Gold rally needs new catalyst as ETF inflows and future longs fall, but bullish drivers remain – ING’s Manthey

(Kitco News) – With ETF inflows slowing and net longs in futures falling, gold needs a new catalyst, but central bank buying has held up and bullish drivers remain, according to Ewa Manthey, Commodities Strategist at ING.

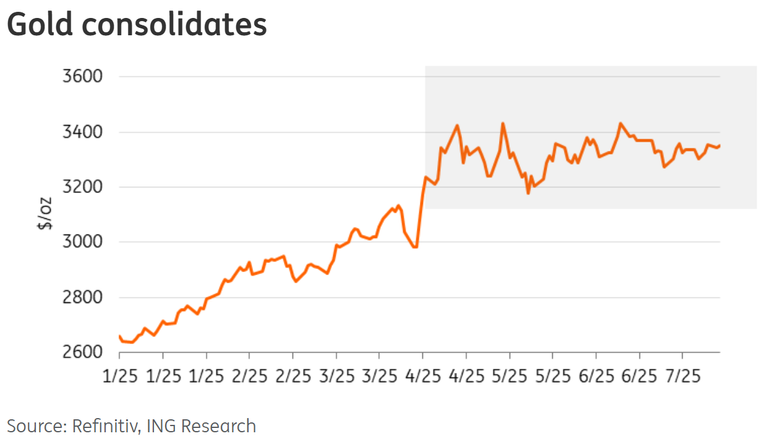

In the bank’s monthly update, Manthey noted that the gold rally has stalled since reaching a record high above $3,500/oz in April.

“Still, prices are up around 28% so far this year with the global trade war, geopolitical risks and central bank buying the key drivers for the precious metal’s rally,” she said.

ETF buying has been another key driver this year, but it has also slowed down in recent weeks – an indication that investor sentiment is cooling.

“The first half of the year saw strong positive flows, marking the strongest semi-annual performance since the first half of 2020,” Manthey said. “Investor holdings in gold ETFs generally rise when gold prices rise, and vice versa. Still, with holdings below the 2020 peak, ETFs have room to add more.”

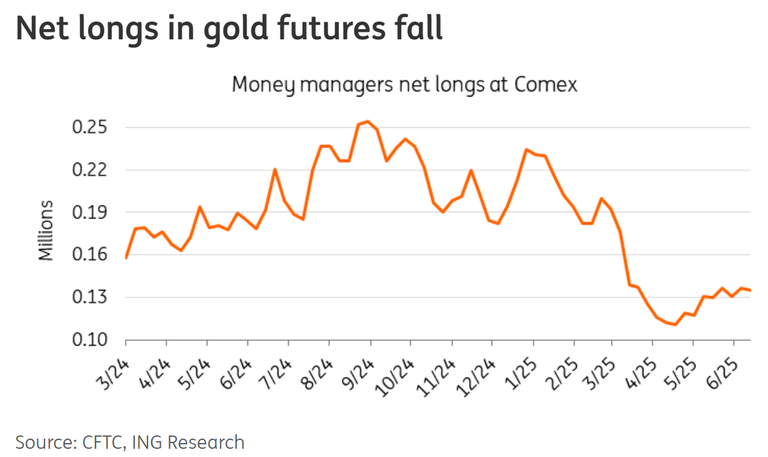

Net long gold positions in the futures market have also been declining, she noted.

Demand from central banks, on the other hand, has remained strong, with central banks buying every month through May.

“Central banks added a net 20 tonnes to global gold reserves in May, an uptick from the previous month; however, it is still below the 12-month average of 27 tonnes, according to the latest data from the World Gold Council,” Manthey wrote. “The National Bank of Kazakhstan led buying this month (7t), followed by Turkey and Poland each with 6t net purchases. Meanwhile, the Monetary Authority of Singapore (MAS) reported sales of 5t over the same period.”

China also added to its official gold reserves for the eighth straight month in June. “Gold held by the People’s Bank of China rose by 70,000 troy ounces last month,” she noted. “Its gold reserves have climbed by 1.1 million troy ounces (about 34.2 tonnes) since the current run of purchases began in November last year.”

ING believes that the uncertain economic environment and the need to diversify away from the U.S. dollar will drive continued central bank gold purchases in 2025.

“In the World Gold Council's recently released Central Bank Gold Reserves Survey 2025, 43% of central bankers surveyed stated their own central bank would increase their gold reserves and 95% believed that official gold reserves would continue to increase in the next 12 months, citing gold’s attributes as a diversifier and hedge during crisis and inflation as key factors influencing their decision to hold gold,” Manthey said. “The pace of annual purchases by central banks has doubled since the outbreak of the Russia-Ukraine war in 2022, from about 500 metric tonnes a year to more than 1,000.”

She noted that central banks bought a combined 1,045 tonnes of bullion in 2024, representing around 20% of global demand, with Poland, India, and Turkey the largest buyers.

ING believes that gold’s bullish drivers – including central bank and safe-haven demand – remain intact. “But with ETF demand cooling and net longs in gold futures declining, gold will need a fresh catalyst to lift it out of the current trading range,” Manthey said. “[T]rade uncertainty remains as US President Trump recently unleashed new tariff threats, among them a 30% levy for the EU that will kick in on 1 August if the two sides fail to agree on a better deal. However, Trump indicated he is open to more trade talks, including with the EU.”

“With global trade risks likely to stay elevated, creating an uncertain market environment, safe-haven demand is likely to remain a support factor. And if we see trade talks deteriorating, this could push gold prices to a fresh record once again,” she said. On the other hand, persistently high gold prices could suppress consumer demand and cap gold’s upside potential.”

“For now, gold is stuck in a range, in need of a fresh catalyst,” Manthey noted, but as trade and geopolitical tensions rise once again, “it might not take much to reignite that rally.”

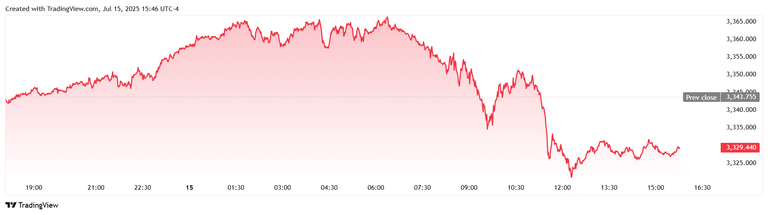

Gold shot up to a session high of $3,365 per ounce in overnight trading, but after a third attempt to break above that level failed at 6:22 am EDT, the yellow metal saw a sharp selloff that took prices all the way down to $3,320 just after noon.

Spot gold last traded at $3,329.53 per ounce for a loss of 0.53% on the daily chart.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10