Regions Financial Corporation (NYSE:RF) reported better-than-expected second-quarter financial results on Friday.

Regions Finl reported quarterly earnings of 60 cents per share which beat the analyst consensus estimate of 56 cents per share. The company reported quarterly sales of $1.905 billion which beat the analyst consensus estimate of $1.858 billion.

John Turner, Chairman, President and CEO of Regions Financial Corp, said, “We are experiencing solid deposit growth, disciplined loan production, and strong performance across fee-based businesses, including Treasury Management and Wealth Management. As we modernize our platforms and expand further in key growth areas across our footprint, we remain committed to executing our plan while generating top-quartile returns and long-term value for our shareholders. Our strong performance is the result of remaining focused on the financial needs and opportunities of our clients and operating in a responsible manner for the benefit of the people we serve.”

Regions Financial shares gained 6.1% to close at $26.01 on Friday.

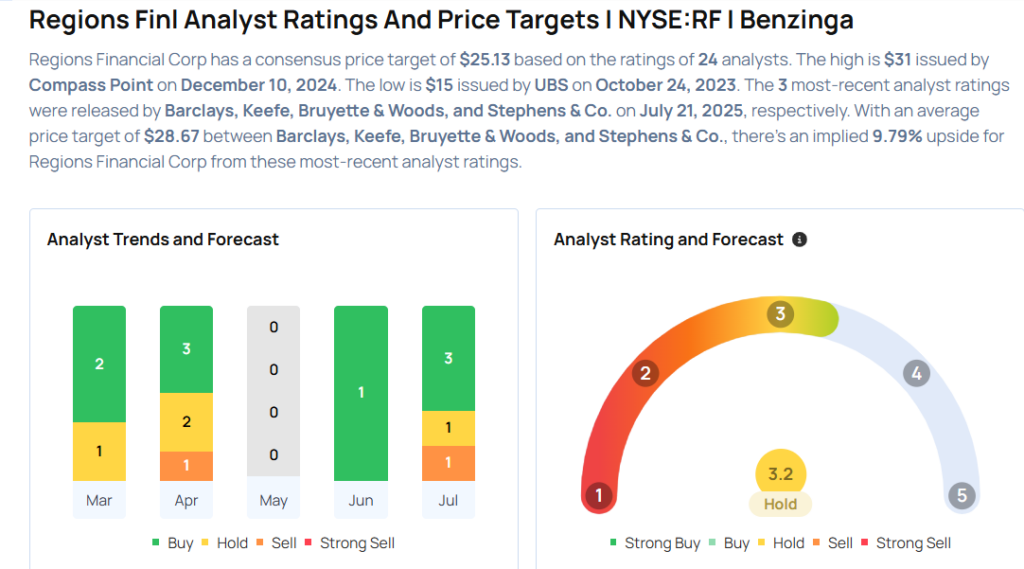

These analysts made changes to their price targets on Regions Financial following earnings announcement.

- Stephens & Co. analyst Terry McEvoy maintained Regions Finl with an Overweight rating and raised the price target from $24 to $29.

- Keefe, Bruyette & Woods analyst David Konrad maintained the stock with an Outperform rating and raised the price target from $29 to $30.

- Barclays analyst Jason Goldberg maintained Regions Finl with an Underweight rating and raised the price target from $24 to $27.

Considering buying RF stock? Here’s what analysts think:

Read This Next:

- Top 2 Energy Stocks That May Fall Off A Cliff This Quarter

Photo via Shutterstock