Should Himax (HIMX) Investors React to Launch of AI-Powered Wearable Sensing System?

- Earlier this month, Himax Technologies and Rabboni Co. Ltd. unveiled bboni Ai, the world’s first multi-scenario endpoint AI sensing system, combining Rabboni’s precision IMU motion sensors with Himax’s ultralow power WiseEye2 AI processor for wearable devices.

- This innovation highlights Himax’s move into real-time, privacy-focused, on-device AI solutions applicable across healthcare, sports, and education, supported by the upcoming bboni Ai Developer Program.

- We will explore how Himax’s entry into wearable-focused endpoint AI may strengthen its investment outlook and technology positioning.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Himax Technologies Investment Narrative Recap

For shareholders, the key story with Himax Technologies is belief in the company’s capacity to turn innovation, like the WiseEye2-powered bboni Ai platform, into sustainable long-term growth amid uncertain demand trends. While this wearable-focused AI launch positions Himax in attractive future markets, it does not yet change the biggest immediate catalyst: ongoing adoption of WiseEye AI in everyday and automotive devices. More crucially, it does not materially reduce exposure to short-term risks such as volatile panel demand and customer inventory management.

Among recent announcements, the debut of Himax’s WiseEye PalmVein authentication solution stands out, as it too underlines the company’s focus on low-power, on-device AI. This consistency across healthcare, smart home, and wearable launches suggests Himax is developing a defensible edge in privacy-centric AI hardware, a potential growth driver as WiseEye products gain more real-world applications. However, whether these innovations can offset global demand swings or pricing pressures remains an open question.

In contrast, investors should also be aware that even as new AI developments generate headlines, persistent weakness in display demand could still weigh on near-term performance…

Read the full narrative on Himax Technologies (it's free!)

Himax Technologies’ narrative projects $1.3 billion revenue and $163.9 million earnings by 2028. This requires 13.8% yearly revenue growth and an $84 million earnings increase from $79.8 million today.

Uncover how Himax Technologies' forecasts yield a $11.29 fair value, a 18% upside to its current price.

Exploring Other Perspectives

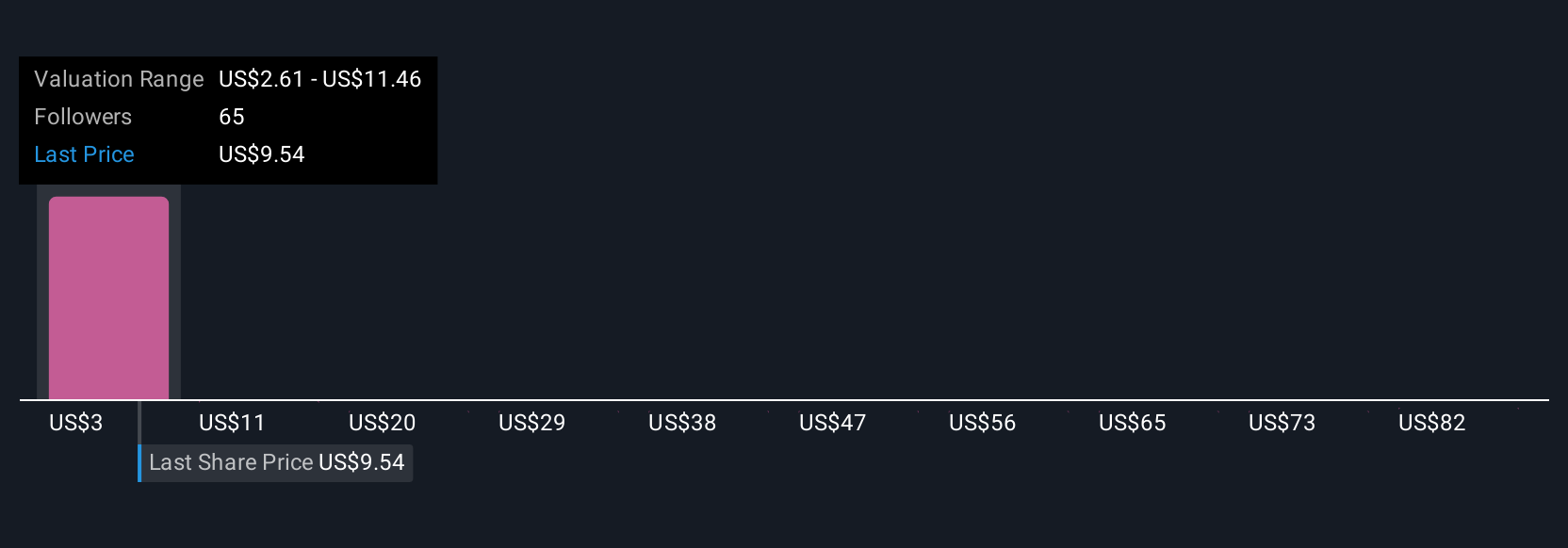

Eight members of the Simply Wall St Community estimate fair value for Himax from US$2.61 up to US$91.18 per share. With broad opinion on the company’s outlook, remember ongoing global display demand uncertainty continues to shape Himax’s near-term earnings and revenue momentum. See how your own outlook compares to this wide spectrum of views.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be worth over 9x more than the current price!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10