Exploring 3 Undervalued Small Caps With Insider Action In Global Markets

As global markets navigate a landscape marked by rising consumer inflation in the U.S. and mixed performances across key indices, small-cap stocks have shown resilience, with the Russell 2000 Index posting gains despite broader market fluctuations. In this environment, identifying undervalued small-cap companies with insider action can offer unique opportunities for investors seeking to capitalize on potential growth amid economic shifts.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Lion Rock Group | 5.2x | 0.4x | 49.18% | ★★★★☆☆ |

| Hemisphere Energy | 5.3x | 2.2x | 8.23% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.9x | 3.1x | 13.27% | ★★★★☆☆ |

| Sagicor Financial | 10.2x | 0.4x | -177.10% | ★★★★☆☆ |

| CVS Group | 44.1x | 1.3x | 40.37% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 11.6x | 7.0x | 19.75% | ★★★★☆☆ |

| A.G. BARR | 19.9x | 1.9x | 45.10% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.8x | 0.5x | -138.16% | ★★★☆☆☆ |

| Chinasoft International | 24.4x | 0.7x | 11.75% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.4x | 0.7x | 5.81% | ★★★☆☆☆ |

Click here to see the full list of 120 stocks from our Undervalued Global Small Caps With Insider Buying screener.

Let's dive into some prime choices out of from the screener.

Dicker Data (ASX:DDR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Dicker Data is a leading wholesale distributor specializing in computer peripherals, with a market capitalization of A$2.37 billion.

Operations: The company generates revenue primarily from wholesale computer peripherals, with recent figures showing revenue of A$2.28 billion. The cost of goods sold (COGS) is significant, amounting to A$1.95 billion, which impacts the gross profit margin, noted at 14.56%. Operating expenses and non-operating expenses further affect profitability, with net income reaching A$78.69 million and a net income margin of 3.45%.

PE: 19.9x

Dicker Data, a player in the tech distribution sector, is drawing attention with its insider confidence as Vladimir Mitnovetski recently purchased 20,000 shares for A$161K. Despite relying solely on external borrowing for funding and carrying high debt levels, the company projects a promising annual earnings growth of 9.27%. Recent dividend affirmations with an ex-div date of May 16, 2025 signal stability amidst financial challenges.

- Take a closer look at Dicker Data's potential here in our valuation report.

Gain insights into Dicker Data's historical performance by reviewing our past performance report.

