SoundHound AI (SOUN) Partners With Peter Piper Pizza To Enhance Ordering Experience

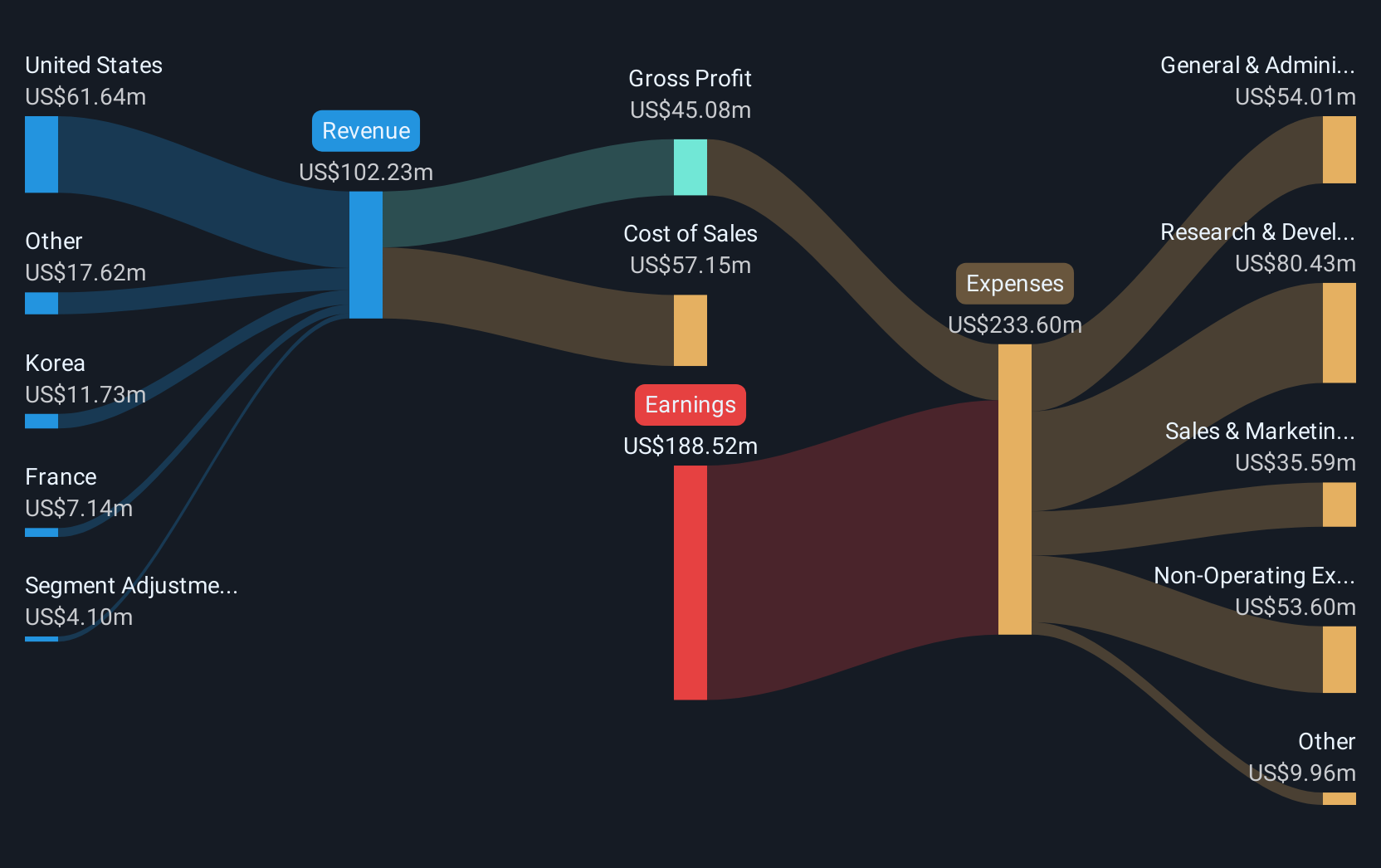

SoundHound AI (SOUN) saw a price movement of 46% over the last quarter, partly influenced by its recent collaboration with Peter Piper Pizza, which improved customer service via conversational voice AI technology. This initiative likely enhanced the company's market presence at a time when overall market performance was relatively flat, with a mixed response to political uncertainties like the situation involving Fed Chair Jerome Powell. Further bolstering SoundHound's position was a robust Q1 earnings report, including significant gains in sales and net income, offering optimism despite challenges like its removal from major indices.

We've spotted 3 warning signs for SoundHound AI you should be aware of.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

The recent collaboration with Peter Piper Pizza may bolster SoundHound AI's efforts to enhance market presence through innovative voice AI technology. This initiative complements the narrative of the company's strategic expansion into voice commerce and diversifying its customer base. Over the longer term, SoundHound's share price has increased by 207.07% over three years. This represents substantial growth relative to both the US Software industry and the broader market, with SoundHound outperforming the US Software industry over the past year.

The actions outlined in the introduction, such as the partnership with Peter Piper Pizza, could impact analysts' revenue and earnings forecasts, reflecting potential for growth through new revenue streams and customer engagement. This optimism comes despite challenges like high research and development expenses that continue to pressure net margins and financial metrics. The current share price of $11.30 shows a moderate discount to analysts' price target of $11.81, indicating limited upside potential based on current forecasts. However, the consistency of the share movement and earnings development will remain central in realizing this target as the company navigates its future growth landscape.

Examine SoundHound AI's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10