热点栏目

客户端

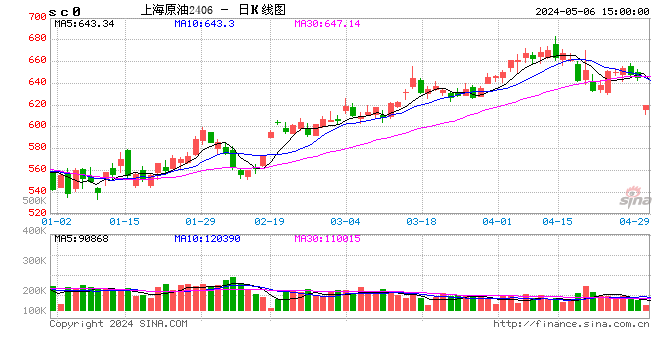

2025年7月18日,国内期货主力合约多数上涨。SC原油涨超3%,焦煤、碳酸锂、棕榈油涨超2%。跌幅方面,液化石油气(LPG)跌超0.5%。

供应方面,前期停产的煤矿逐步复工复产,国内原煤以及焦煤的产量均有所回升,本周洗煤厂、港口炼焦煤库存小幅回落,独立焦企、钢厂焦化厂炼焦煤库存增加,总库存继续攀升,但是需要注意印尼为提高国家收入拟对煤炭出口征税,进口成本存增加预期。截至7月18日当周,炼焦煤总库存为2233.25万吨,环比增加1.79%,同比增加5.90%。据海关总署数据,6月中国进口煤及褐煤3303.7万吨,环比下降8.3%,1-6月累计进口煤及褐煤22170.2万吨,同比下降11.1%。需求方面,本周新增 4 座高炉复产,2 座高炉检修,铁水产量环比增加 2.63 万吨至 242.44 万吨,目前处于偏高水平,下游对原材料消费具有一定支撑,后期继续关注终端工程资金的到位进展。据百年建筑调研,截至7月15日,样本建筑工地资金到位率为58.89%,周环比下降0.09个百分点,其中房建项目资金到位率为51.68%,周环比下降0.08个百分点。

综合来看,政策以及环保扰动焦化,预计短期焦煤盘面震荡偏强运行。(光大期货)

新浪合作大平台期货开户 安全快捷有保障

![]()

责任编辑:赵思远

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.