Global Penny Stocks Under US$500M Market Cap

Global markets have recently experienced a mix of positive corporate earnings and rising consumer inflation, with major indices like the S&P 500 and Nasdaq reaching new records. For investors looking beyond the well-known giants, penny stocks—typically representing smaller or newer companies—can still present intriguing opportunities. Despite being an outdated term, these stocks remain relevant for those seeking potential growth in lesser-known sectors; we will explore three such stocks that combine financial resilience with promising prospects.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.21 | A$106.14M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.46 | HK$908.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.475 | SGD192.51M | ✅ 4 ⚠️ 1 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.49 | SGD9.8B | ✅ 5 ⚠️ 0 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.945 | MYR7.28B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.21 | £192.78M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.964 | €32.51M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,824 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Feiyu Technology International (SEHK:1022)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Feiyu Technology International Company Ltd. is an investment holding company involved in the development, operation, and distribution of various games in Mainland China, with a market cap of HK$769.63 million.

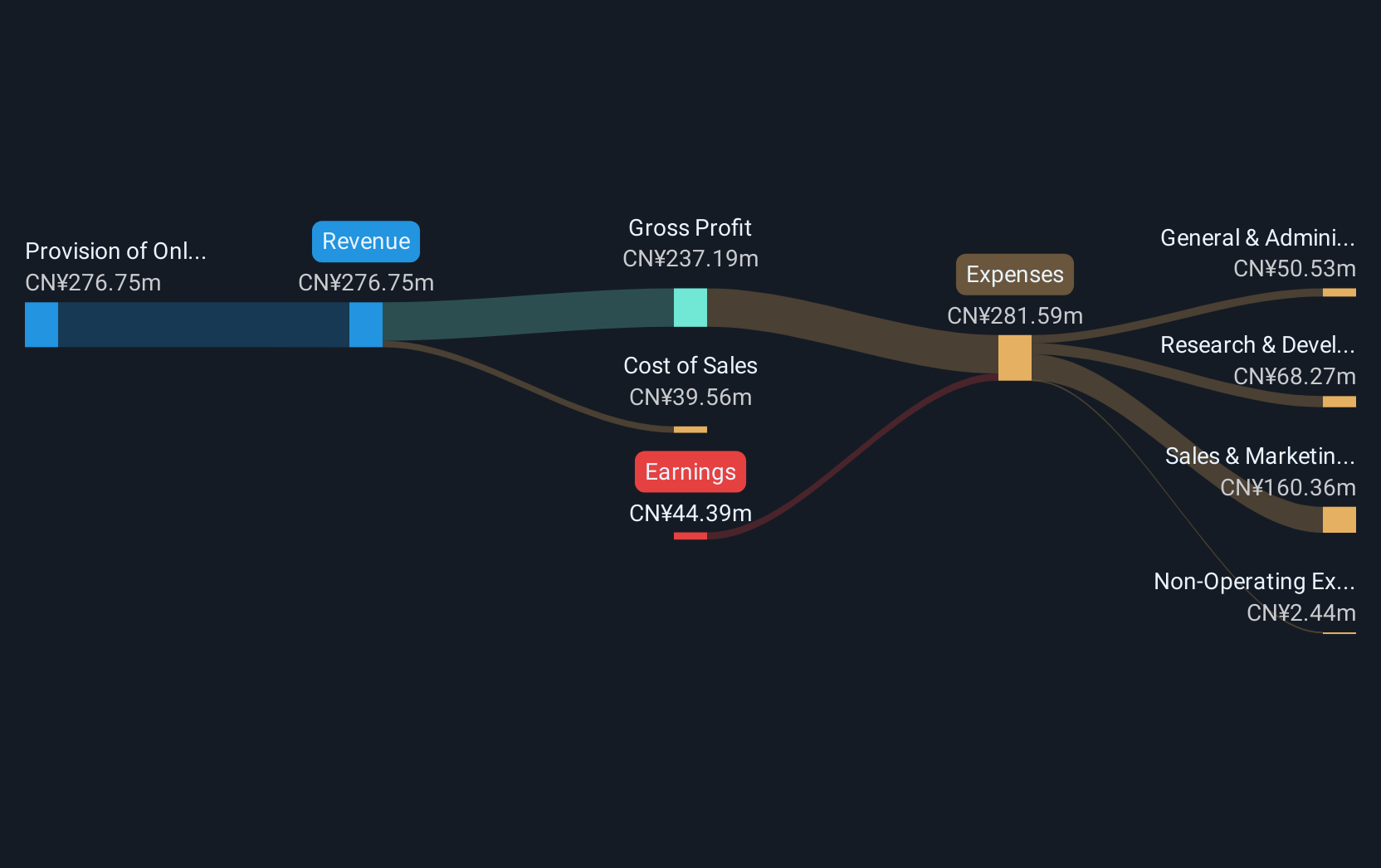

Operations: The company generates its revenue primarily from the provision of online game services, amounting to CN¥276.75 million.