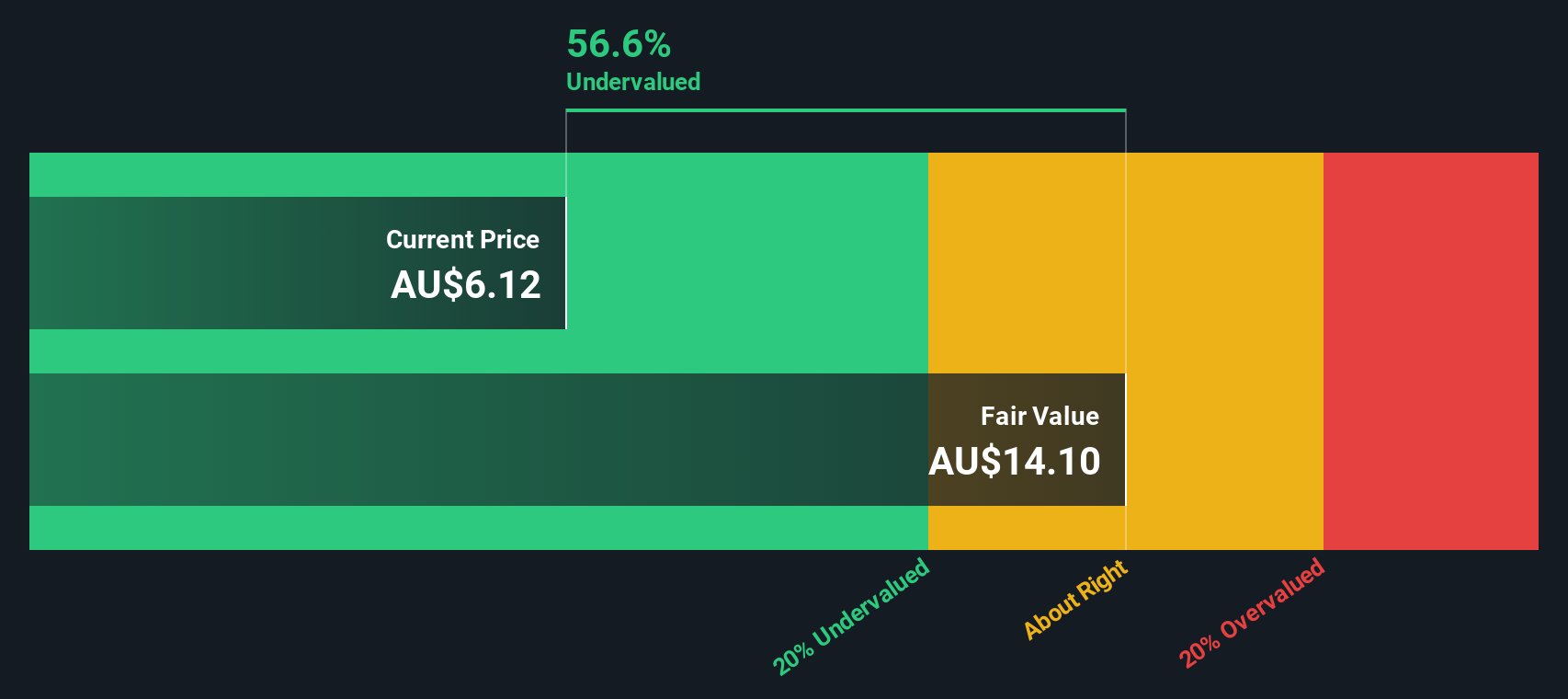

Elders (ASX:ELD)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Elders is an agribusiness company that operates a branch network, supplies wholesale products, and provides feed and processing services with a market cap of A$1.63 billion.

Operations: Branch Network is the primary revenue driver, contributing A$2.70 billion, followed by Wholesale Products at A$362.96 million and Feed and Processing Services at A$142.30 million. The gross profit margin has shown fluctuations, peaking at 21.72% in early 2019 before declining to 17.29% by mid-2023, with a slight recovery to 20.67% in early 2025. Operating expenses are significant, with Sales & Marketing consistently being the largest component within this category over time.

PE: 20.9x

Elders has caught some attention in the small cap space due to its recent performance and insider confidence. Damien Frawley acquired 20,000 shares for A$125,000, indicating a positive outlook from within. For the half-year ending March 2025, Elders reported sales of A$1.41 billion and net income of A$33.62 million, reflecting significant growth compared to last year’s figures. Despite reliance on external borrowing as a funding source, earnings are projected to grow by 25% annually.

- Delve into the full analysis valuation report here for a deeper understanding of Elders.

Explore historical data to track Elders' performance over time in our Past section.

