截至2025年7月21日12:00,主动偏股基金二季报披露率100%,兴证策略团队全方位拆解主动偏股基金持仓特征以及调仓趋势,供投资者参考。详细数据库欢迎联系兴证策略团队或对口销售获取。

基金二季报要点速览:

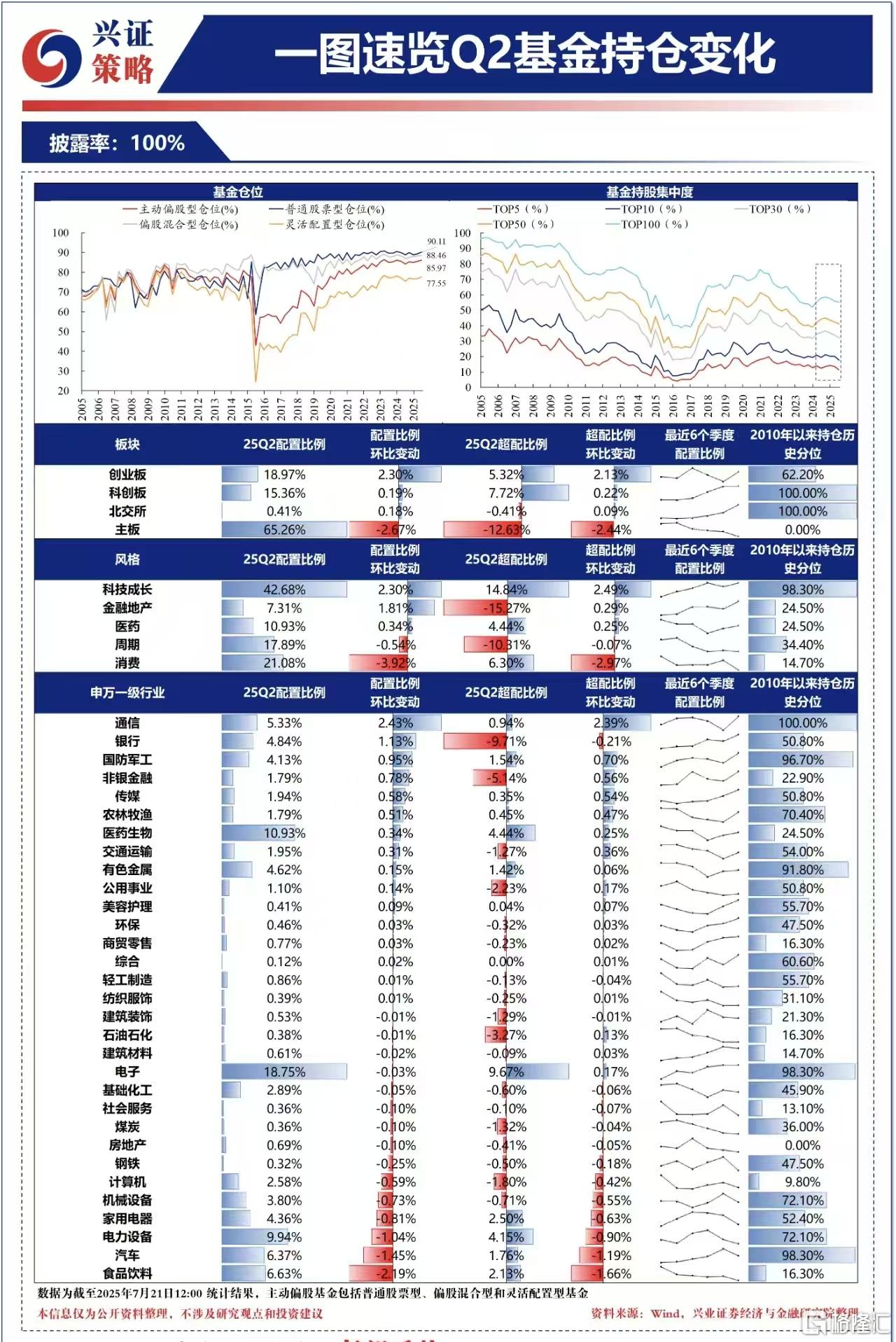

1、主动偏股型基金二季度仓位环比Q1上升0.51pct至85.97%,其中普通股票型、偏股混合型、灵活配置型分别上升0.76pct、0.30pct与0.85pct;

2、板块配置方面,创业板仓位显著提升2.30pct至18.97%,科创板配置小幅增长0.19pct至15.36%,主板仓位下降2.67pct至65.26%;

3、一级行业方面,加仓最多的行业是通信(+2.43pct)、银行(+1.13pct)、国防军工(+0.95pct),科技成长+红利是主动权益Q2增配的方向;减仓最多的行业是食品饮料(-2.19pct)、汽车(-1.45pct)、电力设备(-1.04pct);

4、二级行业方面,加仓居前的行业是通信设备(+2.67pct)、元件(+1.37pct)、化学制药(1.36pct),减仓居前的行业分别是白酒(-2.42pct)、乘用车(-1.34pct)、消费电子(-0.91pct);

5、个股方面,仓位环比提升居前的个股为中际旭创、新易盛、沪电股份、胜宏科技,分别提升1.07pct、1.00pct、0.65pct、0.50pct,并且均新晋主动权益前20大重仓,而仓位环比下降居前的个股为比亚迪、立讯精密、贵州茅台、五粮液;

6、港股方面,重仓口径下,主动权益港股仓位小幅提升0.81pct至19.90%;行业上,加仓医疗保健、金融业,减仓资讯科技、非必需消费;个股上,信达生物、泡泡玛特、三生制药仓位提升最多,而阿里巴巴、腾讯控股被明显减持。