ⚠️ 1 View Analysis > |

| Southern Cross Electrical Engineering (ASX:SXE) | A$1.75 | A$462.72M | ✅ 4 ⚠️ 1 View Analysis > |

| Regal Partners (ASX:RPL) | A$2.62 | A$880.91M | ✅ 4 ⚠️ 2 View Analysis > |

| Sugar Terminals (NSX:SUG) | A$0.99 | A$360M | ✅ 2 ⚠️ 2 View Analysis > |

| Navigator Global Investments (ASX:NGI) | A$1.70 | A$833.14M | ✅ 5 ⚠️ 3 View Analysis > |

| CTI Logistics (ASX:CLX) | A$1.84 | A$148.2M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 458 stocks from our ASX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Aurelia Metals (ASX:AMI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aurelia Metals Limited is involved in the exploration and production of mineral properties in Australia, with a market cap of A$338.51 million.

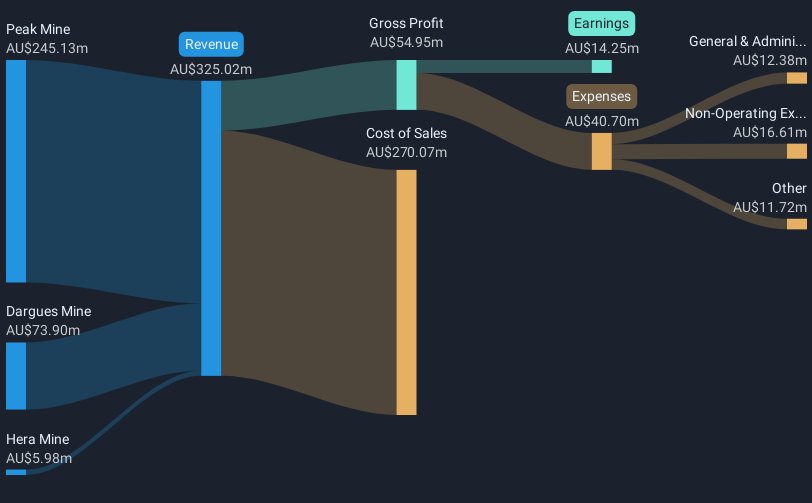

Operations: The company's revenue is derived from its operations at the Peak Mine (A$245.13 million), Dargues Mine (A$73.90 million), and Hera Mine (A$5.98 million).

Market Cap: A$338.51M

Aurelia Metals has shown significant progress by becoming profitable in the past year, which marks a notable shift for the company. Despite low return on equity at 4.3%, its financial health appears stable with short-term assets exceeding both short and long-term liabilities. The company's debt is well covered by operating cash flow, indicating effective cash management despite increased debt levels over five years. However, interest payments are not sufficiently covered by EBIT. Recent events include an Analyst/Investor Day focusing on strategy and growth opportunities, reflecting proactive engagement with stakeholders to bolster future prospects in the competitive mining sector.

- Jump into the full analysis health report here for a deeper understanding of Aurelia Metals.

- Examine Aurelia Metals' earnings growth report to understand how analysts expect it to perform.

Australian Strategic Materials (ASX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Australian Strategic Materials Ltd is an integrated producer of critical metals for advanced and clean technologies in Australia, with a market cap of A$127.85 million.