Market Cap: HK$769.63M

Feiyu Technology International, with a market cap of HK$769.63 million, generates CN¥276.75 million in revenue from online game services but remains unprofitable. The company's short-term assets of CN¥178.7 million exceed both its short and long-term liabilities, indicating solid liquidity management despite high volatility in share price and negative return on equity (-9.56%). Over the past five years, it has reduced losses by 37.9% annually while maintaining more cash than total debt and avoiding shareholder dilution recently. The seasoned management team and board bring stability during this phase of financial restructuring.

- Unlock comprehensive insights into our analysis of Feiyu Technology International stock in this financial health report.

- Examine Feiyu Technology International's past performance report to understand how it has performed in prior years.

Best Mart 360 Holdings (SEHK:2360)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Best Mart 360 Holdings Limited operates chain retail stores under the Best Mart 360 and FoodVille brands, focusing on leisure food retailing in Hong Kong, Macau, and the People's Republic of China, with a market cap of HK$2.26 billion.

Operations: The company's revenue primarily originates from retail sales of food and beverage, as well as household and personal care products, amounting to HK$2.81 billion.

Market Cap: HK$2.26B

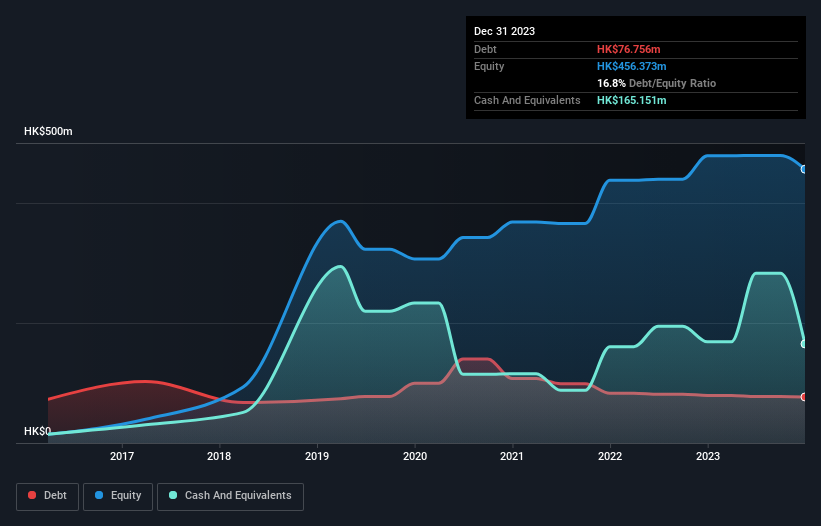

Best Mart 360 Holdings, with a market cap of HK$2.26 billion, has demonstrated stable financial health through its short-term assets (HK$572.4 million) exceeding both short and long-term liabilities. The company holds more cash than total debt, highlighting prudent debt management. Earnings grew by 10.3% over the past year, outpacing the Consumer Retailing industry average decline of 3.8%. Although recent earnings growth is below its five-year average of 45%, it maintains high-quality earnings and outstanding return on equity at 46.3%. A final dividend increase was approved in May 2025 despite an unstable dividend history and inexperienced board tenure averaging just under two years.

- Dive into the specifics of Best Mart 360 Holdings here with our thorough balance sheet health report.

- Evaluate Best Mart 360 Holdings' historical performance by accessing our past performance report.

Tianjin Jintou State-owned Urban Development (SHSE:600322)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tianjin Jintou State-owned Urban Development Co., Ltd. operates in urban development and infrastructure, with a market cap of CN¥3.25 billion.

Operations: The company's revenue is derived entirely from its operations in China, amounting to CN¥2.72 billion.

