Tenet Healthcare Corporation (NYSE:THC) posted better-than-expected earnings for the second quarter on Tuesday.

The company reported quarterly earnings of $4.02 per share which beat the analyst consensus estimate of $2.87 per share. The company reported quarterly sales of $5.271 billion which beat the analyst consensus estimate of $5.161 billion.

The company raised its FY2025 adjusted EPS guidance from $11.99-$13.12 to $15.55-$16.21 and also increased its sales guidance from $20.600 billion-$21.000 billion to $20.950 billion-$21.250 billion.

“Our strong second quarter results extend our track record of attractive same store revenue growth, operational performance driven by fundamentals, and robust free cash flow generation,” said Saum Sutaria, M.D., Chairman and Chief Executive Officer of Tenet. “We continue to make investments both organically and inorganically to expand our capabilities and innovate to better serve our patients.”

Tenet Healthcare shares rose 1% to trade at $157.49 on Wednesday.

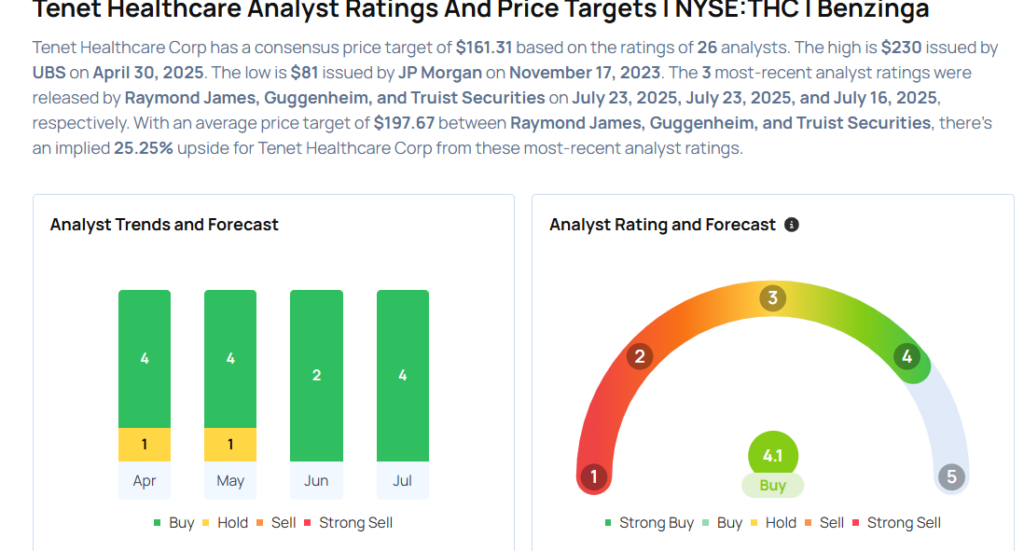

These analysts made changes to their price targets on Tenet Healthcare following earnings announcement.

- Guggenheim analyst Jason Cassorla maintained Tenet Healthcare with a Buy and raised the price target from $180 to $188.

- Raymond James analyst John Ransom reiterated the stock with an Outperform rating and raised the price target from $185 to $200.

Considering buying THC stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Weigh In On 3 Industrials Stocks With Over 5% Dividend Yields

Photo via Shutterstock