Northern Trust (NTRS) Collaborates To Advance Tokenized Assets In Australia

Northern Trust (NTRS) made headlines with its collaboration with Swift as a part of Project Acacia, showcasing its commitment to digital finance innovation. Over the last quarter, Northern Trust's share price surged 41%, a substantial move compared to the overall market's flat performance in the recent week. The company's selection by Clean Alpha Partners and Keyrock Capital, along with the announcement of a significant fund administration role for Partners Group, added momentum to this upward trend. Amid fluctuating financial markets and economic uncertainties, Northern Trust's initiatives have clearly added weight to its remarkable share price appreciation.

You should learn about the 2 warning signs we've spotted with Northern Trust (including 1 which is concerning).

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Northern Trust's recent strategic moves, notably its collaboration with Swift on Project Acacia, signify a robust approach towards digital finance innovation that may impact its future growth narrative. This news supports the company's emphasis on evolving alternative investments and family office services, indicating potential revenue growth as it caters to emerging client needs. However, broader market factors, such as economic uncertainties and intense competition, remain crucial considerations when evaluating the long-term viability of these strategic initiatives.

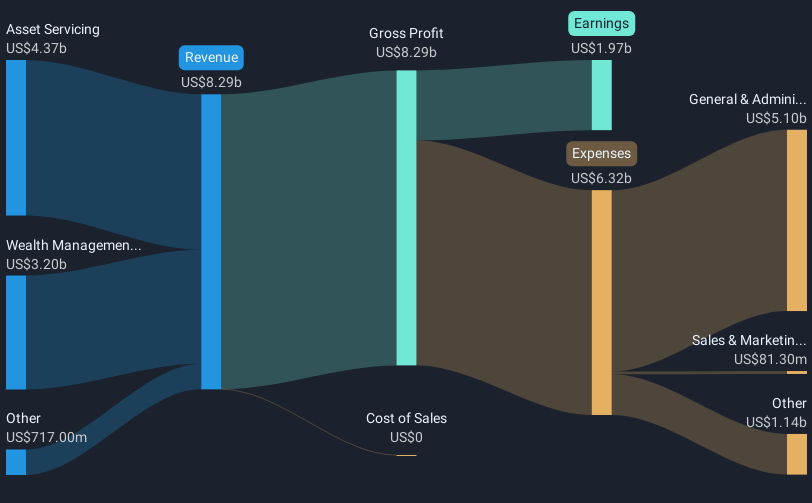

Over the past five years, Northern Trust's total shareholder return, including dividends, reached 81%, emphasizing strong long-term performance. In contrast, its recent 1-year performance exceeded both the US Capital Markets industry, which returned 32.4%, and the broader US market's 11.4% return. Despite current revenue and earnings forecasts indicating potential declines, the recent news could provide a foundation for revenue and earnings stability if successfully leveraged.

Currently, Northern Trust shares trade at US$123.60, above the consensus analyst price target of US$117.79, suggesting a 4.70% premium to the projected fair value. This price movement reflects market optimism, potentially fueled by recent developments. For analysts' forecasts to align with this target, Northern Trust will have to navigate potential declines in revenue and profit margins while capitalizing on its innovative strides in finance.

Gain insights into Northern Trust's outlook and expected performance with our report on the company's earnings estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northern Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10