Mach7 Technologies Limited (ASX:M7T) Looks Inexpensive But Perhaps Not Attractive Enough

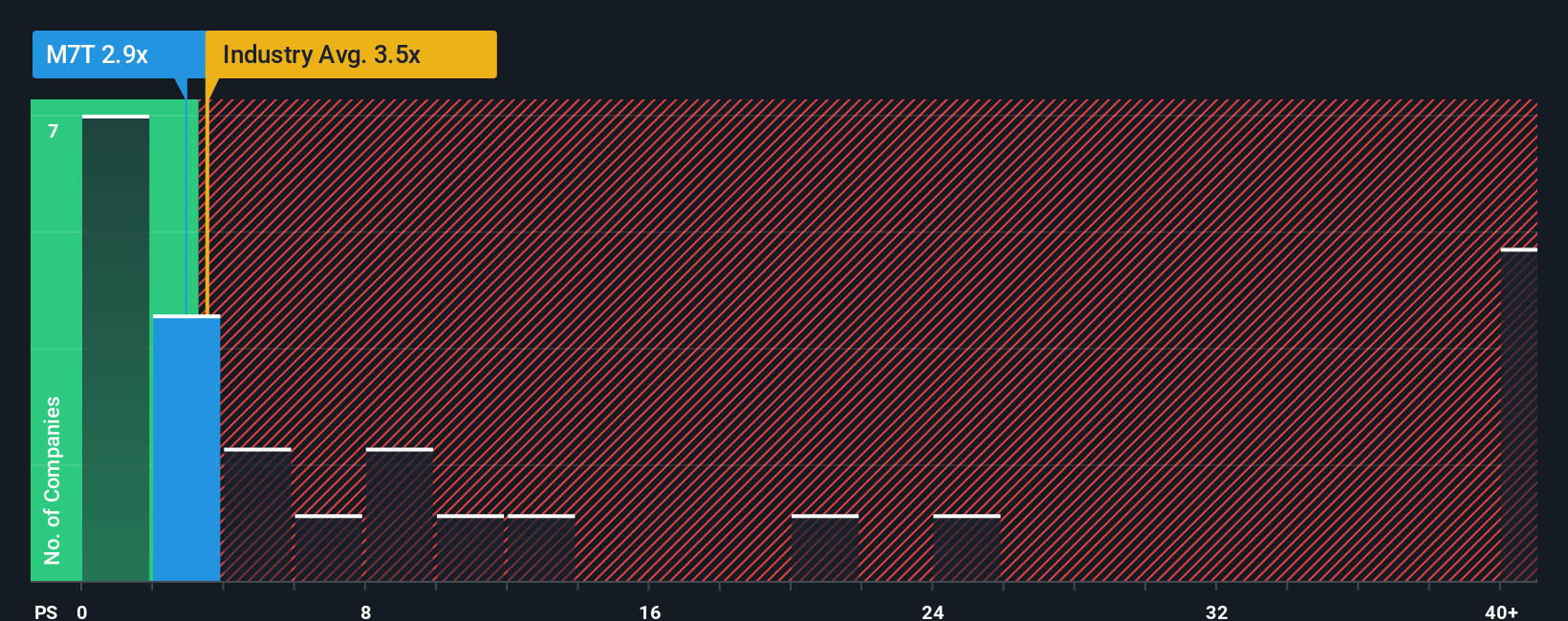

With a price-to-sales (or "P/S") ratio of 2.9x Mach7 Technologies Limited (ASX:M7T) may be sending very bullish signals at the moment, given that almost half of all the Healthcare Services companies in Australia have P/S ratios greater than 10.3x and even P/S higher than 71x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

See our latest analysis for Mach7 Technologies

How Mach7 Technologies Has Been Performing

Mach7 Technologies could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think Mach7 Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Mach7 Technologies?

In order to justify its P/S ratio, Mach7 Technologies would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. As a result, it also grew revenue by 29% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 13% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 300%, which is noticeably more attractive.

In light of this, it's understandable that Mach7 Technologies' P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Mach7 Technologies' P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Mach7 Technologies' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Mach7 Technologies that you need to take into consideration.

If these risks are making you reconsider your opinion on Mach7 Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10