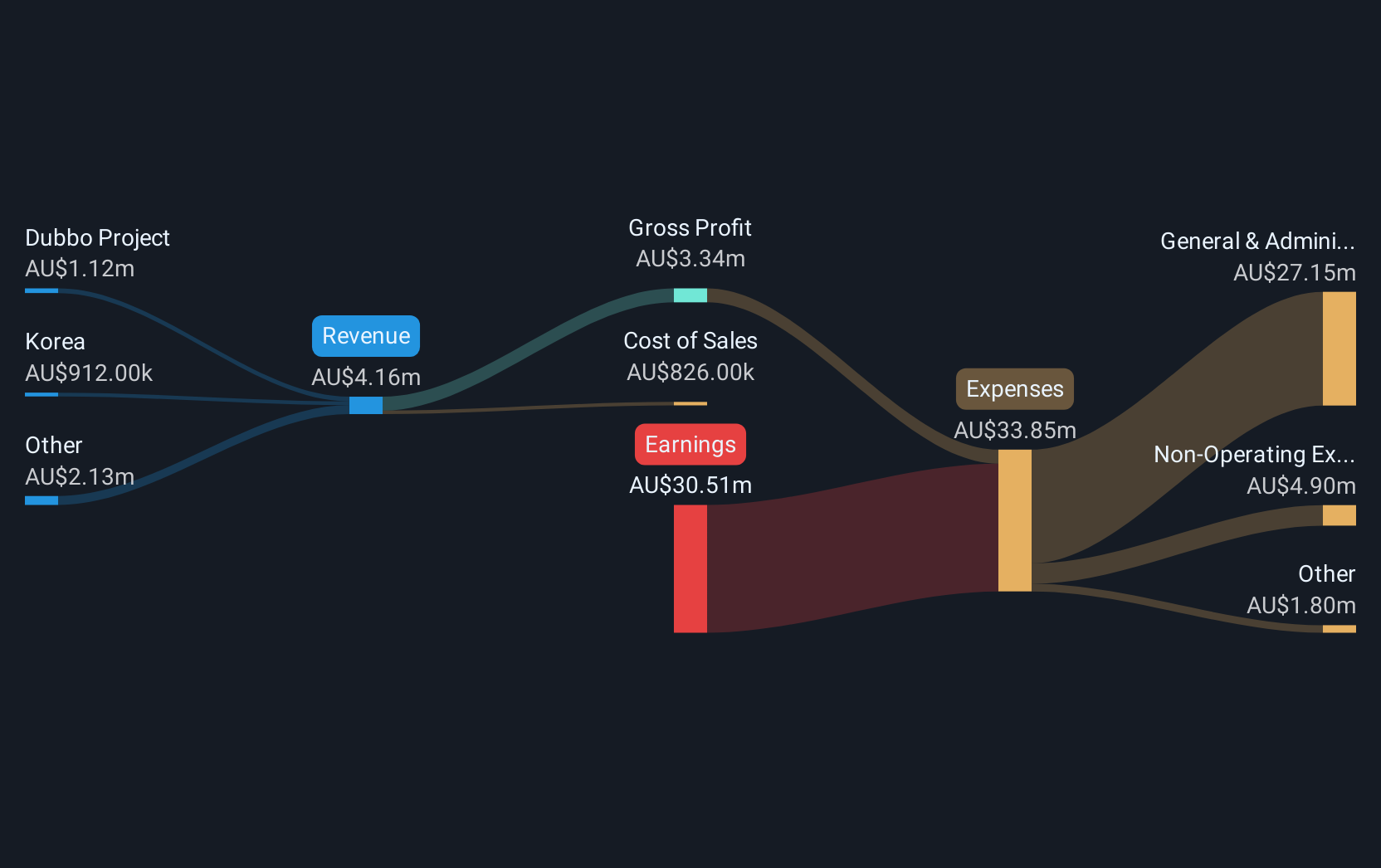

Operations: The company's revenue is derived from two segments: Korea, contributing A$0.91 million, and the Dubbo Project, generating A$1.12 million.

Market Cap: A$127.85M

Australian Strategic Materials Ltd is navigating the challenges typical of penny stocks, with a market cap of A$127.85 million and limited revenue streams, indicating it is pre-revenue. Despite this, the company has a solid financial footing with short-term assets exceeding liabilities and reduced debt levels over five years. However, it remains unprofitable and isn't expected to achieve profitability in the near future. Recent capital raising through a follow-on equity offering suggests efforts to bolster its cash runway beyond the current 11 months based on free cash flow trends. Revenue growth is forecasted at a very large rate annually, reflecting potential upside if execution aligns with forecasts.

- Dive into the specifics of Australian Strategic Materials here with our thorough balance sheet health report.

- Gain insights into Australian Strategic Materials' outlook and expected performance with our report on the company's earnings estimates.

Li-S Energy (ASX:LIS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Li-S Energy Limited focuses on the development and commercialization of lithium sulphur and metal batteries in Australia, with a market cap of A$98.61 million.

Operations: Currently, Li-S Energy Limited does not report any specific revenue segments.

