Intuitive Surgical (ISRG) Showcases Transatlantic Telesurgery Capabilities in Strasbourg Conference

Intuitive Surgical (ISRG) recently showcased its telesurgery capabilities, highlighting advancements at the Society of Robotic Surgery conference, which aligns with its commitment to innovation. The company's share price increased by 6% over the last quarter. This rise coincided with FDA clearance of the Vessel Sealer Curved for their da Vinci systems and CE mark approval of the da Vinci 5 Surgical System for minimally invasive procedures. The appointment of a new CEO, David J. Rosa, and strong earnings growth may have bolstered investor confidence. However, market stability amid political and economic volatility provided a neutral backdrop.

Buy, Hold or Sell Intuitive Surgical? View our complete analysis and fair value estimate and you decide.

Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

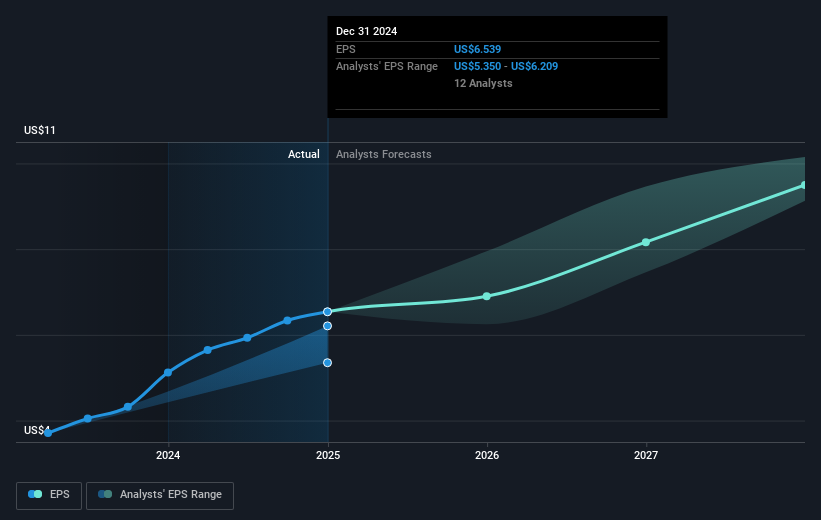

The recent advancements showcased by Intuitive Surgical, including FDA and CE mark approvals for their da Vinci systems, could significantly influence the company's revenue and earnings forecasts. These product upgrades aim to enhance surgical outcomes and expand market adoption, potentially boosting revenue growth. The appointment of David J. Rosa as CEO might also reinforce strategic alignment with these innovations, fostering investor confidence. Although the company's price increased by 6% from these announcements, it still trades below the analyst consensus price target of US$581.45. This suggests room for growth if projected revenue and earnings come to fruition.

Over the past three years, Intuitive Surgical’s total return, encompassing share price appreciation and dividends, was 138.87%. This performance significantly exceeds its recent one-year return, where it outpaced the US Medical Equipment industry’s 6.6% growth. Such long-term gains reflect strong market positioning and the anticipated success of its surgical systems. The company's enhanced product features and expanded manufacturing efforts underline expectations of future revenue growth, aligning closely with analyst projections. However, macroeconomic factors like potential trade tensions could pose risks to these positive forecasts.

Learn about Intuitive Surgical's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10