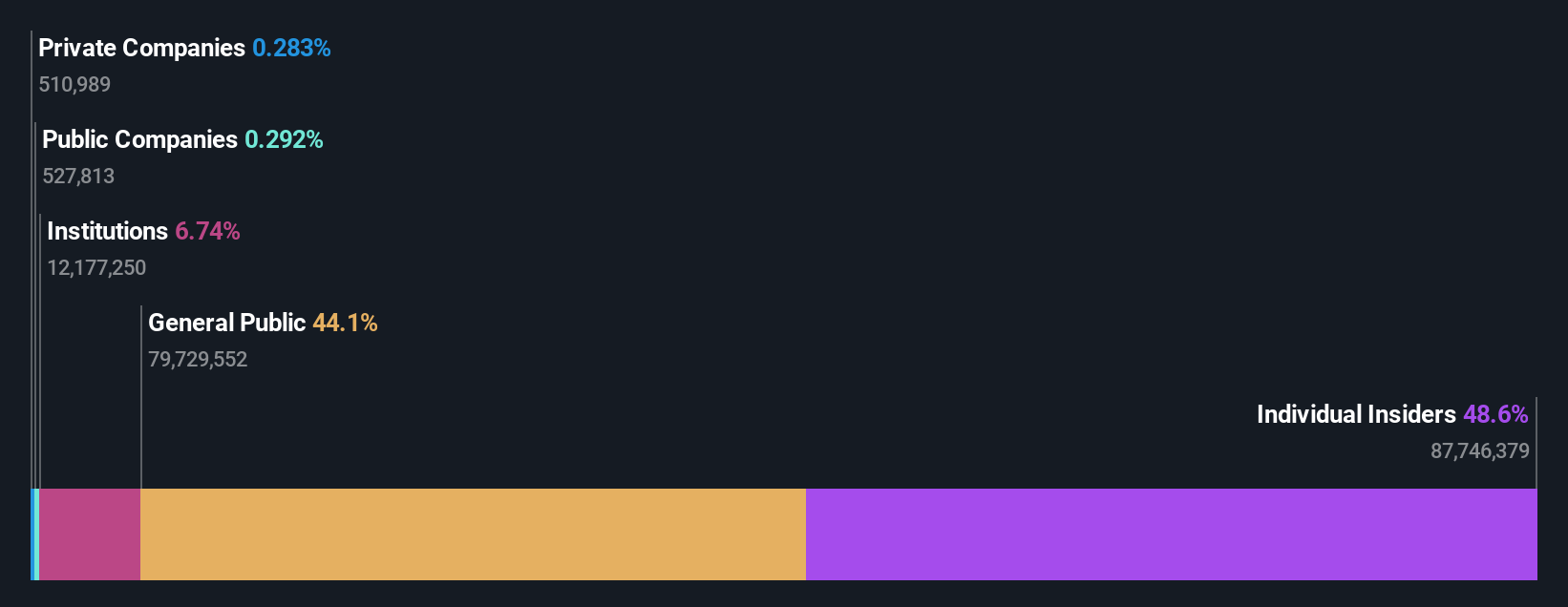

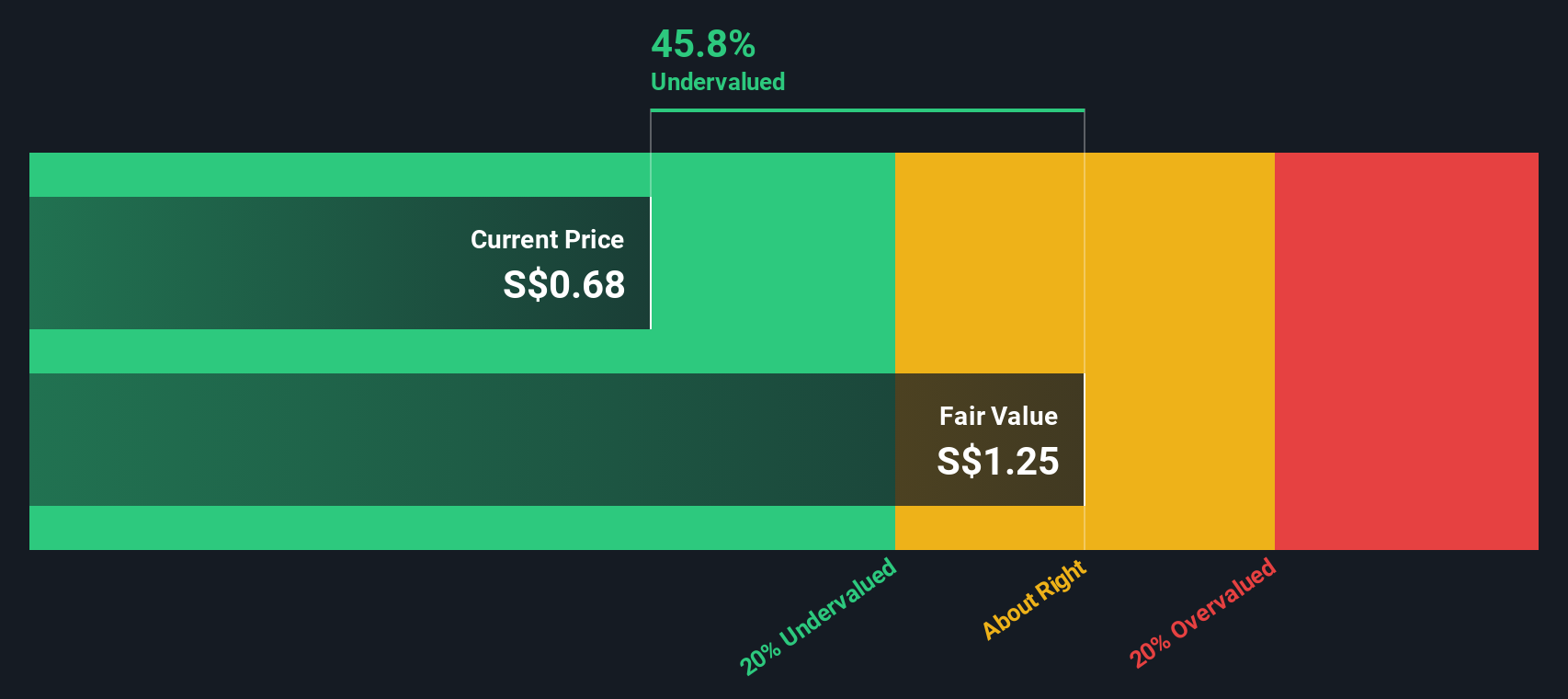

Riverstone Holdings (SGX:AP4)

Simply Wall St Value Rating: ★★★★★☆

Overview: Riverstone Holdings is a company primarily engaged in the manufacturing and distribution of gloves, with additional operations in other sectors, and has a market capitalization of approximately S$1.14 billion.

Operations: The company's primary revenue stream is from gloves, contributing significantly to its overall income. Over time, the net income margin has shown variability, reaching a peak of 48.28% in September 2021 before declining to 25.21% by March 2025. Operating expenses have varied but generally remained a smaller proportion of revenue compared to cost of goods sold (COGS).

PE: 12.6x

Riverstone Holdings, a small company in the glove manufacturing industry, recently experienced insider confidence with Co-Founder Teek Son Wong acquiring 1 million shares for approximately RM719K in May 2025. This purchase reflects a 13% increase in their stake, signaling potential optimism about the company's future. Despite facing higher-risk funding due to reliance on external borrowing, Riverstone's earnings are projected to grow by 4.49% annually. The recent appointment of Dumrongsak Aroonprasertkul as Non-Executive Director could enhance strategic growth opportunities in Thailand.

- Click here and access our complete valuation analysis report to understand the dynamics of Riverstone Holdings.

Learn about Riverstone Holdings' historical performance.

Next Steps

- Access the full spectrum of 120 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10