How Investors May Respond To S&P Global (SPGI) Integrating Data With Anthropic’s Claude AI

- S&P Global recently announced a collaboration with Anthropic to integrate its financial data directly into Claude, Anthropic’s AI assistant, allowing financial professionals seamless access to trusted datasets and insights using natural language.

- This integration leverages the latest Model Context Protocol and Kensho LLM-ready API, highlighting the expanding use of generative AI in financial analysis workflows.

- We’ll examine how embedding trusted financial datasets into AI-powered tools like Claude could impact S&P Global’s investment narrative moving forward.

Uncover 15 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

What Is S&P Global's Investment Narrative?

S&P Global’s long-term value story depends on its reputation as a trusted, indispensable provider of data, analytics and indices to financial professionals worldwide. For shareholders, the most compelling catalysts have traditionally revolved around broad adoption of new data products, pricing power, and the stickiness of recurring subscription revenues, balanced against risks such as slower revenue growth relative to broader markets, high valuation multiples, and occasional significant insider selling. The recent collaboration with Anthropic doesn’t appear to shift these short-term catalysts in a material way just yet, with only a modest share price move following the announcement. However, integrating S&P Global’s financial data directly into AI tools like Claude reflects a deliberate push to stay ahead in workflow innovation, supporting data accessibility and client relevance, factors that could play a larger role in longer-term competitive positioning if adoption accelerates. Investors should still keep a close watch on growth rates and the premium valuation, as those were principal concerns before this announcement.

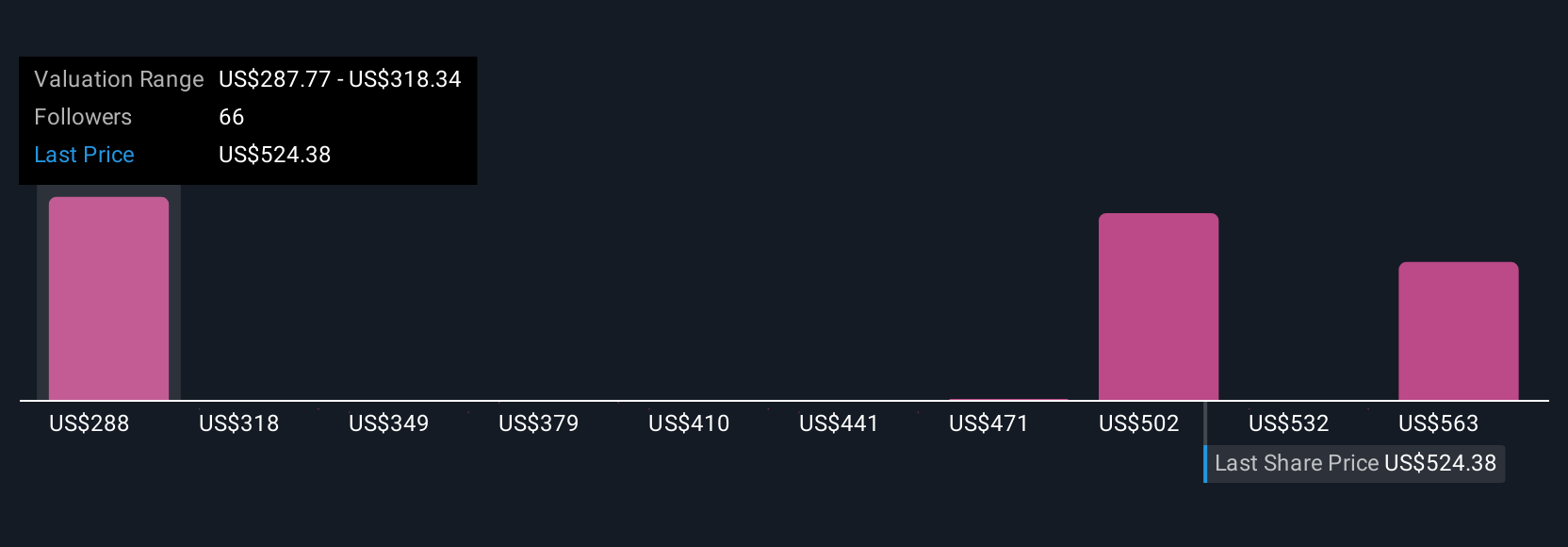

But S&P Global’s high valuation compared to market peers remains a key point for investors to note. S&P Global's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 16 other fair value estimates on S&P Global - why the stock might be worth as much as 13% more than the current price!

Build Your Own S&P Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your S&P Global research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free S&P Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate S&P Global's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10