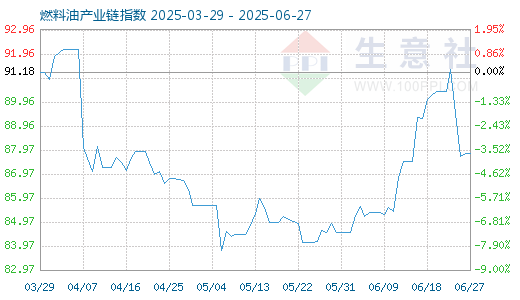

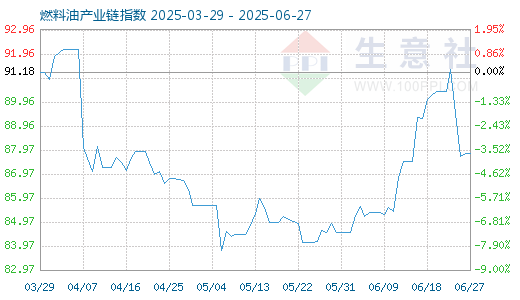

1.7月17日生意社燃料油产业链指数为86.27

7月17日生意社燃料油产业链指数为86.27,较昨日下降了0.45点,较周期内最高点123.02点(2022-06-12)下降了29.87%,较2016年02月11日最低点45.34点上涨了90.27%。(注:周期指至今)

产业链指数,是生意社基于商品产业链及其各节点商品指数而创建的用于反映整个产业链景气状况的定基指数。

2.生意社:7月17日国内燃料油市场行情下行7月17日国内燃料油市场行情下行,燃料油180cst自提低硫报价5100-5650元/吨,燃料油120cst自提低硫报价5200-5750元/吨。(燃料油详情)

3.生意社:7月16日国际原油期货收跌7月16日,国际原油期货收跌。美国WTI原油期货8月合约结算价报66.38美元/桶,跌幅0.14美元或0.2%。布伦特原油期货9月合约结算价报68.52美元/桶,跌幅0.19美元或0.3%。(原油详情)

4.EIA:上周美国原油库存降幅远超预期燃料油库存上升7月16日(周三),美国能源信息署(EIA)报告显示,由于出口增加,上周美国原油库存下降,而汽油和馏分油库存上升,截至7月11日当周,原油库存减少390万桶至4.2216亿桶,而此前调查显示分析师预期为减少55.2万桶。汽油库存增加340万桶,至2.329亿桶,预期为减少100万桶。包括柴油和取暖油在内的馏分油库存增加420万桶,达到1.07亿桶,而预期为增加20万桶。(原油详情)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.