Market Cap: A$98.61M

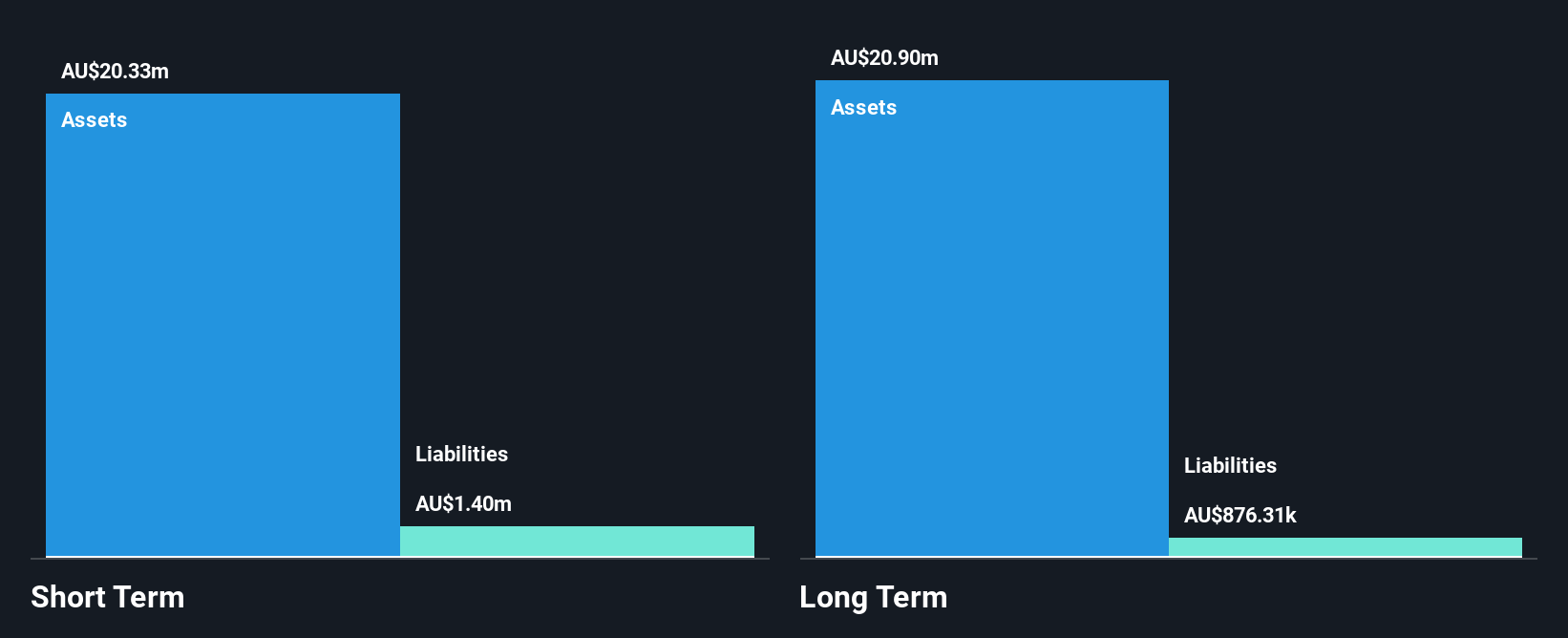

Li-S Energy Limited, with a market cap of A$98.61 million, is pre-revenue and unprofitable, reflecting typical characteristics of penny stocks. The company's financial health is supported by its debt-free status and short-term assets (A$20.3M) exceeding both short-term (A$1.4M) and long-term liabilities (A$876.3K). Despite stable weekly volatility over the past year at 14%, the share price has been highly volatile recently. While losses have increased annually by 15.2% over five years, Li-S Energy possesses a cash runway sufficient for more than one year under current conditions or up to 2.8 years if free cash flow continues to decline at historical rates.

- Click here and access our complete financial health analysis report to understand the dynamics of Li-S Energy.

- Gain insights into Li-S Energy's past trends and performance with our report on the company's historical track record.

Make It Happen

- Unlock our comprehensive list of 458 ASX Penny Stocks by clicking here.

- Interested In Other Possibilities? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10