Could Buying Lockheed Martin Stock Today Set You Up for Life?

-

The medium-term outlook for defense spending is positive, with both the U.S. and other NATO countries looking to ramp up investment.

-

Lockheed Martin is well positioned to benefit from President Trump's defense budget.

-

The company's execution issues have troubled it in recent years, and many defense companies have faced margin pressures.

There's a lot to like about defense giant Lockheed Martin's (LMT -1.09%) stock, but is it enough to make it an investment that investors can feel comfortable with, knowing it will generate life-changing long-term returns?

The bulls' case for Lockheed Martin

The investment case for the stock is relatively easy to understand. It's based on the enduring need for defense equipment and services, as well as its increasing importance in an age of geopolitical conflict. Not only is President Donald Trump seeking to ramp up the defense budget to a record $1.01 trillion, but NATO has also been enlarged, and its members have recently agreed to invest 5% of their gross domestic product (GDP) on core defense requirements as well as defense and security-related spending by 2035.

Moreover, much of the spending, at least in the U.S., focuses on missile defense and tactical missiles, which Lockheed Martin specializes in. Indeed, discussing the matter on an earnings call in April, CEO Jim Taiclet said, "Our 21st century security strategy, where we integrate existing and new satellites, aircraft, ships, missile launchers, and command and control systems with constantly upgradable digital technologies, was tailor-made for [missile defense system] Golden Dome."

Furthermore, Lockheed Martin's current backlog of $173 billion represents 2.3 years' worth of sales based on the midpoint of management's guidance for full-year 2025 revenue. It's also worth noting that its core customer, the U.S. government, is a highly reliable payer.

Turning to valuation, the midpoint of management's guidance range calls for $23.15 in earnings per share and $6.7 billion in free cash flow (FCF). Based on the current price, it would put the stock at 17.2 times earnings and 16.3 times FCF.

They are attractive valuations for a company with such solid growth prospects. So is it that case closed? As usual, investing is rarely that simple.

Image source: Getty Images.

The bears' case for Lockheed Martin

The negative case for the stock can be seen in three interrelated arguments:

- Lockheed Martin's execution challenges in recent years, notably with its most important single program, the F-35 Lightning II Joint Strike Fighter, have damaged confidence in its ability to produce "long-run franchise" programs.

- Lockheed Martin, like many other defense contractors, including Boeing and RTX, has struggled to achieve margin expansion in recent years, as the U.S. government has become more adept at negotiating contracts, particularly through the use of fixed-price contracts.

- The current environment is highly conducive to defense spending, but that doesn't guarantee that it will be the case in the future.

Lockheed Martin's execution and margin challenges

The company's execution challenges are encapsulated in two events this year. First, a Department of Defense description of the proposed 2026 defense budget included reducing F-35 procurement.

There's little doubt why procurement has been reduced. The DOD is focusing on making existing F-35s mission-capable (able to perform a core mission) rather than procuring new planes. According to airandspaceforces.com, just 51.5% of F-35s were mission-capable in 2024. High-profile delays and issues on the Technology Refresh 3 (TR3) on the F-35 have reduced that percentage. In addition, the cost overrun on the F-35 has been so significant that the military is now considering flying it less to reduce costs.

These issues damage confidence in Lockheed Martin, not least as it faces upfront costs on programs in expectation of turning them into "long-run franchises." As such, there are questions about its ability to grow margins in the future.

The second issue is the loss of the next-generation air dominance (NGAD) contract to Boeing, a decision highly likely to have been influenced by the issues with the F-35.

Long-term defense spending

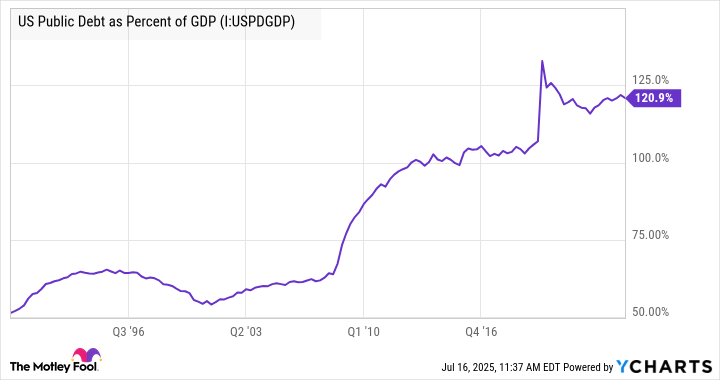

This isn't the place to enter a detailed debate over the sustainability of government spending. Still, it's worth noting that if you are buying defense stocks based on the security of long-term growth in spending from the U.S. government (which currently accounts for two-thirds of NATO spending), then you will be comfortable with the following chart of U.S. public debt to GDP and the idea that the possibility of rising debt levels won't constrain spending on defense and other matters in the future.

US Public Debt as Percent of GDP data by YCharts

In addition, it's extremely difficult to predict where global defense priorities will be over the next few years, let alone a lifetime.

Is Lockheed Martin stock a buy?

On balance, defense stocks appear slightly undervalued; however, Lockheed Martin's issues with the F-35 may not make it the best way to capitalize on a positive medium-term outlook for defense spending. As such, Lockheed Martin isn't likely to be a stock that investors can make a life-changing investment in.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10