JPMorgan Chase & Co. (NYSE:JPM) reported better-than-expected second-quarter earnings on Tuesday.

JPMorgan Chase reported quarterly earnings of $4.96 per share which beat the analyst consensus estimate of $4.48 per share. The company reported quarterly sales of $45.680 billion which beat the analyst consensus estimate of $44.167 billion.

Jamie Dimon, Chairman and CEO, commented," The U.S. economy remained resilient in the quarter. The finalization of tax reform and potential deregulation are positive for the economic outlook, however, significant risks persist – including from tariffs and trade uncertainty, worsening geopolitical conditions, high fiscal deficits and elevated asset prices. As always, we hope for the best but prepare the Firm for a wide range of scenarios."

JPMorgan shares fell 0.5% to trade at $285.25 on Wednesday.

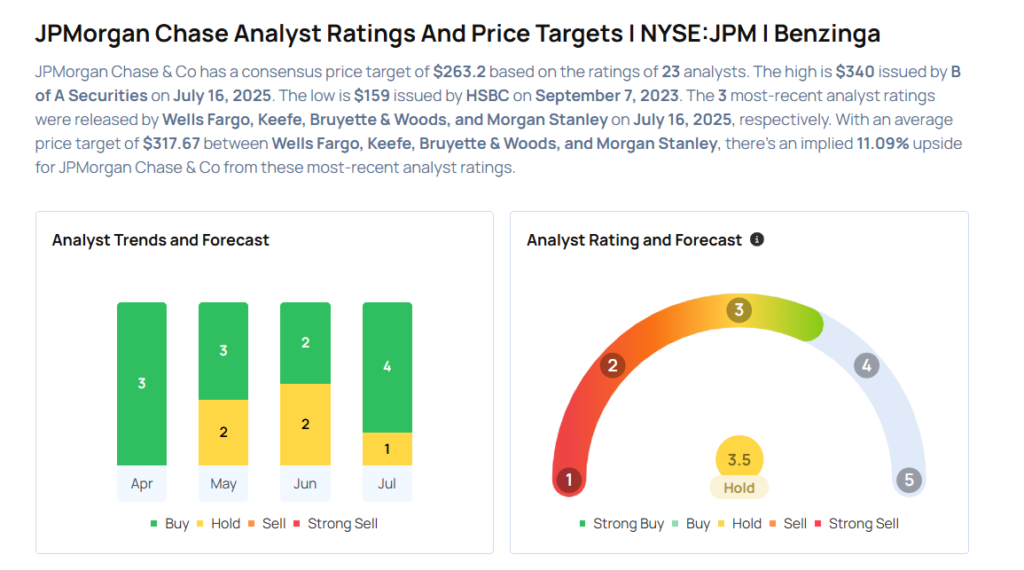

These analysts made changes to their price targets on JPMorgan following earnings announcement.

- B of A Securities analyst Ebrahim Poonawala maintained JPMorgan with a Buy and raised the price target from $330 to $340.

- Keefe, Bruyette & Woods analyst David Konrad maintained the stock with an Outperform rating and raised the price target from $327 to $330.

- Morgan Stanley analyst Betsy Graseck maintained JPMorgan Chase with an Equal-Weight rating and raised the price target from $296 to $298.

- Wells Fargo analyst Mike Mayo maintained the stock with an Overweight rating and raised the price target from $320 to $325.

Considering buying JPM stock? Here’s what analysts think:

Read This Next:

- Abbott Earnings Are Imminent; These Most Accurate Analysts Revise Forecasts Ahead Of Earnings Call

Photo via Shutterstock