Market Cap: CN¥3.25B

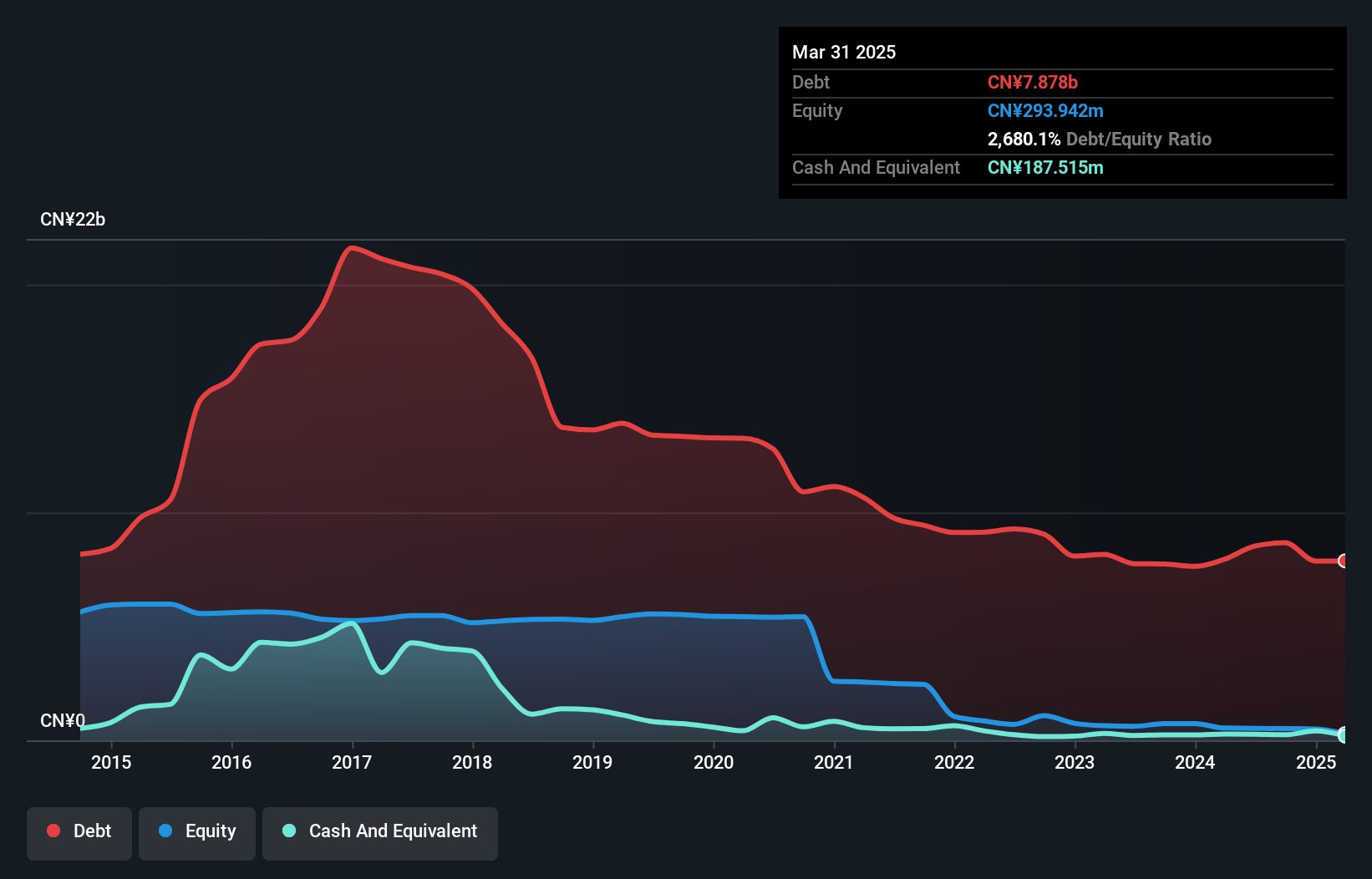

Tianjin Jintou State-owned Urban Development, with a market cap of CN¥3.25 billion, faces challenges due to its high net debt to equity ratio of 2616.3%, which has increased significantly over the past five years. Despite being unprofitable, the company has managed to reduce losses by 34.2% annually over the same period and maintains a sufficient cash runway for more than three years, supported by positive free cash flow. The company's short-term assets of CN¥11.6 billion comfortably cover both its short and long-term liabilities, indicating strong liquidity management amidst ongoing financial restructuring efforts such as recent private placements and shareholder meetings.

- Get an in-depth perspective on Tianjin Jintou State-owned Urban Development's performance by reading our balance sheet health report here.

- Assess Tianjin Jintou State-owned Urban Development's previous results with our detailed historical performance reports.

Next Steps

- Get an in-depth perspective on all 3,824 Global Penny Stocks by using our screener here.

- Ready To Venture Into Other Investment Styles? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Best Mart 360 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10